Market Trends and Stock Performance Amid Economic Concerns

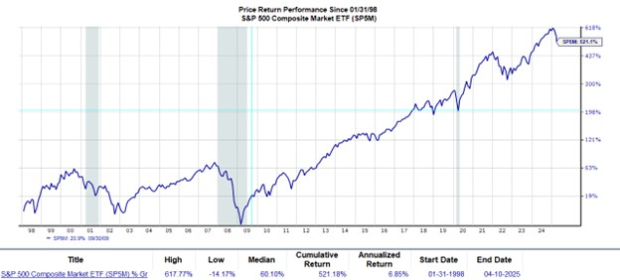

In recent weeks, the Stock market has experienced its most significant monthly decline since the COVID-19 pandemic. Historically, the recovery after the pandemic provided unique opportunities for investors to achieve substantial returns when the market rebounded.

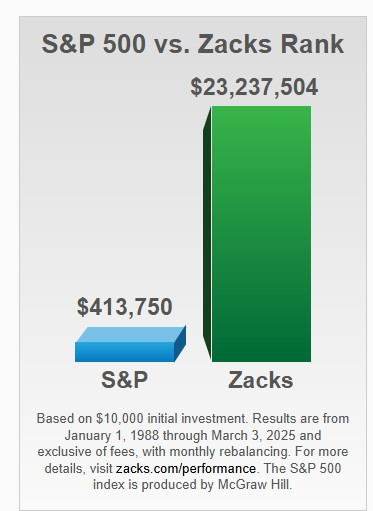

While the current economic climate may differ from the past, earnings estimate revisions remain a crucial tool for investors. This method is at the core of the Zacks Rank, which aids investors in identifying promising stocks.

Following the Zacks Rank can help determine which companies are effectively maneuvering through a tariff-driven economic slowdown. Although long-term market prospects remain strong, current uncertainties are understandable as the Trump administration has imposed the highest tariffs on imports in over a century, likely triggering retaliatory actions from other nations.

Nevertheless, the Zacks Rank provides valuable insights, highlighting that stocks rated #1 (Strong Buy) have historically outperformed the S&P 500, averaging gains of +23.9% per year since 1998.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Market Recalibration and Cape Ratio Insights

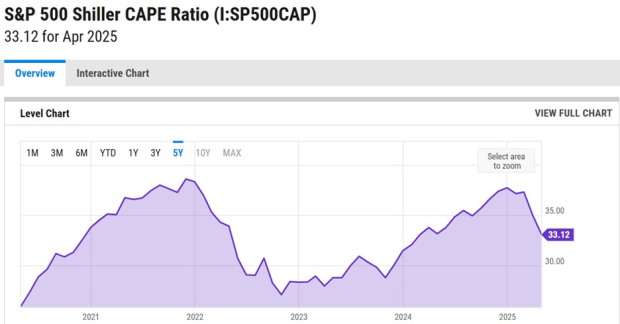

Many analysts are calling for a recalibration in the market. Investor Jeffrey Gundlach has noted that the Cape ratio for the S&P 500 is nearing its second-highest level ever at 38X, indicating that stocks remain overvalued.

The Cape ratio, also referred to as the Shiller P/E ratio, evaluates stock prices against average inflation-adjusted earnings over the last decade to minimize economic cycle fluctuations. While the S&P 500’s forward earnings multiple stands at a manageable 20.1X, the Cape ratio is significantly higher at 33.1X compared to a historical average of 16.9X.

Gundlach has suggested a 60% chance of a recession, highlighting risks for leveraged investors amid turbulent market conditions, as companies face challenges related to tariffs rather than pandemic-related supply chain issues.

Image Source: YCHARTS

Exploring Opportunities in the Mag 7

Intriguing long-term investment opportunities are arising, particularly among the Mag-7 stocks, which include electric vehicle leader Tesla TSLA, AI chip frontrunner Nvidia NVDA, and electronics giant Apple AAPL.

For instance, Apple is in a challenging position; its recent trading near a 52-week low of $164 a share before climbing to just under $200 raises questions for investors considering whether to buy on the dip. The stock is still about 23% away from its 52-week high, and with its heavy reliance on international manufacturing in China, India, and Vietnam, it stands to be significantly impacted by tariffs.

According to the Zacks Rank, it may be time to reconsider recent gains in AAPL. Earnings estimates have been falling over the past quarter, particularly for fiscal years 2025 and 2026, which has resulted in a Zacks Rank #4 (Sell) for the company’s stock.

Image Source: Zacks Investment Research

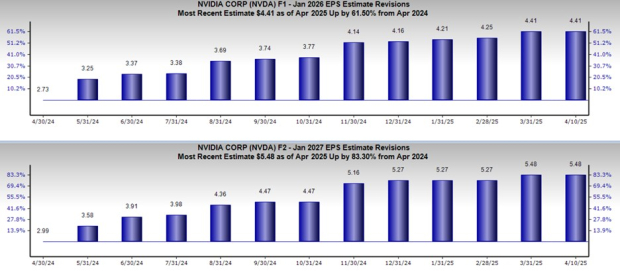

In contrast, Nvidia is the only Mag 7 stock currently rated as a buy (Zacks Rank #2). The chipmaker has experienced a favorable trend of positive earnings estimate revisions, suggesting that NVDA may be positioned for a stronger rebound compared to its technology peers. Over the last year, the rising EPS estimates have contributed to a +25% increase in NVDA, despite an 18% dip in 2025 projections.

Image Source: Zacks Investment Research

ASLE: A Noteworthy Addition to the Zacks Rank #1 List

Trading under $10, ASLE offers an interesting option as investors explore opportunities in this volatile environment.

AerSale: A Top Contender with Soaring Earnings Forecasts

AerSale’s ASLE stock stands out as a noteworthy entry on the Zacks Rank #1 (Strong Buy) list. The company specializes in integrated, diversified aviation aftermarket products and services, aiding aircraft owners and operators in achieving cost efficiencies in the operation, maintenance, and monetization of their aircraft, engines, and components. Remarkably, AerSale’s Zacks Aerospace-Defense Equipment Industry is currently situated in the top 9% among over 240 Zacks industries.

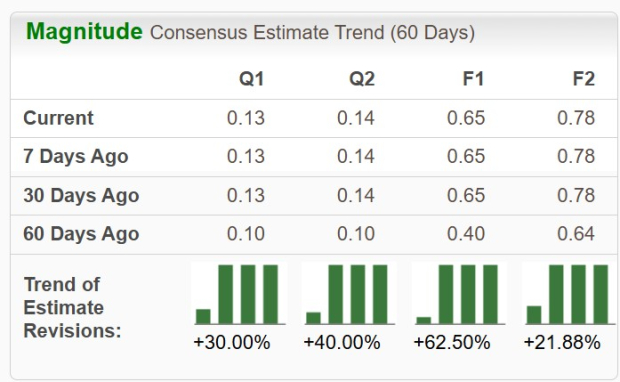

In response to a robust business environment, AerSale’s earnings per share (EPS) estimates have surged over the past 60 days. Analysts project an impressive 261% increase in annual earnings this year, reaching $0.65 per share, up from $0.18 in 2024. Additionally, the FY26 EPS is forecasted to rise another 20% to $0.78.

Image Source: Zacks Investment Research

Conclusion

Given that earnings estimate revisions are a critical factor influencing stock prices, keeping an eye on the Zacks Rank can provide valuable insights, especially during times of increased market volatility amid a historic trade war.

Zacks Identifies a Leading Semiconductor Stock

This semiconductor stock is a diminutive player compared to NVIDIA, which has skyrocketed more than 800% since its recommendation. While NVIDIA remains a strong performer, this new top chip stock holds significant growth potential.

With robust earnings growth and a growing customer base, this stock is well-positioned to capitalize on the mounting demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is anticipated to soar from $452 billion in 2021 to $803 billion by 2028.

Check Out This Stock Now for Free >>

For the latest recommendations from Zacks Investment Research, you can download the report on “7 Best Stocks for the Next 30 Days”. Click here to get this free report.

Apple Inc. (AAPL): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Tesla, Inc. (TSLA): Free Stock Analysis report

AerSale Corporation (ASLE): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.