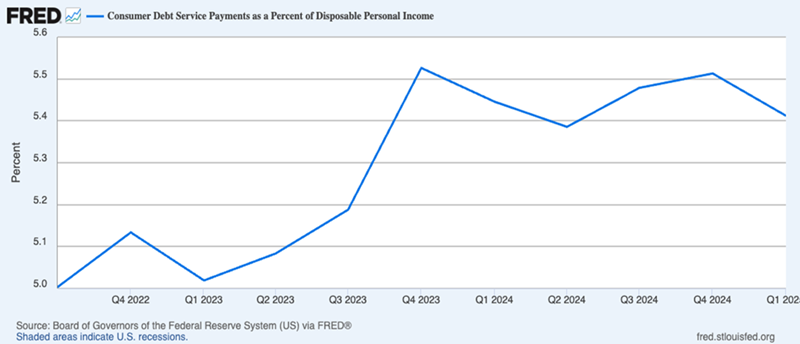

Amidst the murky economic waters, the Federal Reserve’s stance on interest rates holds substantial sway over investor sentiment. Will they act? Can inflation be tamed? The uncertainty is palpable. Market darlings of yesteryear falter under the weight of past rate hikes, while others surge in anticipation of looming cuts. But what if the Fed throws a curveball? Some stocks stand precariously at the mercy of monetary policy.

This is where the allure of Fed-proof equities shines. Certain companies exhibit resilience, weathering the shifting sands of monetary policy with grace. These stalwart ventures, impervious to the ebb and flow of interest rates, are the bedrock of a robust investment strategy.

For those seeking to fortify their portfolios with three dependable picks, here’s where the hunt begins.

Restaurant Brands International (QSR)

Source: Tony Prato / Shutterstock.com

Restaurant Brands International (NYSE:QSR) emerges as a beacon for investors seeking shelter in the consumer discretionary domain. The Canadian conglomerate, home to renowned fast-food chains like Tim Horton’s, Burger King, Popeye’s Louisiana Kitchen, and Firehouse Subs, boasts a resilient cash flow stream, underpinning a consistent dividend yield averaging 3% in recent memory.

With visionary expansion plans aiming to amass over 40,000 restaurants and $60 billion in revenue, Restaurant Brands International’s future gleams with promise. In times of plenty or paucity, sustenance remains a non-negotiable. In an economic downturn, the trade-down phenomenon could potentially bolster the company’s market standing. QSR stock emerges as a defensive bastion against the vagaries of consumer spending, a gem glittering amidst market uncertainties.

Devon Energy (DVN)

Source: Jeff Whyte / Shutterstock.com

Amidst recent turbulence in the oil and gas sector, Devon Energy (NYSE:DVN) emerges as a beacon of resilience and stability. With a formidable footprint in natural gas and oil production, Devon’s strategic maneuvers, heralded by savvy acquisitions and technological advancements, power industries and homes worldwide.

Entering 2024 on a high note, Devon Energy proudly announced a cash dividend of $0.22 per share, a riveting spectacle for investors. While this figure lagged behind its 2023 counterparts, Devon’s annual dividend of $0.88 showcases a tantalizing 1.81% yield, bundled with a modest price-earnings ratio of 8.3 times.

Devon Energy’s dividend framework, blending fixed and variable elements, beckons to investors seeking both stability and periodic windfalls. Despite market vicissitudes, Devon Energy’s trajectory points skyward, offering long-term capital appreciation under any energy price regime. With a breakeven threshold that belies market volatility, Devon Energy stands as a sturdy anchor in the tempestuous energy domain.

Allstate (ALL)

Source: Jonathan Weiss / Shutterstock.com

In the pantheon of recession-resistant stocks often overlooked by investors, Northbrook-based Allstate (NYSE:ALL) stands tall as one of the largest property-casualty insurers in the United States. With a wide array of insurance and investment products catering to over 16 million households in the U.S. and Canada, Allstate’s financial fortitude rarely fails to impress.

In a climate favoring low-interest rates, Allstate exudes promise. Reduced rates invigorate Allstate’s bond portfolio, elevating its worth and desirability. An economy in flux spurs a surge in financial coverage demands, positioning Allstate as a premier post-Fed decision stock candidate. Noteworthy upgrades from financial stalwarts like HSBC (NYSE:HSBC) herald Allstate’s meteoric rise, with bullish sentiments echoing across the financial realm.

Chris MacDonald’s passion for investing, honed through an MBA in Finance and rich corporate finance and venture capital experience spanning 15 years, underscores his conservative, long-term investment ethos. His keen eye for undervalued growth prospects illuminates the path for astute investors seeking long-term wealth creation.