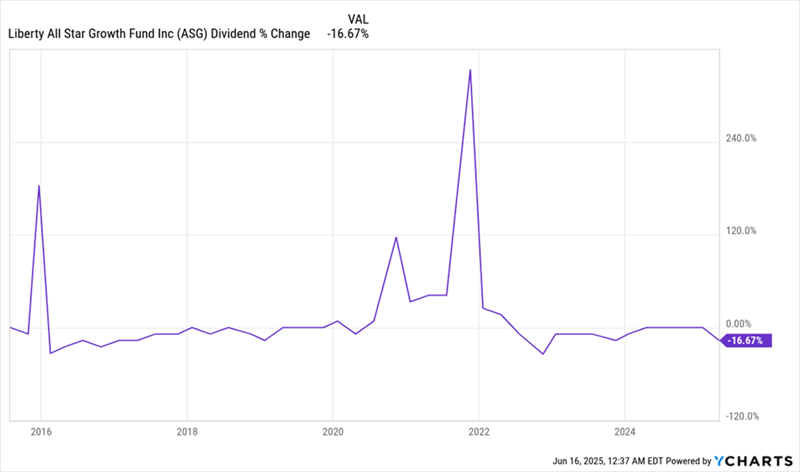

The Liberty All-Star Growth Fund (ASG), currently yielding 8.2%, has experienced a 17% decline in its dividend from a decade ago but has still delivered a total return of 162% over the past decade, primarily due to strong capital gains and special dividends. ASG trades at a 7.7% discount to its net asset value (NAV), indicating that the fund’s underlying portfolio is valued at just over 92 cents on the dollar.

Another high-yield investment, the BlackRock Technology and Private Equity Term Trust (BTX), offers a yield of 13.6% but has also seen its dividend cut, resulting in a 19.3% decrease in the past five years. Despite this, BTX has returned 16% since being added to the CEF Insider service in April 2025, as its trading discount has narrowed to around 2% from a double-digit figure earlier in the year.

The Pioneer High Income Fund (PHT), which invests in high-yield corporate bonds, has had a 15.6% annualized return over the last three years, even after a 12% dividend cut. The fund’s current yield is 8.2%, and despite reduced dividends, the overall capital gains have more than compensated for the payout decline.