Bank stocks come in all shapes and sizes. But which one offers the most long-term upside right now? It’s a bank stock most investors have never heard of: Nu Holdings (NYSE: NU).

If you want to maximize your long-term profit potential, this stock is for you.

This stock could be a monster

Nu isn’t your average bank stock. The company was founded in 2013 for a singular reason: to capitalize on the massive potential of Latin America’s banking industry.

For years, Latin America — which boasts a population of 650 million — had a banking industry largely dominated by a handful of competitors. These old-school banks charged customers high fees for simple services, with the integration of technology far lagging more developed markets like the U.S. or Europe.

Nu was launched to take on these stodgy competitors with a digital-first approach. The start-up allowed customers to open and use their bank accounts, credit cards, and other financial products straight from a smartphone app, something few competitors were doing at the time.

“At first, the competition failed to take Nubank seriously,” writes Doug Leone, a partner at Sequoia Capital, a legendary venture capital firm that eventually backed the project. “[T]hey didn’t understand the deep technological work involved in the backend of the deceptively simple user experience, and thought the company was nothing more than an app.”

Fast forward to today, and Nu is dominating the markets it operates in. More than half of all adults in Brazil, for instance, are Nu customers. The company has entered the Colombian and Mexican markets as well, which have also experienced rapid adoption. For example, deposits in its Mexican division grew from $0 to $1 billion in under 7 months.

While incumbents are racing to catch up, Nu has a strong first-mover advantage. Its business model is lean, meaning it can deliver new products faster and more efficiently than the competition, all with higher profitability. While the competition is stuck operating hundreds of physical branches focused on basic financial services, Nu has expanded into innovative products, like NuCripto, which brought crypto investing to its entire user base in 2022.

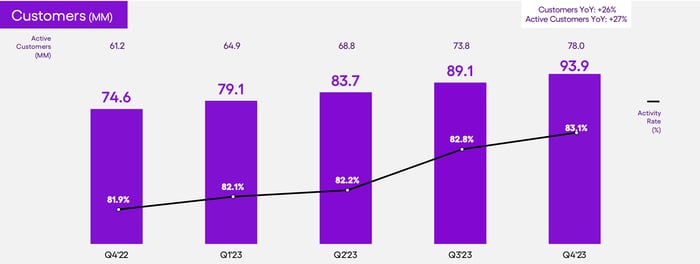

Nu now has a proven record of growth and a reputation for keeping its customers engaged with new products and services. More than 80% of its customer base, for example, generates revenue monthly for the company. Nu could enter more than a dozen new countries over the coming years. And while these don’t have the scale or income levels of Brazil, Mexico, or Colombia, Nu shouldn’t have any trouble growing. Analysts expect sales to grow by nearly 25% next year alone.

Source: Nu Holdings Q4 Investor Presentation. YoY = year over year.

Should you buy Nu stock right now?

Nu has a quality business model, a proven record of success, and a long runway for growth. But is the stock a buy right now? That depends on your time frame.

Nu has already been the product of too much hype. When shares went public in 2021, they were priced at 24 times book value. That lofty valuation quickly cratered, with the share price plummeting from $10 to $4 over the course of 2022. The valuation bottomed at 3.2 times the book value, with shares tripling from there.

Today, the share price is fairly close to its initial public offering (IPO) valuation of $10. Due to book value growth, however, the stock is priced at just 8.2 times book value. That’s high for a bank stock, but as we’ve learned, Nu isn’t your average bank stock.

Put simply, Nu stock isn’t for short-term investors. High multiple stocks like this can be very volatile, as Nu’s history proves. The company’s opportunity is decades-long and will take years to fully play out. In the meantime, the valuation multiple may gyrate wildly.

But patient investors need not worry. Nu currently has a market cap of just $50 billion. With a potential customer base of a half-billion strong and a proven record of execution, expect Nu to win big over the long term. Those willing to hold through the ups and downs should come out on top.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 3, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.