The Future of Quantum Computing: Is IonQ the Right Investment?

Quantum computing could revolutionize industries, but is IonQ a smart buy or a risky gamble?

Quantum computing holds the potential to transform our understanding of computers. This technology aims to address problems that traditional computers struggle with and to expedite slow computing tasks. In theory, quantum computers should excel at detecting patterns in unstructured data, making them valuable for real-world applications in fields like healthcare research, financial services, and cryptocurrencies. However, realizing this potential is still a long ways off.

Currently, quantum computers are hefty and costly, and their performance has not yet reached impressive levels. Many proposed applications rely on hundreds, thousands, or even millions of qubits—units of quantum information—before they can outperform conventional computers.

Although researchers have recently overcome the 1,000-qubit milestone, these experimental systems require expensive superconductors and experience high data errors. Presently, the best commercial hardware features only a few dozen qubits.

IonQ (NYSE: IONQ) has emerged as a pioneer in quantum computing systems. The company recently fulfilled its first international order and secured a $54.5 million research contract with the U.S. Air Force. While these achievements are notable, investors are keenly focused on what lies ahead.

The question now is: What will IonQ’s role be in the quantum computing market in three years? Is this a suitable stock for investors today?

Why Investors Should Monitor IonQ

There are several positive indicators for IonQ that investors should keep an eye on:

- IonQ has outperformed Wall Street’s earnings expectations for the past two quarters, with a consistent record of positive revenue surprises dating back to spring 2023. Investors are growing accustomed to favorable earnings reports.

- Research and development (R&D) is critical to the quantum computing field, and IonQ is investing significantly in this area. Its R&D budget increased by 57% year-over-year in the second quarter, representing 52% of the company’s total operating expenses.

- This substantial investment in research is yielding results. IonQ has achieved 99.9% accuracy in a two-qubit system and aims for 99.999% accuracy by the end of 2025, alongside plans to develop commercial-grade systems with over 100 qubits.

The High Cost of R&D

However, IonQ has its challenges. Here are some concerns regarding its stock:

- IonQ’s R&D expenditures amount to 274% of its revenue for the same quarter. The company reported a net loss of $37.6 million in the second quarter, based on $11.4 million in revenue.

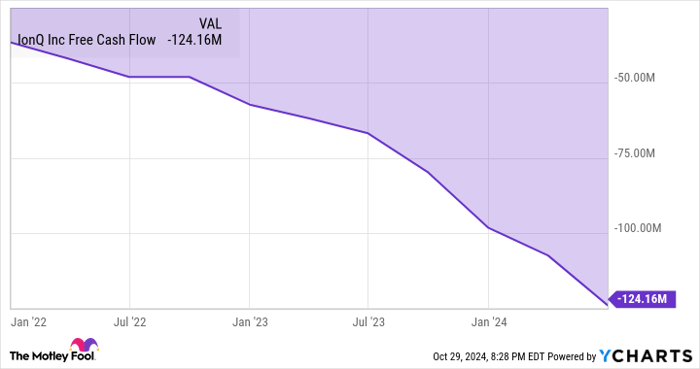

- IonQ raised $573 million during its public debut in 2021 through a merger with a special purpose acquisition company (SPAC). Three years later, it has $370 million in cash equivalents, having depleted one-third of its reserves at an increasing rate. How long will it take before IonQ needs to take on debt or conduct a substantial stock sale to sustain operations?

IONQ Free Cash Flow data by YCharts

- IonQ is a leader in the commercialization of quantum computing, but it faces tough competition from well-established tech giants like IBM (NYSE: IBM), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Microsoft. Competing successfully against these players is no small feat, and any one of them could decide to acquire IonQ if it gains too much traction.

Potential Outcomes for IonQ by 2027

IonQ faces two potential paths: it could emerge as a major player or become a financially struggling entity in three years. There’s also the possibility it could become a subsidiary of a larger corporation, providing early investors with a substantial buyout.

Without a stable, cost-effective quantum computer, predicting the odds of these scenarios is as complex as the technology itself. Thus, for now, I have decided against purchasing IonQ stock—its status feels more like a gamble than a solid investment.

I prefer to observe the developments in quantum computing from a safe distance while maintaining investments in established companies like IBM and Alphabet. These tech leaders have a strong chance of thriving in this emerging field while already being successful in other areas. I will keep an eye on IonQ’s growth, but its current risk level isn’t suitable for my investment strategy.

Don’t Miss Out on This Investment Opportunity

Have you ever felt like you missed out on successful stock investments? If so, this may be your chance to catch up.

From time to time, our team of expert analysts identifies “Double Down” stocks—companies poised for significant growth. If you’re concerned about missing your opportunity, now is the time to invest before it slips away. Here are some impressive results:

- Amazon: A $1,000 investment in 2010 would have grown to $21,706!*

- Apple: A $1,000 investment in 2008 would now be worth $43,529!*

- Netflix: A $1,000 investment in 2004 would be valued at $406,486!*

Right now, we’re issuing “Double Down” alerts for three outstanding companies, and opportunities like this may not come around again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and International Business Machines. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.