Preparing for the AI Era: What You Need to Know

How AI Might Change Your Career and Investments

Hello, Reader.

“Am I future proof?”

This question should be on our minds, both regarding our investment portfolios and our personal careers.

The rise of AI demands that we think about how to make our financial futures secure and how to navigate our job paths.

Consider these career comparisons: which occupation seems more secure in the age of AI — accountant or bartender, software developer or yoga instructor, graphic designer or river raft guide?

While I can’t claim to know the definitive answer, my instinct would lean toward bartenders, yoga instructors, and river guides.

This brings me to what I call the “Revenge of the Bartender”—a job that I held in my younger years and one that is likely to remain in demand as long as people enjoy socializing over drinks.

On the other hand, we must consider what lies ahead for high-paying intellectual jobs typically requiring degrees. The trends show a concerning reality: these jobs are disappearing or lagging behind the overall employment growth in the U.S.

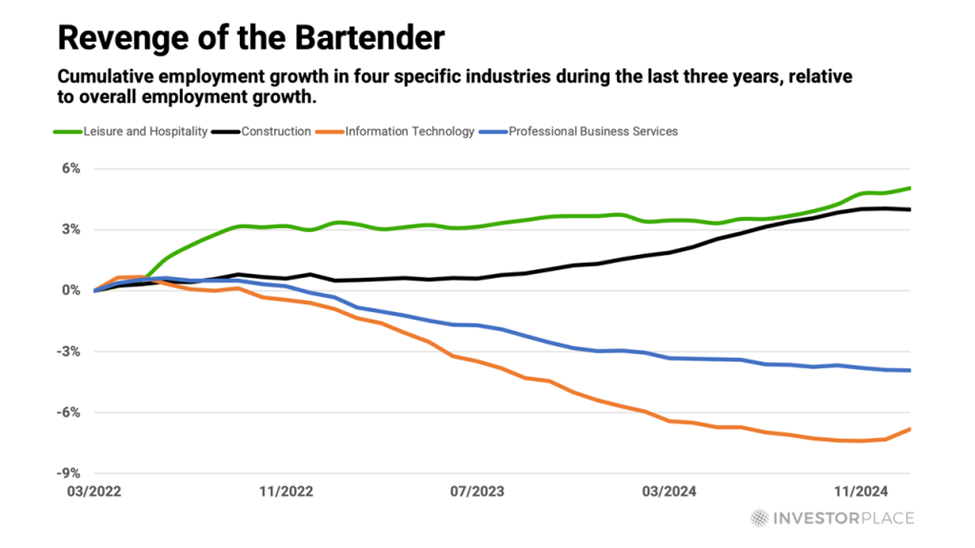

The chart below highlights the employment growth across four industry groups over the past three years, compared to the overall employment growth. While three years may seem short for drawing solid conclusions, it’s significant because that’s when AI began to make its mark on the economy.

From the chart, it’s clear that the “Leisure and Hospitality” sector, which includes bartenders, has seen the most growth — up 5% more than the overall employment increase. Following closely is “Construction,” which has risen 4% above the national average.

On the opposite end, industries that rely on “thinking” skills and often require a college degree are struggling. “Information Technology” saw a 7% decline relative to overall employment growth in the last three years, while “Professional Business Services” fell short by 4%.

These employment trends show a consistent pattern. Professions centered around human interaction, like bartending and construction, are expanding, while many intellectual fields are seeing stagnant or decreasing growth rates.

AI is playing a key role in this shift.

We are witnessing AI’s impact across multiple sectors, even among tech companies creating AI technologies. In 2023, both Alphabet Inc. (GOOGL) and Microsoft Corp. (MSFT) laid off over 10,000 employees each. In total, U.S. tech firms let go of more than 150,000 workers last year.

This trend isn’t limited to tech. Recently, Chevron Corp. (CVX) announced they would reduce their workforce by 15% to 20%, amounting to approximately 6,000 to 8,000 employees. Chevron, along with other major oil companies, is adopting advanced technologies, integrating AI for tasks such as analyzing hydrocarbon deposits and optimizing drilling processes, leading to fewer jobs for human workers.

Thus, preparing for these imminent changes has become crucial. AI’s impact has already been significant, and the arrival of artificial general intelligence (AGI) — which could replicate human-like reasoning and decision-making — will likely pose even greater threats to jobs.

I believe AGI is on the horizon, which is why I initiated my 1,000-Day Countdown to AGI back in September. You can explore this more in my free, special broadcast.

When AGI arrives, both blue-collar and white-collar workers may face unprecedented job losses and declining wages.

This makes it essential to start future-proofing your finances now. Fortunately, the current stock market still offers opportunities ahead of AGI.

I have identified several stocks poised to benefit from AGI’s transformative impact on the economy. More information can be found in my special reports: My 3 Top AGI Stocks for 1,000% Gains and The AI Dominators.

For details on accessing these reports, click here.

While you work on securing your financial future, let’s revisit what we discussed here at Smart Money last week…

Smart Money Roundup

Elon Musk Unveils New AI Bot – My Attention is Elsewhere

Unlocking Hidden AI Investment Opportunities Beyond the Big Players

Elon Musk and Sam Altman spearhead leading “AI Creator” companies that develop the LLMs behind popular tools like Grok and ChatGPT. While these companies are worth considering for investment, another equally important sector of AI often goes unnoticed. Let’s examine this lesser-known opportunity that might help secure your financial future.

Chasing 30X Returns? Discover What Louis Navellier Learned from Nvidia

In Thursday’s report, Louis Navellier delves into Nvidia’s journey from a gaming-focused company to a leader in AI technology. Although the company still has growth prospects, the next wave of AI advancement may lie in different areas. Find out the seven emerging strategies to capitalize on what Nvidia’s CEO refers to as a $100 trillion opportunity.

Don’t Miss Out: Solar Stocks May Be on the Rise Again

Solar stocks are starting to show signs of recovery after a challenging period. Following the selloff after Donald Trump’s reelection, historical data indicates that solar stocks performed better during Trump’s first term than during Joe Biden’s. Find out why Trump’s potential return could illuminate new possibilities for the solar sector and how you can make strategic investments in this momentum.

The Right Timing: When to Buy and Sell for Maximum Profit

Back in early 2020, TradeSmith CEO Keith Kaplan faced disbelief when he sold his stocks and warned of a looming bear market. His predictions, backed by his software, shielded those who listened from significant losses. Now, his system is flashing signals of another market shift, offering you a chance to stay ahead while others rely on outdated methods.

Looking Ahead: A Unique Market Pattern Emerges

Amid the disruptions caused by AI development, markets are beginning to exhibit a rare trend not seen in three decades.

This unusual market situation can lead to exaggerated gains and losses, even more pronounced than typical market fluctuations.

That’s why this Thursday, February 27, at 8 p.m. Eastern time, TradeSmith CEO Keith Kaplan will host a special event, The Last Melt-Up, to present a new technological advance aimed at mathematically tracking market behaviors during these melt-ups. He will also discuss what this technology reveals about our current market climate.

Moreover, Keith will showcase 10 promising stocks to capitalize on this market shift and identify 10 “timebomb” stocks to avoid. You can click here to register for the event.

More insights from Keith will be shared later this week. Stay tuned.

Best regards,

Eric Fry