Eli Lilly’s Strong Performance: Is It Time to Invest?

Eli Lilly (NYSE: LLY) has demonstrated remarkable results over the past five years, consistently outperforming the broader market compared to other pharmaceutical giants. Some investors may wonder if it’s too late to buy into Eli Lilly’s success, while others argue that the company’s advances in diabetes and obesity treatments still present a long-term investment opportunity. This article aims to analyze Lilly’s potential through the end of the decade and evaluate current investment viability in its stock.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Promising Revenue Growth Ahead

First, let’s examine how Eli Lilly’s new products could impact its performance in the coming five years. Significant developments include the Alzheimer’s disease medication Kisunla, the ulcerative colitis treatment Omvoh, and the cancer drug Jaypirca.

Most notably, Lilly’s diabetes treatment Mounjaro and weight management drug Zepbound, both containing the active ingredient tirzepatide, stand out. In 2024, Eli Lilly reported a remarkable 32% year-over-year revenue growth, totaling $45 billion. The tirzepatide franchise alone accounted for approximately $16.5 billion, despite being on the market for less than three years.

Analysts foresee potential peak annual sales for tirzepatide reaching $25 billion, suggesting that previous estimates might have underestimated its potential. Expectations are that Zepbound and Mounjaro will continue their growth trajectory through 2030, although increased competition might temper their pace.

Moreover, other products in Lilly’s expanding portfolio are expected to gain traction. Kisunla, particularly critical in Alzheimer’s treatment, could generate around $2.5 billion in revenue by 2030. Other products like Jaypirca and Omvoh are also anticipated to contribute meaningfully to sales by the decade’s end.

Strong Pipeline Progress is Expected

Lilly’s pipeline is filled with several promising candidates, anticipated to receive approvals in the next five years. Notably, orforglipron and retatrutide are potential weight loss therapies progressing through phase 3 trials, with applications also considered for diabetes and sleep apnea.

Retatrutide, a triple agonist, stands out as it stimulates three hormones: GLP-1, GIP, and GCG. This could offer enhancements over tirzepatide, which targets only GLP-1 and GIP. Clinical trials will ultimately demonstrate retatrutide’s effectiveness.

Compared to its competitors, particularly Novo Nordisk, Lilly’s pipeline in the competitive GLP-1 market appears robust. Analysts suggest that by 2030, retatrutide could generate around $5 billion, with orforglipron possibly reaching $8.3 billion in sales.

Additionally, other innovative Lilly products could emerge by 2030, with existing therapies potentially receiving label expansions. Overall, the company’s product lineup is likely to be even more formidable by the decade’s completion.

Is Eli Lilly Stock a Good Buy?

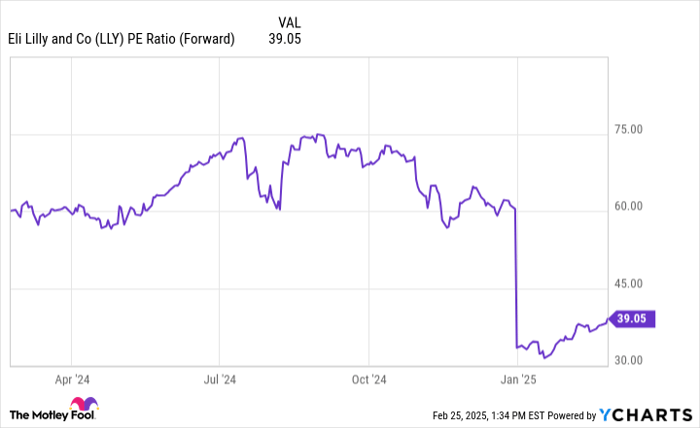

Critics may highlight Eli Lilly’s forward price-to-earnings (P/E) ratio of 39. The current average for the healthcare sector rests at 17.7, suggesting that Lilly may be overvalued. This raises the question – should investors wait for a better entry point?

LLY PE Ratio (Forward) data by YCharts.

I contend that the stock is fairly valued. Eli Lilly has consistently outpaced revenue and earnings growth compared to its similarly sized healthcare peers, justifying a higher forward P/E ratio.

In my opinion, Eli Lilly is likely to outperform the market over the next five years. Given its strong innovation capabilities, it should continue to be a worthwhile stock beyond that period.

Should You Invest $1,000 in Eli Lilly Right Now?

Before making an investment in Eli Lilly stock, it’s essential to consider this:

The Motley Fool Stock Advisor analyst team recently identified their top ten best stocks for investment, and Eli Lilly did not make the list. The selected stocks are projected to yield significant returns in the future.

For example, when Nvidia was recommended on April 15, 2005, a $1,000 investment would have grown to $765,576!

Stock Advisor offers investors a straightforward pathway to success, including portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has quadrupled the S&P 500 returns. Don’t miss out on the latest top 10 list, available with your subscription to Stock Advisor.

*Stock Advisor returns as of February 28, 2025

Prosper Junior Bakiny has positions in Eli Lilly and Novo Nordisk. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.