Tesla Faces Challenges as Stock Slips: A Close Look at the Numbers

Electric vehicle (EV) manufacturer Tesla TSLA has encountered a tumultuous start to the year. Following a dramatic increase of over 50% in its stock after Trump’s election win, which led to record highs in December, that momentum has swiftly faded. The excitement around Musk’s connection with Trump seems to have diminished, causing investors to evaluate Tesla’s fundamentals more critically, and the outlook appears dim.

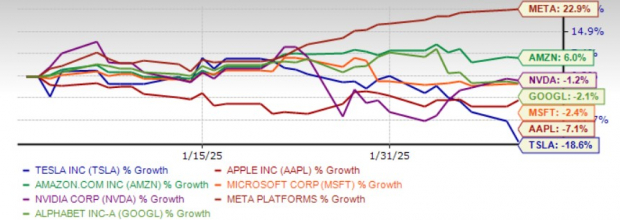

Currently, TSLA is on a five-day losing streak, closing at $328.50 yesterday—marking its lowest level since November 15. So far this year, it has been the poorest performer among the Mag-7 stocks, falling behind NVIDIA, Apple, Alphabet, Microsoft, Amazon, and Meta Platforms.

Analyzing TSLA’s Year-to-Date Performance Against Mag-7 Peers

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Tesla has been a pioneer in the EV industry, comparable to how Amazon changed shopping and Netflix transformed entertainment. For over ten years, TSLA has been a name associated with cutting-edge innovation and market leadership. However, that perception seems to be faltering.

Much of Tesla’s growth has been attributed to its visionary CEO Elon Musk. Once considered the company’s greatest strength, he is now a source of worry for some investors. His controversial comments, political involvement, and divided focus are shaking investor confidence. Additionally, Tesla’s share of the market is decreasing rapidly due to fierce competition, attracting the attention of concerned shareholders.

While Musk asserts that Tesla is on the verge of significant growth, claiming it could surpass the combined value of the next five largest companies, the tumbling stock price and rising competition have led investors to question the sustainability of Tesla’s growth narrative.

Sales Decline and Market Share Erosion

Tesla’s sales drop is now a significant concern. After reporting its first annual delivery decline in 2024, forecasts for 2025 are also gloomy. Key markets are witnessing a sales decline, notably in Europe and China.

In January alone, Tesla’s sales fell 63% in France and 8% in the UK, while registrations in Germany dropped by 59%—despite an overall increase of 54% in EV sales there. Brands like Volkswagen VWAGY and BMW are starting to fill the gap left by Tesla. Furthermore, Musk’s support for Germany’s far-right AfD party has ignited backlash, which might turn potential customers away.

Sales in China are also struggling. The market is crowded with domestic competitors such as BYD Co Ltd BYDDY, NIO, XPeng, and others. In January, Tesla’s sales dipped by 11.5%, while BYD enjoyed a substantial surge of 48%. The competitive landscape is heating up, as BYD recently announced an expansion of its AI-powered “God’s Eye” self-driving system, extending features even to its more affordable models. Meanwhile, Tesla is facing regulatory hurdles that have delayed its Full Self-Driving (FSD) rollout in China, which has yet to be launched in that country or Europe.

In its home market, Tesla’s dominance is waning. Sales in California declined steeply last year across all four quarters. Furthermore, TSLA’s U.S. EV market share has slipped below 50%, down from 63% in 2022, as traditional automakers like General Motors GM and Ford F ramp up their electric vehicle offerings, alongside emerging threats from Rivian and Lucid.

With increased global competition and diminishing market share, Tesla’s growth story is facing serious challenges.

Musk’s Divided Focus Contributes to TSLA’s Struggles

Musk’s expanding duties are creating unease among investors. Besides Tesla, he is also at the helm of SpaceX, Neuralink, X (formerly known as Twitter), and AI startup xAI. His recent government involvement under Trump in the Department of Government Efficiency adds further distractions.

Concerns regarding Musk’s focus intensified this week after his $100 billion bid to take over OpenAI was quickly rejected. OpenAI’s CEO, Sam Altman, proposed buying X for $9.74 billion in return, which Musk criticized, branding Altman a “swindler” on social media.

As political controversies stack up and focus on multiple ventures, it’s natural for investors to question if Tesla remains Musk’s primary concern.

2025: A Critical Year for Tesla

With declining EV sales and affordability issues, Tesla must adhere to its schedule for launching more affordable cars. The company aims to introduce a new model in the first half of 2025, which could help regain demand in price-sensitive markets and recover lost ground.

Simultaneously, Musk is banking on FSD and robotaxis as key future revenue streams. The rollout of unsupervised FSD is set for Austin this June, with plans for broader expansion throughout the U.S. by the end of the year, contingent on regulatory approvals.

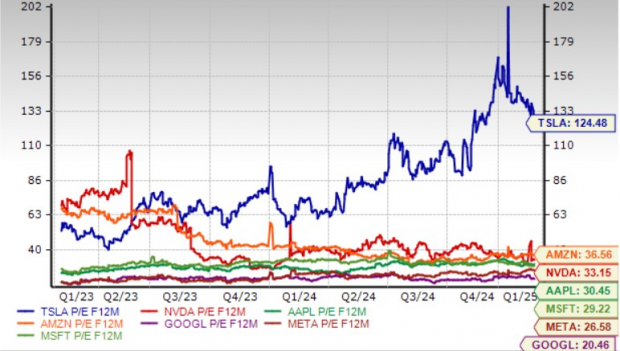

Tesla’s Valuation Remains a Concern

Even after its tumultuous performance thus far in 2025, Tesla is still the most overvalued stock within its Mag-7 peers. It is currently trading at a forward 12-month P/E of 124.48X—nearly quadrupling the average forward P/E of its competitors. Given slowing EV growth and potential execution risks, many investors are beginning to perceive Tesla’s valuation as excessively high.

Tesla’s P/E Ratio Shows High Potential Risk

Image Source: Zacks Investment Research

Strategic Approaches to TSLA

As Tesla navigates through a challenging EV landscape with modest growth expectations in 2025, it faces external threats from trade policies. Trump’s 25% tariffs on steel and aluminum may increase vehicle costs and impact affordability and margins. Proposed tariffs affecting Mexico and Canada could complicate or disrupt supply chains even further. Additionally, TSLA’s earnings projections have seen downward revisions in the past month.

Image Source: Zacks Investment Research

On a positive note, Tesla’s energy generation and storage division is thriving, with deployments doubling to 31.4 GWh in 2024. Musk anticipates another 50% growth in this sector for 2025, positioning it as a vital revenue source moving forward.

Tesla finds itself at a critical juncture this year. Success hinges on demonstrating its ability to deliver on autonomous driving promises and affordable EVs. Investors will closely monitor Tesla’s advancements in autonomous vehicles, as approvals for FSD and robotaxi innovations will significantly impact the company’s long-term growth prospects.

Despite its long-term potential, short-term hurdles may present risks in investing. For current stakeholders, it may be beneficial to hold while assessing future developments, whereas prospective buyers could consider waiting until Tesla validates its capabilities in autonomous technologies and affordable vehicle offerings.

Tesla currently holds a Zacks Rank #3 (Hold) and has a VGM Score of D. For additional investment insights, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names Top Semiconductor Stock

With the semiconductor market set to rapidly expand from $452 billion in 2021 to $803 billion by 2028, the top chip stock identified by Zacks, which is only 1/9,000th the size of NVIDIA, aims to capitalize on this growth. Its strong earnings trajectory and growing customer base place it well to meet the relentless demand for Artificial Intelligence, Machine Learning, and the Internet of Things.

Discover this Stock Now for Free >>

For more investment recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days report for free.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.