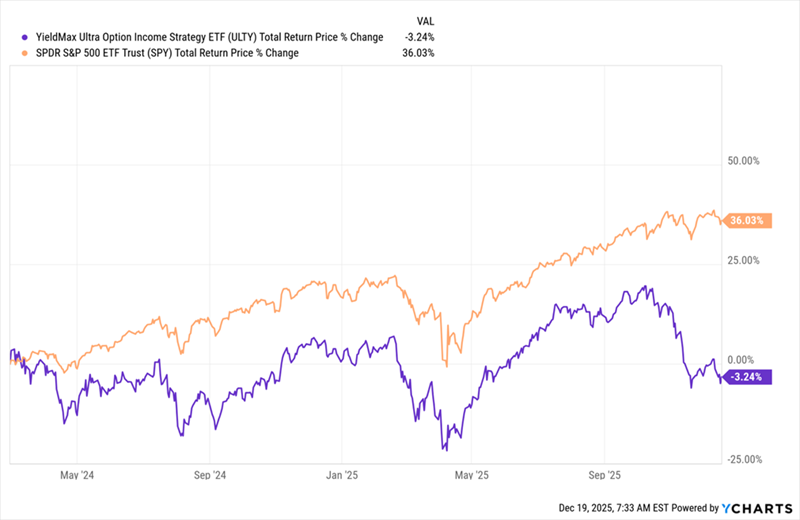

The YieldMax Ultra Income Strategy ETF (ULTY) boasts a staggering 68% annualized yield, raising concerns among investors about its sustainability. Launched in February 2024, ULTY has faced an 80% drop in price since its inception, despite the S&P 500 gaining 37% during the same period. The fund’s shift from monthly to weekly dividends has introduced further unpredictability in payouts, which have recently fallen by 58% from $1.18 per share in May to $0.492 in December.

ULTY primarily focuses on speculative tech stocks and employs a covered call strategy to generate income. However, this approach can limit upside potential in rising markets. The fund’s expense ratio stands at 1.4%, considered high for an ETF, and recent management changes indicate a shift towards larger-cap stocks to stabilize its net asset value and modify its dividend strategy.

Investors are advised to proceed with caution, as the high yield may be masking underlying risks associated with ULTY’s volatile performance and uncertain payout structure.