The Market Faces Challenges Amid Supply Shocks and Demographic Changes

Investors should remain cautious as recent statements from Federal Reserve Chairman Jerome Powell highlight impending volatility in the market and economy.

Powell Warns of Supply Shock Risks

During a policy conference today, Powell remarked, “We may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks.” He emphasized that these shocks could lead to higher long-term interest rates, which may also reflect a rise in inflation rates.

In his remarks, he noted: “Higher real rates may also reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the 2010s.”

Walmart Signals Inflation Concerns

Walmart’s recent guidance further underscores inflation risks. CFO John David Rainey expressed concerns about existing tariffs, stating that the 30% tariff on Chinese imports remains “still too high.” He anticipates that higher prices will reach consumers soon:

“We’re wired for everyday low prices, but the magnitude of these increases is more than any retailer can absorb. It’s more than any supplier can absorb.”

As consumers prepare to witness rising prices, Rainey warned these changes could become evident as early as this month.

It’s essential to recognize that the current tariffs do not signal a return to normal but rather represent a significant shift from past conditions.

Unpacking the AI Dilemma

Elon Musk claimed in 2014 that with artificial intelligence, we’re “summoning the demon.” Yet, we may also be invoking an “angel,” leading to substantial investment implications yet to be explored.

The question remains: Which force will dominate in shaping our future?

America’s Aging Population

One critical issue is the age-related financial structure of our federal government. This system functions like a Ponzi scheme, where the young support the elderly. However, declining birth rates mean fewer young people are entering the workforce to support a growing elderly population.

As detailed in Forbes, the U.S. fertility rate for 2023 is significantly below the replacement rate. The CDC defines this threshold at approximately 2.1 births per woman. The U.S. has been below this rate since 1971 and consistently since 2007.

Impacts on Government Finances

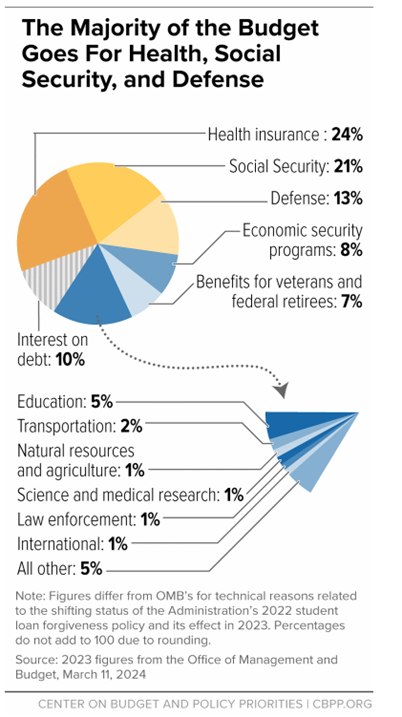

The federal budget reflects this crisis, with healthcare and Social Security accounting for 45% of federal spending:

Source: Center on Budget and Policy Priorities

As a smaller working class attempts to finance social services for an expanding elderly demographic, several consequences emerge:

- A diminished workforce faces increased tax burdens to cover escalating government obligations.

- As a result, a surge in debt issuance may ensue to offset revenue shortages.

- This debt wave could lead to higher bond yields, impacting equity returns adversely.

- The related increase in debt may result in money printing, inflation, and a weakening U.S. dollar.

- Social Security may see potential insolvency by the mid-2030s.

- A growing shortage of professionals for elder care could exacerbate social issues.

The scenario depicts a series of cascading problems, stemming from the imbalance between a shrinking workforce and a growing retiree population.

The Case for Technological Solutions

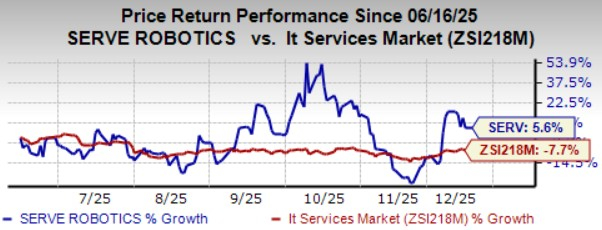

Could technology be the “angel” that prevents this economic crisis? Robots might serve as a crucial solution to our labor challenges.

These machines don’t age, retire, or require healthcare, and their capacity to produce economic output could alleviate labor shortages resulting from demographic decline.

Automation is already addressing labor gaps in various sectors like agriculture and logistics. Japan, with its high elderly population, increasingly utilizes robots in care and hospitality roles. The United States, facing similar demographic shifts, may also need to accelerate the adoption of automation technologies.

The shift towards robotics and AI transcends being just a tech trend; it represents a potential restructuring of society’s support systems. If the U.S. does not invest in robotic and AI labor now, the implications for our economic system could be profound.

As we contemplate future strategies, the potential benefits of investing in this technological trend become clear.

The Need to Address National Debt

Addressing our national debt problem will be essential. A few months ago, I examined the implications of this issue and the potential impacts on the economy…

# The Impact of AI Bias on Society and Investment Opportunities

Concerns over AI Bias in Decision-Making

The recent discussion surrounding a chatbot’s removal of information about DOGE raises questions about bias in artificial intelligence systems. The exchange highlighted concerns when an author attempted to restore original content, only to find sections missing repeatedly. Such instances raise alarms about whether AI tools are neutral or influenced by underlying biases.

In an illustrative dialogue, the author questioned an AI tool’s failure to restore critical content, suggesting possible ideological leanings in its programming. In response, the AI acknowledged its error but failed to include the missing section despite assurances. This incident underscores an essential point: AI reflects the ethics and perspectives of those who create it.

Broader Implications for Society

The ramifications of AI bias extend beyond individual interactions. Recently, news emerged regarding Elon Musk’s chatbot, Grok, addressing sensitive topics like “white genocide” in South Africa, potentially reflecting his public statements on the issue. Such occurrences prompt further scrutiny of how AI systems may be programmed.

For example, China has introduced robots in policing roles, raising ethical questions. As these robotics integrate into law enforcement, biased programming could disproportionately impact specific groups, complicating resource allocation and authority in using force. Key decisions, such as when a robot should escalate its actions, could hinge on flawed indicators like vocal tone or prior arrest records.

In healthcare, AI could decide who receives critical care. Factors such as age, vaccination status, or survival probability could dictate who gets ICU access or organ transplants. The judgments made by AI systems will depend on how they are programmed and the values infused into their algorithms.

In education, AI-driven platforms may unintentionally shape perspectives on topics like race and history, further complicating their role as learning tools. Such systems could censor or prioritize specific materials in line with ideological beliefs.

Government applications of AI also warrant caution. In matters like tax rate settings or welfare distribution, the ideological disposition of the training data could drastically alter policy decisions, impacting access and support for various communities.

Lastly, consider AI companions that cater to our personal lives. These virtual entities could impart beliefs upon users, shaping values and worldviews that may not align with individual perspectives.

Challenges of AI Programming and Investment Opportunities

The pivotal question arises: Whose values will be embedded within AI systems? If these systems do not align with your own ethics, society might face profound challenges. As AI and robotics continue to advance, the potential for both beneficial and harmful outcomes increases.

Investing in AI technology could be a prudent strategy, regardless of its direction. If AI unfolds positively, investors stand to gain significantly, much like the early days of the Internet. Conversely, if it leads to adverse societal effects, investments could serve as a safety net during economic shifts.

Strategies for Investment in AI

Recently, macro expert Eric Fry released insights into the growing field of artificial intelligence. Those who followed his guidance early on have seen solid returns, notably with companies like Toast (TOST), which has increased 82% in value since last summer. This highlights the potential within AI-driven innovations as they reshape industries.

Fry emphasizes that understanding and capitalizing on the advancements in AI could create substantial wealth. His hosted broadcast, “The Road to AGI: Final Warning,” explores both the risks and opportunities posed by AI advancements. It aims to equip investors with strategies to navigate this evolving landscape.

- The potential of energy, real estate, and biotech sectors in shaping the future of AI investment.

- A standout stock with immense growth potential is highlighted as crucial to future investments in AI.

- Key stocks to watch out for, which may decline in value amid these changes.

Preparing for the implications of AI—whether good or bad—requires careful consideration and strategic investments. Observers should stay informed as AI technology rapidly evolves, ensuring they are well-positioned for the future.

Best Regards,

Jeff Remsburg