“`html

Tesla Inc. (TSLA) reported Q1 2025 revenue of $19.3 billion and adjusted EPS of $0.27, marking year-over-year declines of 9% and 50%, respectively. The company’s gross margin also contracted to 16.3%, down from 17.4% the previous year. In the same period, Tesla delivered approximately 337,000 electric vehicles (EVs) and produced nearly 363,000.

In contrast, Rivian Automotive Inc. (RIVN) gained roughly 2% in 2025, reporting a gross profit of $206 million and producing about 14,600 vehicles while delivering 8,600. Rivian has revised its FY25 delivery guidance to 40,000-60,000 units due to current economic conditions, while its EPS outlook has seen positive revisions with a consensus estimate of -$2.49, up 14% over the past few months.

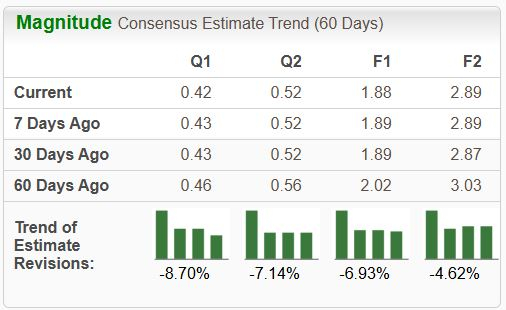

Tesla currently holds a Zacks Rank of #5 (Strong Sell), with analysts revising EPS expectations negatively, indicating a tough outlook for the stock when compared to the stronger performance and bullish EPS revisions for Rivian.

“`