Is ASML the Next Trillion-Dollar Company?

The trillion-dollar market cap has become a noteworthy metric for identifying mega-cap companies. Although we may overemphasize round numbers, achieving a market value with four commas is undeniably impressive. Currently, there are seven non-state-owned companies valued above $1 trillion, while two others that once reached this benchmark have since fallen below it. This leaves an exclusive group seeking its 10th member.

While many investors turn their attention to companies that have already crossed the trillion-dollar line, savvy investors recognize that past performance doesn’t guarantee future stock returns. Spotting the next potential trillion-dollar company could lead to rewarding investment opportunities. Semiconductor equipment manufacturer ASML (NASDAQ: ASML), valued at $285 billion today, stands out as a leading contender. As the 31st largest company worldwide by market capitalization, ASML is experiencing rapid growth, supported by favorable industry trends.

Will ASML hit a market cap of $1 trillion by 2030? Let’s examine the figures.

The AI Advantage

ASML specializes in creating semiconductor manufacturing equipment, particularly lithography machines. These machines are essential for placing transistors on computer chips with remarkable precision. Its extremely advanced extreme ultraviolet (EUV) lithography machines play a crucial role in the production of sophisticated semiconductors for firms like Taiwan Semiconductor Manufacturing.

The demand for these semiconductors is rising in various sectors, including smartphones and data centers for artificial intelligence (AI). As the need for advanced chips increases, the reliance on ASML’s EUV machines in global factories also grows. Over the past decade, ASML’s revenue has surged by 266%.

Given the escalating demand for advanced computer chips to support AI advancements, ASML’s revenue growth appears poised to continue over the next 10 years. Last quarter, the company reported sales of around 7.5 billion euros, a jump from 6.2 billion euros the previous year. Although new bookings were below expectations during one period, this is not overly concerning, especially considering ASML’s historical ability to expand orders and deliver machines to its customers.

Analyzing the Financials

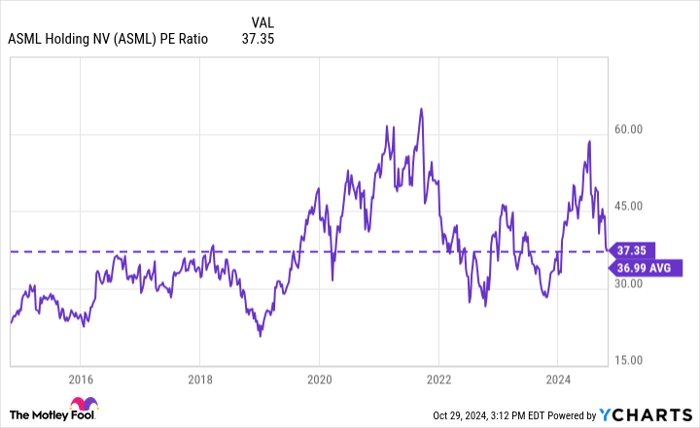

ASML clearly operates a strong business, but is it on track to reach a $1 trillion market cap by 2030? Let’s delve into the financial details. Currently, ASML’s net income stands at $7.5 billion. To reach a trillion-dollar valuation, the company would need to achieve a net income of at least $25 billion, which would yield a price-to-earnings ratio (P/E) of 40 at that market cap. While a P/E of 40 is relatively high, it’s not impossible, as ASML has maintained an average P/E of 37 over the past decade.

Looking ahead to 2030, ASML’s management anticipates a 9% annual growth rate in semiconductor market spending. If ASML can slightly exceed this growth, achieving a 12% annual revenue increase over the next five years, the revenue could reach $50 billion. Given that ASML’s net income margin is around 25%, this would translate to approximately $12.5 billion in net income. To reach $25 billion in net income, ASML would need a much higher margin of 50%—a highly unlikely scenario.

In summary, it is improbable that ASML will achieve a market cap of $1 trillion by 2030.

ASML P/E Ratio data by YCharts.

Beyond the Trillion-Dollar Question

Even if ASML does not reach a trillion-dollar market cap by 2030, this does not automatically make it a poor investment. Investors should consider two critical questions: Is ASML a solid business? Is its stock priced reasonably?

The company holds a monopoly on advanced lithography equipment, which supports its stature as a strong business. Even significant investments in state capacity initiatives in China have not been able to replicate ASML’s technology. Moreover, the stock does not seem excessively priced. After declining 35% this year, it now has a P/E ratio of 37—essentially the same as its long-term average.

As long as ASML can continue to grow its revenue in line with the semiconductor market, the stock may still provide satisfactory returns over the next five years. However, investors should not expect it to cross the $1 trillion mark anytime soon.

A Second Chance for Investors

Have you ever felt you missed out on investing in successful companies? If so, you might want to consider this opportunity.

Occasionally, our team of analysts identifies “Double Down” stock recommendations—companies they believe are poised for significant growth. If you think you’ve lost your chance to invest, now might be the best time to get in, based on historical results:

- Amazon: If you invested $1,000 following our recommendation in 2010, you’d have $22,292!

- Apple: If you invested $1,000 in 2008, you’d have $42,169!

- Netflix: If you invested $1,000 in 2004, you’d have $407,758!

Currently, we are issuing “Double Down” alerts for three outstanding companies, and such opportunities may not happen again soon.

Explore these 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.