As you go through life, there are thousands of little forks in the road, and there are a few really big forks – those moments of reckoning, moments of truth.

Lee Iacocca

Redefining Our Business Model

Following an inspired nudge from a client, we’ve undertaken a shift in our business model, delving into listed securities based on seven megatrends. This endeavor led to the creation of a groundbreaking investment vehicle, tailored for qualified professional clients as per the FCA regulations.

Intrigued about whether you qualify? Just click here to determine your eligibility under the FCA’s classification of “professional client.”

January: A New Approach

In the spirit of evolution, our January letters will now steer clear from Saxo Bank’s Outrageous Predictions. Instead, they will serve as a compass for the upcoming year, delving into the most pressing issues facing us in the months ahead.

Each December, the team will drum up the most vital questions/issues pertinent to the ensuing 12 months. These will then be addressed in the January letter. This year, four primary questions have emerged:

- Will 2024 be a good year to invest in risk-assets?

- What is the outlook for commodities?

- Will green stocks continue to rebound after having had a tough year?

- How do you expect equities to react, if interest rates do not come down as implied by the bond market?

So, let’s dive into the first question.

Q1: Will 2024 be a good year to invest in risk assets?

Whether 2024 is a prime time to invest in risk assets hinges largely on the behavior of the US consumer. The outlook across the pond differs significantly. While parts of Europe and the UK are poised on the brink of recession, the US presents a more polarized view – a tug-of-war between recession and a softer landing. The latter seems plausible due to the underlying spending power of US consumers and the employment landscape.

An anticipated soft landing in the US bodes well for risk assets across the globe, with a potential nod of favor towards Japanese risk assets. The significance of US financial markets cannot be overstated; a thriving US market can mitigate the impact of any downturn in European risk assets. Meanwhile, Japanese risk assets are poised to outperform their US and European counterparts.

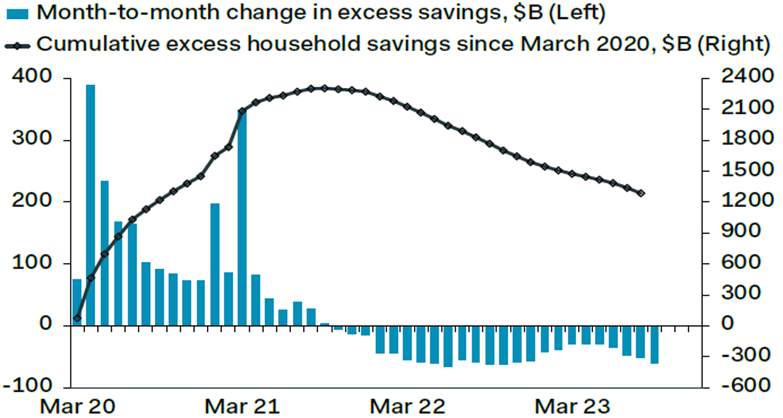

Exhibit 1: Excess US Savings From the Pandemic

The reason a soft landing in the US is good for risk assets worldwide has to do with the prominent role of US financial markets.

Q2: What is the outlook for commodities?

The fate of commodities is closely intertwined with the broader economic landscape. The performance of many commodities in the preceding year was dampened by China’s decelerating activities. While China hasn’t succumbed to recession, the perceptible slowing in growth has cast a shadow over certain commodities.

If early signs from China and the anticipated resilience of the US economy materialize in 2024, commodities could witness a resurgence. Not all commodities share a uniform outlook; industrial metals and oil drilling and exploration companies appear to show promise. Robust demand for industrial metals could be on the horizon, and decreased capex in the oil sector might trigger a supply shortage, bolstering prices.

Q3: Will green stocks continue to rebound after having had a tough year?

Many subsets of green stocks have weathered a challenging period after achieving record highs in 2021. The fervor around green stocks during 2019-2021 led to indiscriminate rallies, dismissing concerns about earnings outlook. The buoyancy waned in the subsequent years, as the broader climate outlook worsened, despite the pressing need for environmental resolutions.

The recalibration in valuation and the potential turnaround of previously unprofitable green companies infuse a glimmer of hope into their future prospects. Renegotiated contracts coupled with favorable market conditions might pave the way for sustainable profitability.

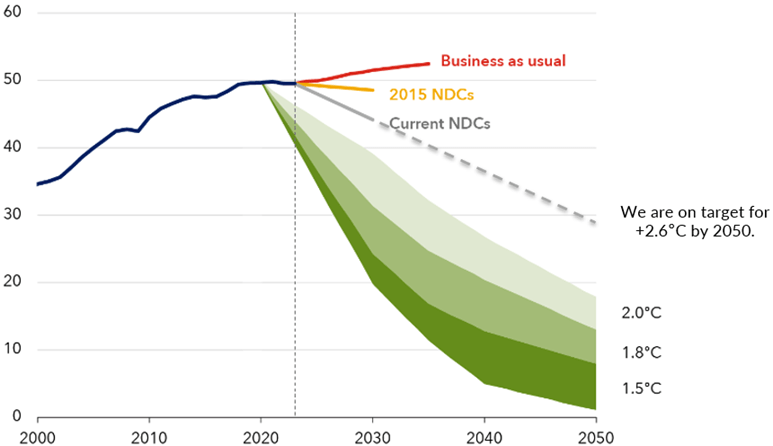

Exhibit 2: CO2 Emission Cuts Required to Meet 2050 Targets

As we anticipate a realignment in the investment landscape, these fundamental questions are a lodestar, guiding us through the terrain of the investment world.

The Unsteady Path Ahead: Navigating Economic Volatility

Unraveling the Re-bounce

The market’s erratic dance mirrors the peripatetic journey of a butterfly in a windstorm. The re-bounce, which has held investors in thrall, appears poised to continue its erratic course. With the pall of economic stagnation in China gradually receding, the future looks less murky. However, lurking in the shadows is the disquieting prospect of a global recession that could potentially diminish the appetite for sustainable solutions. History has taught us that governments are wont to neglect environmental concerns in times of fiscal hardship.

Strategizing in the Face of Unchanged Interest Rates

The saga of escalating inflation rooted in global supply chain disruptions has tested the market’s mettle. After a prolonged dormancy, inflation reared its head, owing partly to the convulsions in global supply chains. The recent unrest in the Middle East, sparked by hostilities between Hamas and Israel, has cast a long shadow over shipping routes via the Red Sea, inflicting an inflationary sting on goods transiting between Asia and Europe. The protracted conflict portends a protracted turbulence in shipping, elevating the specter of enduring inflation. Furthermore, the alternative route around the Cape of Good Hope, though ostensibly cheaper in terms of insurance, will impose onerous fuel costs. While the immediate impact might seem confined to Europe, the intricately interwoven nature of today’s global economy dictates that inflationary ripples in one part of the world will reverberate across other regions.

Should this bode ill for interest rates, the brunt is likely to be borne by ‘junk’ stocks. Companies reliant on borrowed capital, denizens of the tech realm with negative earnings, and the most shorted stocks are particularly poised on a precipice. The dalliance with lower interest rates in 2024, as hinted by Jerome Powell, burnished the prospects of ‘junk’ stocks, but the looming shadow of higher interest rates in Q3 eclipsed the fortunes of unprofitable tech stocks and heavily-shorted stocks. The resulting Q4 rally, while seemingly propitious, bears the nagging whisper of unsustainability, should higher interest rates persist. In essence, the rallying cry of ‘junk’ stocks has propelled the broader market, but any retreat could likely unleash a market-wide squall.

Niels C. Jensen