Recent trends indicate a shift in investor sentiment towards U.S. markets, particularly in closed-end funds (CEFs), despite previous narratives of a “sell America” attitude. Notable funds like the PIMCO Dynamic Income Fund (PDI) and the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) are attracting attention for their high yields and attractive discounts, signaling a potential pivot back to U.S. investments.

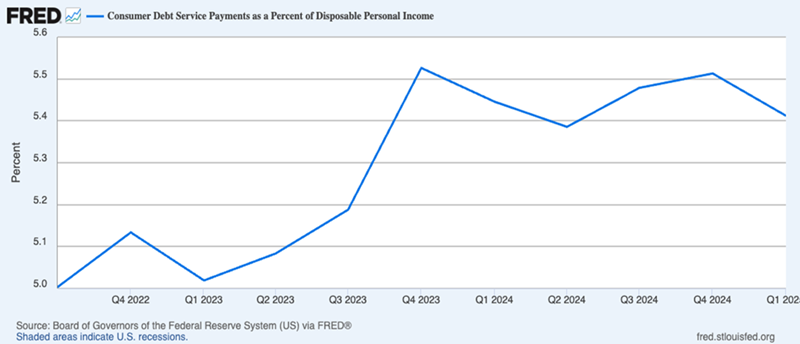

Data suggests that American households are managing their debt more efficiently than widely believed. Currently, household debt payments stand at about 5.5% of disposable income, a level similar to the early 2010s and significantly lower than in past decades. This financial resilience allows the average U.S. household to spend approximately $282 per month on debt, affirming that consumers are not as overstretched as reported.

In the realm of returns, U.S.-focused funds like SPXX and PDI are outperforming their global counterparts, highlighting the strength of the U.S. economy. SPXX offers a yield of 7.6% while PDI provides a 14% payout, in contrast to the Clough Global Opportunities Fund (GLO), which, despite higher market demand, shows lagging fundamentals and is now trading at an 11.7% discount to NAV.