Is Now the Right Time to Invest in the Stock Market?

Investing in the Stock market might feel daunting amid current uncertainties. However, it may be an ideal moment to consider investing. Currently, the S&P 500 (SNPINDEX: ^GSPC) is down approximately 10% as of Thursday’s prices. Historically, the index has shown a trend of increased value over time.

This index tracks 500 of the top publicly traded stocks, and for long-term investors, exchange-traded funds (ETFs) that monitor this broad index provide an easy pathway to capitalize on market growth.

Where should you invest $1,000 today? Our analyst team recently identified the 10 best stocks to purchase now. Continue »

You can learn here how to easily invest in an S&P 500 ETF and the reasons for considering this option today.

Effortlessly Tracking the Index

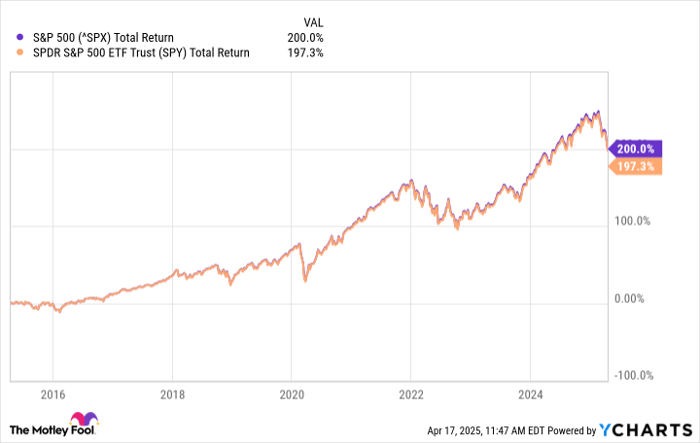

Many ETFs exist to help investors track the S&P 500. A notable choice is the SPDR S&P 500 ETF (NYSEMKT: SPY), which features a low expense ratio of 0.09%. Over the past decade, its total returns, including dividends, have closely mirrored those of the index.

^SPX data by YCharts

As depicted, long-term investment in the ETF has enabled investors to achieve substantial returns while enjoying a high degree of diversification. A $10,000 investment in this fund would have surged to around $30,000, even accounting for the market’s decline this year.

However, rapid price escalation can sometimes lead to market corrections.

Were Stocks Due for a Downturn?

Historically, the S&P 500 has averaged annual returns of around 10%. This average accounts for a mix of good and bad years. Notably, the index increased over 20% in both 2023 and 2024, driving its value up beyond typical levels.

The cyclically adjusted price-to-earnings ratio, known as CAPE, analyzes a decade of data to assess the market’s valuation. Before this year’s sell-off, the CAPE ratio was approximately 37, a level not seen since 2021, which preceded a notable market crash when the S&P 500 fell more than 19%.

Currently, the CAPE ratio sits at 33. While this rate is still elevated, it indicates that stocks may not be as drastically overvalued as earlier in the year. While future declines cannot be entirely ruled out, investing in the SPDR S&P 500 ETF at more manageable valuations may enhance long-term return potential.

The Perks of Investing During Market Weakness

Heading into this year, the market appeared to be due for a correction, given its strong performance leading to 2025. Purchasing stocks at inflated levels can present an increased risk of a decline.

Although timing the market can be tricky, investing in the S&P 500 during downturns is often advantageous, as it can yield better long-term returns than buying at peak valuations. Therefore, investing in the S&P 500 now could be a wise move for long-term investors.

Is Investing $1,000 in SPDR S&P 500 ETF Trust the Right Choice?

Before purchasing shares of the Stock in SPDR S&P 500 ETF Trust, consider the following:

The Motley Fool Stock Advisor team has recently determined the 10 best stocks to invest in now, and SPDR S&P 500 ETF Trust did not make this list. The selected stocks are projected to deliver significant returns in the upcoming years.

Reflect on the history of when Netflix appeared on our list on December 17, 2004… if you had invested $1,000 at that time, you would now have $524,747!* Additionally, when Nvidia made the list on April 15, 2005… your $1,000 investment would have grown to $622,041!*

It’s also important to note that the Stock Advisor has achieved an average return of 792% — significantly outperforming 153 % for the S&P 500. Don’t overlook the latest top 10 list, available to those who join Stock Advisor.

*Stock Advisor returns as of April 14, 2025

David Jagielski holds no positions in any mentioned stocks. The Motley Fool also has no positions in these stocks. The Motley Fool’s disclosure policy applies.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.