Tesla Faces Investor Skepticism Despite Advancements in Technology

Electric car leader Tesla (TSLA) is actively pushing the boundaries of its technology with two notable projects: the upcoming Model Y Juniper and its enhanced Full Self Driving (FSD) system. However, investors expressed concerns about the pace of development, leading to a slight decline in share price during Friday’s trading.

Full Self Driving Progress through Project Rodeo

According to a report by Business Insider, Tesla’s Full Self Driving system is benefiting from “Project Rodeo,” an initiative focused on advancing autonomous driving features. The project’s aim is to rigorously test the current software in real-world scenarios, such as navigating busy streets filled with various hazards including cars, pedestrians, and cyclists.

The drivers involved in Project Rodeo deliberately delay their interventions until the final moments, allowing the software to maximize its self-correcting abilities. As a result, this approach generates valuable data that can improve the system’s performance over time.

Upcoming Model Y Juniper Release

In addition to advancements in self-driving technology, Tesla is set to unveil a new Model Y, referred to as the Juniper. A report from The Independent suggests that the reveal is mere weeks away. Preliminary artist renderings indicate that this version may resemble a traditional four-door sedan, hinting that the major innovations may be found under the hood and in the vehicle’s interior.

Moreover, replacing a Tesla battery pack has become easier. According to Jalopnik, the company Re/Cell will provide aftermarket replacements for the original Tesla Roadster at a competitive price, although specific costs remain undisclosed. Interestingly, the Re/Cell batteries promise enhanced performance due to their lighter weight compared to the originals.

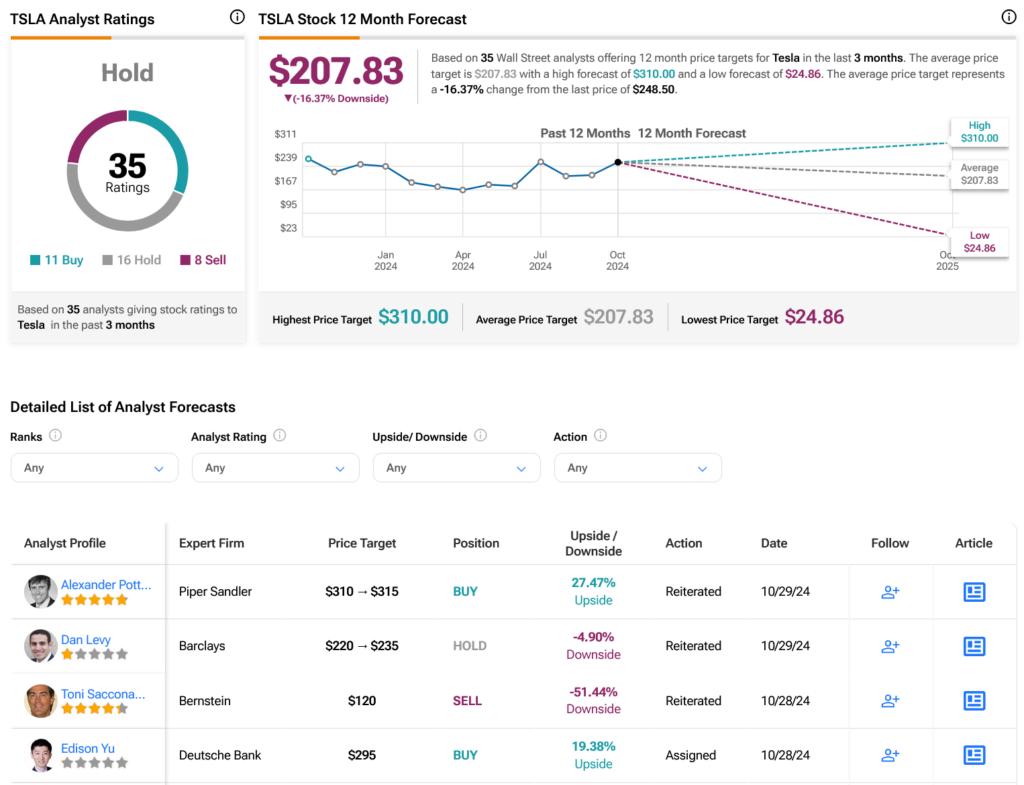

Current Analyst Consensus on Tesla Stock

On Wall Street, Tesla’s stock has received a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sells in the past three months. After a notable 13% increase in share price over the past year, analysts set an average price target of $207.83 per share, suggesting a potential downside risk of 16.37%.

See more TSLA analyst ratings

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.