LNG’s Growing Importance in the Shift from Coal

The shift from coal to natural gas plays a crucial role in the global efforts to tackle climate change. Natural gas, seen as a “transition fuel,” produces lower carbon dioxide emissions than coal. It supports renewable energy sources by ensuring reliability when wind or solar energy is not available. The global trade of natural gas is aided by liquefied natural gas (LNG), making companies like Cheniere Energy Inc. LNG, Chevron Corporation CVX, and Shell plc SHEL well-equipped to thrive amid this shift.

Rising Global Demand for LNG

Natural gas stands out as the cleanest-burning hydrocarbon, making it increasingly sought after worldwide to fight climate change. Many consumers and regions in need of natural gas are geographically distant from gas fields, creating high costs associated with pipeline construction and transportation.

To overcome this distance issue, natural gas is cooled into a liquid state, reducing its volume for global storage and shipping. Data from Shell indicates that LNG accounted for 14% of the worldwide demand for natural gas in 2023.

LNG Market Trends and Future Growth

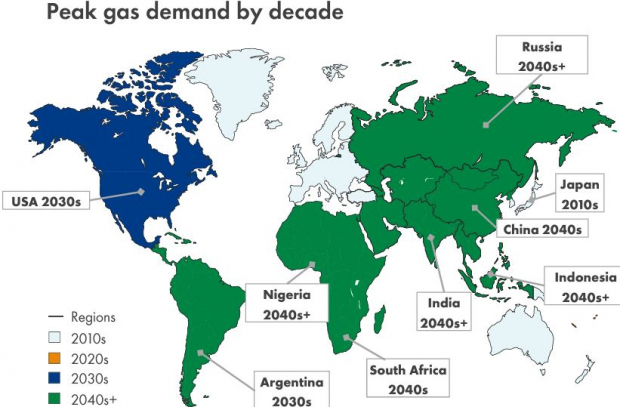

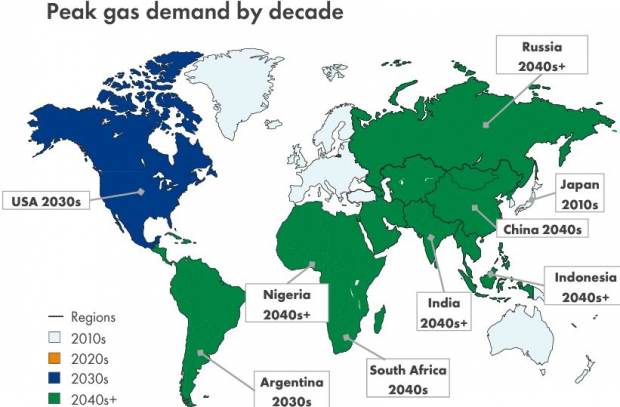

Shell’s LNG outlook for 2024 highlights that while demand for natural gas has plateaued in some developed nations, it continues to swell globally. This increase is mainly driven by developing economies such as China and India, which rely on natural gas to support their industrial and decarbonization objectives.

Image Source: Shell plc

According to the report, global LNG demand is expected to rise by over 50% by 2040. In 2022, the total LNG traded volume reached 404 million tons, slightly up from 397 million tons in the previous year.

Three Key Energy Stocks to Watch: LNG, CVX, SHEL

With the changing energy landscape, keeping an eye on significant LNG players like Cheniere Energy, Chevron, and Shell is essential. Currently, all stocks hold a Zacks Rank #3 (Hold). You can view the complete list of top-ranked stocks here.

Cheniere Energy

Cheniere Energy is a prominent player in the U.S. LNG market, engaged in producing and exporting LNG. The company provides a comprehensive range of services, from gas procurement and transportation to liquefaction and delivery.

Their Sabine Pass and Corpus Christi facilities are among the largest liquefaction sites worldwide, with a combined production capacity of 45 million tons per year, and more capacity is expected to come online soon.

Chevron

Chevron holds a 47.3% interest in Australia’s Gorgon Project, which has an LNG production capacity of 15.6 million metric tons annually. Most of Chevron’s LNG output from Australia is allocated to long-term contracts with major utilities across Asia, while any excess is sold on the Asian spot market.

Shell

With over 50 years in the LNG sector, Shell operates supply projects in 10 countries and ranks as one of the largest global LNG shipping companies. Their fleet comprises 67 vessels under long-term charters and 14 that Shell manages, accounting for about 11% of the worldwide LNG shipping fleet.

Five Stocks with Potential to Double

Experts at Zacks have identified five stocks they believe could soar by +100% or more in 2024. While past performance isn’t guaranteed, previous picks have shown significant gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks remain under the radar on Wall Street, offering a prime opportunity for early investment.

Explore These Five Potential Winners >>

Chevron Corporation (CVX): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.