Tesla Faces Tough Times as First Quarter Earnings Loom

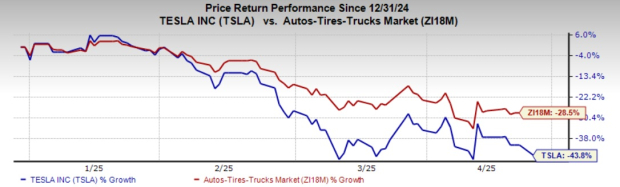

Electric carmaker Tesla, Inc. (TSLA) is set to report its results for the first quarter of 2025 today after the market closes. The company has seen a significant decline of approximately 44% this year, contrasting sharply with the industry average drop of 28.5%. Tesla is currently navigating a substantial crisis characterized by widespread protests and boycotts that stem from CEO Elon Musk’s controversial political activities and his affiliations with the Trump administration. This involvement has negatively impacted Tesla’s brand image, leading to reduced sales and diverting Musk’s focus from his leadership role. Many analysts have subsequently reduced their target prices for Tesla ahead of the earnings announcement.

The overall market sentiment might shift if Tesla offers encouraging updates, as much of the negative news appears to have already been accounted for. Nevertheless, forecasts for first-quarter earnings remain unpromising.

Image Source: Zacks Investment Research

Analysts Prepare for Dismal Q1 Earnings

Tesla’s Earnings ESP stands at -4.93% with a Zacks Rank #4 (Sell). According to the methodology used, a combination of a positive Earnings ESP with a Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold) can enhance the likelihood of an earnings beat. For further insights, you can utilize our Earnings ESP Filter.

In the last week, Tesla’s earnings estimates have seen a decline of one cent, and over the past 30 days, they have decreased by nine cents. The Zacks Consensus Estimate indicates a year-over-year earnings drop of 2.2% alongside a slight revenue increase of 0.95%. Historically, the company’s earnings track record has been lackluster, with misses on earnings estimates in three of the last four quarters.

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

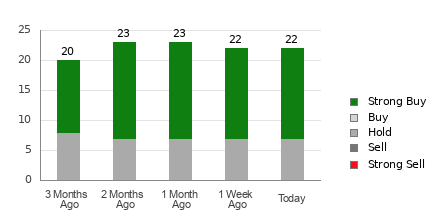

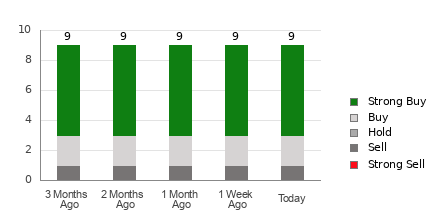

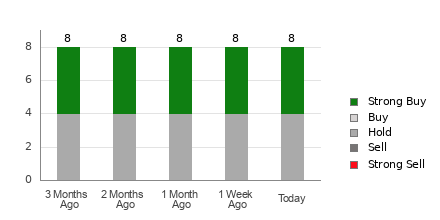

Currently, Tesla holds a Wall Street analyst recommendation average of 2.65 (on a scale from 1 for Strong Buy to 5 for Strong Sell) from 42 brokerage firms. Among these, 16 analysts rate Tesla as Strong Buy and three as Buy, representing 38.1% and 7.14% of all recommendations respectively. Analysts’ short-term price targets average $338.00, ranging from a low of $120.00 to a high of $550.00.

Disappointing Q1 Delivery Numbers

Tesla experienced its weakest sales quarter in the past three years. During the first quarter, the EV maker delivered 336,681 vehicles globally (including 323,800 Model 3/Y and 12,881 of other models)—a 13% decline from the previous year and below the Bloomberg estimate of 390,342. This performance marks the lowest deliveries since Q2 2022 and threatens the company’s full-year recovery goals.

In a significant shift, Tesla relinquished its title as the world’s foremost EV manufacturer to Chinese competitor BYD, which sold 416,388 EVs in the same timeframe. The automaker produced 362,615 vehicles in the quarter (345,454 Model 3/Y and 17,161 other models).

Key Areas of Focus for Investors

Investors will closely monitor Tesla’s advancements in autonomous driving, its plans for a robotaxi service, and the impact of tariffs on profitability. Developments regarding Musk’s engagement with the administration will also be under scrutiny.

During the last earnings call, Musk announced the upcoming launch of a robotaxi service in Austin this June, intending to compete with Waymo, with plans for expansion to other cities by year-end. He mentioned an internal target of producing 10,000 Optimus humanoid robots and suggested that the initial builds of Tesla’s semitruck would be finished by the year’s end. However, recent months have cast doubt on these initiatives.

Moreover, the 145% tariffs implemented on Chinese imports by the Trump administration are forecasted to impact a quarter of Tesla’s U.S. production, raising concerns about profitability.

Analysts Reduce Target Prices Ahead of Earnings

With a backdrop of dwindling confidence, several analysts have reduced their target prices for Tesla. Barclays has lowered its target from $310 to $275, citing slowing fundamentals. Earlier, UBS and Mizuho made similar cuts, mentioning tariff challenges likely to affect the auto sector overall.

ETFs with Significant Tesla Holdings

Simplify Volt TSLA Revolution ETF (TESL): This fund employs an active management strategy to benefit from Tesla’s stock fluctuations while utilizing advanced options for risk management.

The Nightview Fund (NITE): Tesla constitutes 18.9% of this portfolio.

Consumer Discretionary Select Sector SPDR Fund (XLY): Tesla represents 18.1% of assets here.

Vanguard Consumer Discretionary ETF (VCR): Tesla accounts for 13.3% of this fund’s assets.

Fidelity MSCI Consumer Discretionary Index ETF (FDIS): Here, Tesla makes up 13.4% of the portfolio.

Stay Updated on Key ETF Information

To stay informed, consider subscribing to Zacks’ free Fund Newsletter for weekly updates on important news, analysis, and top-performing ETFs.

For the latest recommendations, download 7 Best Stocks for the Next 30 Days for free.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Consumer Discretionary Select Sector SPDR ETF (XLY): ETF Research Reports

Vanguard Consumer Discretionary ETF (VCR): ETF Research Reports

Fidelity MSCI Consumer Discretionary Index ETF (FDIS): ETF Research Reports

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.