Tesla Faces Decline in European Market Share Amid Increased EV Demand

Tesla Inc. TSLA is experiencing a significant reduction in its market share in Europe, even as demand for electric vehicles (EVs) continues to rise. The automaker has reported a drop in sales for two consecutive months.

Sales Data Reveals Shrinking Market Share

According to the European Automobile Manufacturers Association (ACEA), Tesla’s sales in Europe have decreased by 42.6% this year. The company’s current market share is 1.8% of the overall vehicle market and 10.3% of the battery electric vehicle (BEV) market. This is a noticeable decline from last year’s figures of 2.8% and 21.6%, respectively, as reported by Reuters.

In February, Tesla sold under 17,000 vehicles in the European Union, the UK, and the European Free Trade Association countries—a significant reduction from more than 28,000 sales in the same month of 2024. The company’s challenges include an aging product lineup and increasing competition from established car manufacturers and new entrants from China, offering more affordable electric models.

Market Performance Versus Tesla’s Struggles

Interestingly, despite Tesla’s sales issues, overall BEV sales in Europe grew by 26.1% compared to February 2024, while total car sales fell by 3.1%, according to ACEA data. A recent disclosure from the EU revealed that Tesla has created a pool to sell carbon credits to over six automakers, helping them meet European CO2 emission targets initiated in January.

Impact of Analyst Predictions

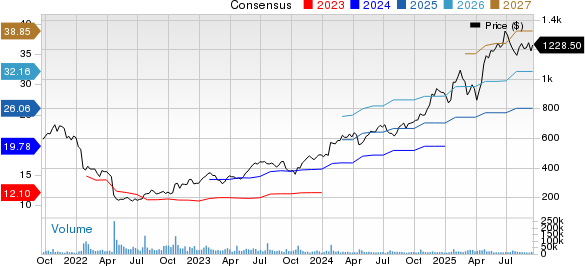

This downturn in Tesla’s market share follows a negative forecast from analysts at JPMorgan, who predict a significant drop in Tesla’s share price. A report highlighted a staggering loss of $127 billion in Tesla’s market cap during a single trading day in early March, as noted by Forbes.

Furthermore, JPMorgan has lowered its delivery expectations for this quarter from 445,000 vehicles to 335,000, which, if realized, would reflect Tesla’s lowest delivery numbers since Q3 2022. Recently, Gene Munster, Managing Partner at Deepwater Asset, expressed that expected delivery figures in March would be less than anticipated.

Analyst Insights on Market Dynamics

Felipe Munoz, a Global Analyst at JATO Dynamics, has stated that Tesla is undergoing considerable changes. These include CEO Elon Musk’s increasing political engagement, heightened competition in the EV sector, and the transition from the current Model Y to a refreshed version, as reported by Autocar Professional.

Munoz explained, “During model updates, brands often experience sales declines before rebounding, particularly those like Tesla that have a limited lineup.” This vulnerability during model changes can significantly impact registration numbers.

Financial Performance Metrics

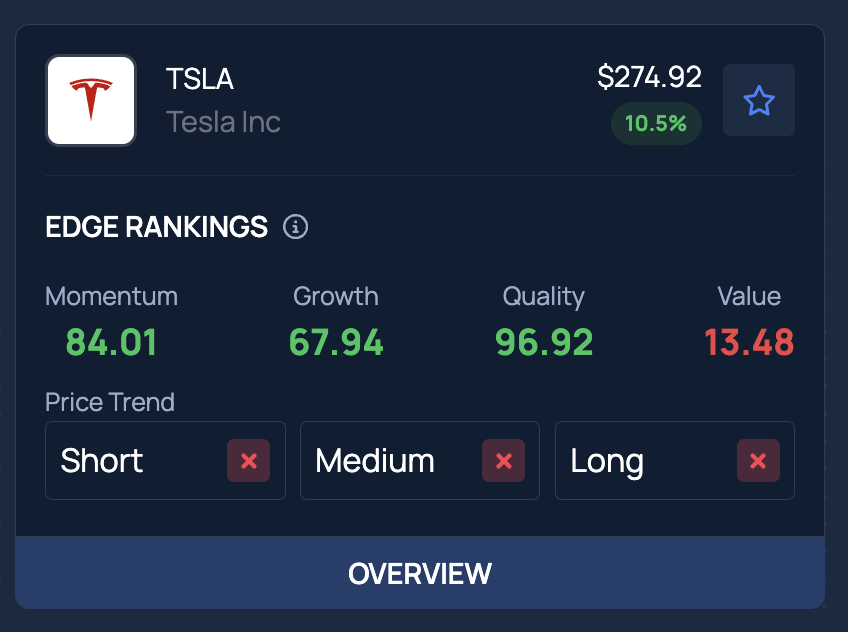

Tesla currently boasts a momentum rating of 84.01% and a growth rating of 67.94%, per Benzinga’s Proprietary Edge Rankings. The Benzinga Growth metric assesses a Stock‘s historical earnings and revenue progression over various timeframes, focusing on both long-term trends and recent results. For further insights into stocks and growth opportunities, consider signing up for Benzinga Edge.

Image via Shutterstock

Disclaimer: This content was partially generated with AI assistance and reviewed by Benzinga editors.

Momentum84.01

Growth67.94

Quality96.92

Value13.48