“If everyone’s thinking alike, then somebody isn’t thinking.” ~ George S. Patton

Exhibit A: Despite Super Micro Computer’s (SMCI) roller-coaster ride in the stock market, investors should recall that success requires skating to where the puck is going, not where it’s been. Is it time for investors to diversify out of the red-hot tech sector and back into the lagging energy sector?

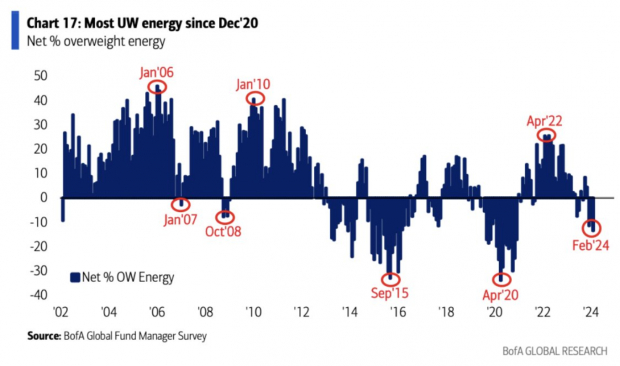

Funds are the Most Underweight Energy Stocks Since the Pandemic

Historically, lack of interest from hedge funds in the energy sector has indicated a contrarian opportunity. When funds were this underweight energy stocks in April 2020, the United States Oil Fund ETF (USO) doubled over the next few months.

Image Source: Bank of America

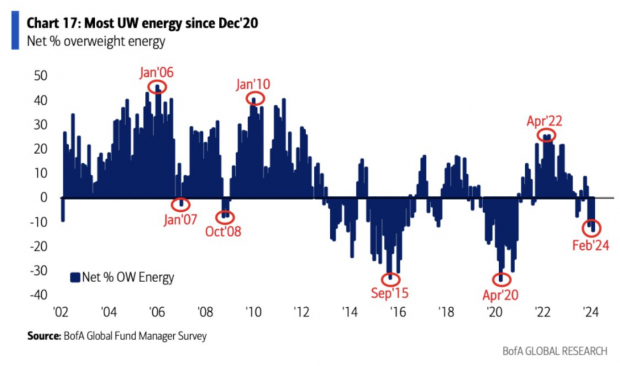

Buffett’s High Conviction OXY Play

Berkshire Hathaway’s recent 13F disclosure revealed Warren Buffett’s bullish stance on energy companies like Chevron (CVX) and Occidental Petroleum (OXY). Despite the energy sector’s lag, Buffett has increased his energy allocation, a meaningful move considering Berkshire’s whopping 50% stake in Apple (AAPL).

Image Source: Zacks Investment Research

Red Sea Disruptions Persist

Houthi rebels have disrupted the Red Sea corridor, a critical energy route globally. Despite efforts to counter the rebels’ activities, their disruptive tactics continue to pose a challenge for shippers in the area.

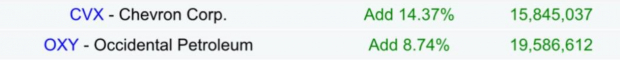

Long-Term Perspective Tells the Story

Amateur investors often succumb to “recency bias” regarding technical analysis. Zooming out to a monthly chart, one can observe the bullish trend in the SPDR Select Energy ETF (XLE) and other energy proxies.

Image Source: TradingView

Valuations

Energy giants like OXY and CVX are currently undervalued with Price-to-Book Values at multi-year lows. Seeking out such value plays might be a prudent move, especially if money rotates out of the red-hot tech sector.

Image Source: Zacks Investment Research

Recent Relative Price Strength

Amid a relatively flat S&P 500 performance for the week, energy names like ExxonMobil (XOM) have shown short-term relative strength, mostly up 2% or more.

Bottom Line

In the ever-evolving market, investors who dare to think independently often thrive over the long run. With the tech sector’s recent meteoric rise, newfound attention on the lagging energy sector may bear fruit.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

The Unseen Potential of the Energy Sector: A Time to Buy?

The prevailing mood toward the energy sector might be likened to the bleak streets of an underappreciated neighborhood. However, stocks such as Apple Inc. (AAPL), Chevron Corporation (CVX), Exxon Mobil Corporation (XOM), Occidental Petroleum Corporation (OXY), Super Micro Computer, Inc. (SMCI) and the Energy Select Sector SPDR ETF (XLE) are among those casting a flicker of hope on this seemingly forgotten sector. Emerging from the ashes like a phoenix, the energy sector is now under scrutiny, beckoning investors to pull up a chair and take notes.

Spotlight – Energy Sector: The Unloved Underdog

Despite its unpopularity, the energy sector has been showing signs of life. The public has largely turned a blind eye, but savvy investors recognize that there is more than meets the eye. The emergence of the energy sector could be compared to a diamond in the rough, obscured by externalities but emanating a luster worth investigating.

Re-evaluating the Perception

With the global push for sustainable energy solutions and the resulting decline in traditional sources, the energy sector has weathered a significant storm. However, the industry’s reaction to new demands for renewable energy and its embrace of innovative technology and business models are rewriting the narrative.

Rising from the Ashes

Even in the face of adversity, the energy sector has displayed a remarkable ability to adapt and evolve. The recent upturn in stocks suggests a subtle shift in the winds. Like a Phoenix rising from the ashes, the sector has demonstrated its resilience and capacity for revival.

Embracing the Change

The energy sector is not just surviving; it is poised to thrive. Companies within this sector, like Apple Inc., Chevron Corporation, Exxon Mobil Corporation, Occidental Petroleum Corporation, and Super Micro Computer, Inc., are spearheading a revival that could reshape the entire industry.

Final Thoughts

Though the energy sector may be currently unloved, it presents a compelling value proposition for prospective investors. Its phoenix-like rise, though subtle, reveals a story of triumph over adversity. If history has taught us anything, it is that underdogs often have the most resolve and potential. The time to buy might be closer than imagined.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.