The Joe Rogan Experience: A Game-Changer for Spotify’s Growth and Investor Returns

The Joe Rogan Experience (JRE) launched exclusively on Spotify Inc. SPOT in September 2020 as part of a multi-year agreement valued at around $200 million. This partnership marked a significant turning point not just for podcast enthusiasts but also for investors looking for growth in the podcasting market.

Rogan’s Role in Boosting Spotify

Spotify’s exclusive agreement with Rogan proved to be a strategic move that reaped rewards. Since the deal commenced, podcasting on the platform has surged by an impressive 232%, as reported by the company.

As a result, advertising interest has grown, contributing to a remarkable 80% revenue increase in 2023 compared to 2021. Rogan’s show, which consistently ranks as the world’s most-streamed podcast, has been instrumental in establishing Spotify as a dominant force in the podcast industry.

In 2023, Rogan’s podcast once again topped Spotify’s podcast charts for the fourth consecutive year.

Investment Growth Since the JRE Premiere

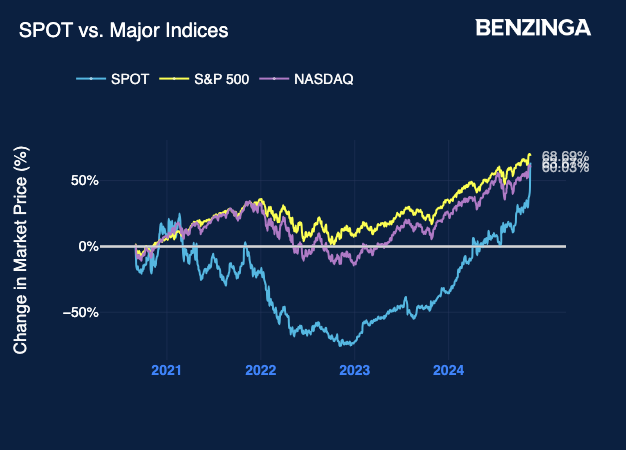

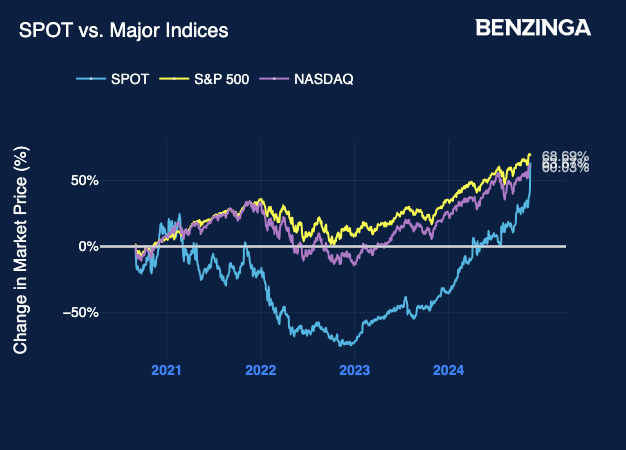

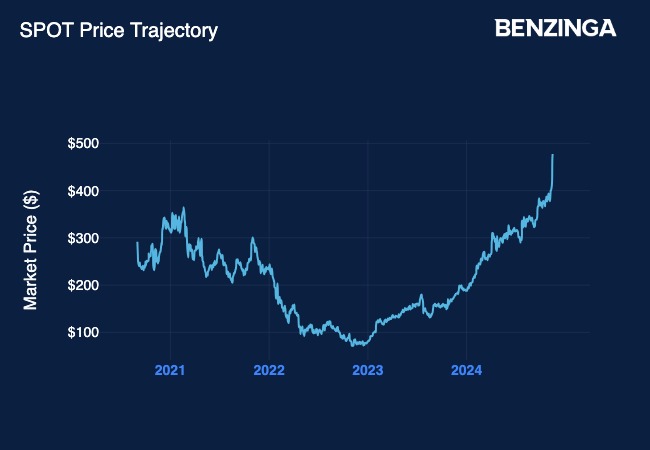

Consider this: if you had invested $1,000 in Spotify stock on September 1, 2020—the day Rogan’s show began streaming exclusively—you would now see your investment valued at approximately $1,696.

This equates to a gain of 69.7%, outperforming major market indices during the same timeline. For comparison, the S&P 500 rose by 68.7%, while the Nasdaq Composite saw a gain of 60%.

New Developments for JRE and Spotify

This year, Spotify renewed its partnership with Rogan; however, the show will now be available on multiple platforms, including Apple, Amazon, and Google’s YouTube.

In its third-quarter financial report released earlier this month, Spotify reported earnings of $1.46 per share, falling short of the analyst expectation of $1.76. Quarterly revenue totaled $3.99 billion, slightly below the anticipated $4.02 billion but increased from $3.65 billion in the same period last year.

Spotify’s Stock Update: As of Thursday’s close, Spotify shares gained 2.17%, finishing at $477.50. In after-hours trading, the stock experienced a slight decrease, settling at $476 according to the latest data from Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs