Investment Contradictions: Navigating Market Realities with AI Support

Have you noticed the contradictions among our “wisest” investment strategies? Here are a few notable examples:

- “Let your winners run” versus “Little pigs get big, but big pigs get slaughtered.”

- “Cut your losers short” against “Time in the market beats timing the market.”

- “Be greedy when others are fearful” compared to “Never catch a falling knife.”

- “Stick to your investment plan” or “When the facts change, I change my mind.”

There are always maxims that, in retrospect, seem like the best choice—often cited by a novice at a brokerage firm. Consider the stock you sold after it dropped 20%, prompting a stop-loss. When it bounces back and becomes a 300% gainer, it’s easy to think you should have known better. Warren Buffett famously remarked, “The stock market is designed to transfer money from the active to the patient.”

However, keeping that other 20% loser in your portfolio might sting even more when it plummets 85% without recovery. As Buffett said, “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” Although this quote originates from Peter Lynch, Buffett appreciated its wisdom enough to include it in his shareholder letters.

In summary, investing is challenging.

The Statistical Challenges of Investing

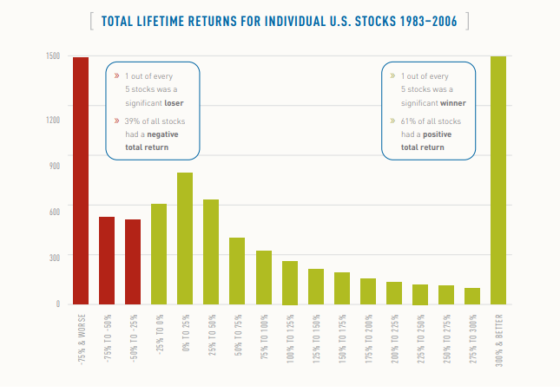

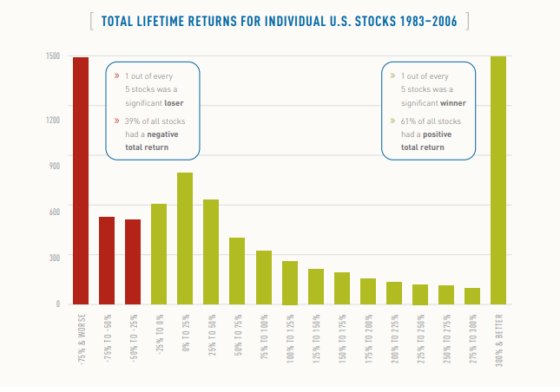

Approximately ten years ago, the research firm Longboard analyzed the lifetime returns for U.S. stocks from 1983 to 2006. They discovered that the 6,000 worst-performing stocks—making up 75% of the stocks studied—had a cumulative return of 0%. The top 2,000 stocks, which represented just 25%, drove all the gains.

According to Longboard’s findings:

If an investor was unfortunate enough to miss the 25% most profitable stocks and instead invested in the other 75%, their total gain from 1983 to 2006 would have been 0%.

In short, a minority of stocks generates the majority of market gains.

This distressing statistic conceals an even bleaker financial reality. While zero return would be disappointing, the implication is that you would at least maintain your original investment. This is not the case. The Longboard study revealed that 18.5% of stocks lost at least 75% of their value—meaning nearly one in five resulted in substantial financial losses.

For further context, here’s the breakdown:

Source: Longboard

Additional studies yield similar outcomes. Research by economist Hendrik Bessembinder, which examined stocks from 1926 to 2015, concluded that around 60% of stocks performed worse than one-month U.S. Treasury notes.

Bessembinder stated:

It is historically the norm that a few top-performing companies significantly influence overall market performance. I expect this pattern to continue.

While this might be the norm, it serves as a sobering reminder for investors. Identifying big winners can be tough. If you fail to find one, a 0% return may not be the worst potential outcome—but facing significant losses is a genuine concern, often more frequent than many investors recognize.

It’s worth noting that the struggle with underperformance is not unique to individual investors.

Market analyst Charlie Bilello commented:

Most professional money managers (>90%) underperform their benchmarks over the long run.

AI Investment Tool An-E Delivers Predictions for Smarter Trading

Last week in the Digest, we introduced “An-E,” short for analytical engine. This AI-driven investment product comes from our corporate partner, TradeSmith.

TradeSmith is highly regarded in the quantitative finance sector. They have invested over $19 million and dedicated more than 11,000 hours to developing sophisticated market analysis algorithms, employing a staff of 36 focused on maintaining their software and data systems.

Here is Keith Kaplan, CEO of TradeSmith, discussing An-E:

Many conversations about artificial intelligence today focus on its potential for the future and the breakthroughs it may yield.

At TradeSmith, however, we recognize that future is already here.

Our work shows how AI can help investors generate wealth—even during challenging market conditions.

This means not only identifying opportunities but also avoiding risks. TradeSmith’s proprietary AI trading algorithm—An-E—is designed specifically for this purpose.

An-E distinguishes itself by forecasting stock prices a month ahead with remarkable accuracy. It can predict both gains and losses.

Recently, case studies in the Digest showcased An-E’s predictive abilities. Let’s examine another bearish prediction, demonstrating An-E’s effectiveness in both bull and bear markets.

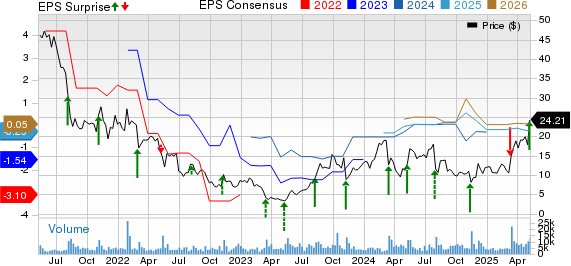

On March 6, An-E forecasted that Dolby Laboratories Inc. (DLB) would experience a 12.91% decline after 21 trading days, with a conviction level of 63%.

After the allotted trading days, DLB closed at $72.49, close to An-E’s prediction of $71.85, resulting in a -12.13% loss—nearly matching the expected -12.91% drop.

Join Us for The AI Predictive Power Event Tomorrow at 8 p.m. ET

During this event, Keith will explain how An-E accurately forecasts stock prices and assists investors in discovering high-probability trades that yield short-term profits.

Additionally, attendees will receive five of An-E’s most bearish forecasts—stocks predicted to decline in the near future—just for participating.

Keith shares:

We are witnessing one of the most significant economic shifts in recent history. With global trade evolving and markets in flux, investors are struggling to keep up.

This is precisely when AI like An-E proves its value.

As markets become increasingly volatile, traditional “buy and hold” strategies are often insufficient. Smart investors are learning to adapt their strategies with market changes—and AI can facilitate that transition.

Understanding AI’s Role in Modern Investing

As American author William Feather observed, “One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.”

Do you know who is on the other end of your stock transactions? Increasingly, it’s AI or sophisticated quantitative algorithms, which vastly outperform humans in predictive analytics.

Here’s how publications like Business Insider highlight Wall Street’s transition towards AI.

Welcome to the age of AI on Wall Street…

Quantitative hedge funds are starting to utilize advanced AI chips, such as Nvidia’s GPUs, to enhance their models.

Google Cloud is assisting quantitative investment firms like Two Sigma and Hudson River Trading in overcoming shortages of desirable Nvidia AI chips.

This trend reveals many companies moving toward AI-driven strategies in various capacities.

So, can the average investor compete? Perhaps a more pertinent question is: “Will the average investor even attempt to compete?”

The evident answer seems to be “no.”

A 2018 survey by the Bureau of Labor Statistics highlighted how Americans allocate their time. Following “sleeping” and “working,” the third most time-consuming activity was watching TV, at 2.84 hours daily. In contrast, personal financial management took an average of just 0.03 hours per day—less than two minutes.

Learn to Invest Alongside AI Tomorrow

Here’s Keith once more:

Not every piece of negative news spells doom for your portfolio. In fact, times of volatility often present significant opportunities.

Now is AI’s moment to excel.

With An-E working for you, the likelihood of identifying winning stocks while avoiding poor investments increases dramatically.

Sign up for tomorrow’s AI Predictive Power Event at 8 p.m. Eastern here to learn how to leverage An-E effectively.

Whether targeting winners or dodging losers, An-E equips you with the clarity essential in times of uncertainty.

To reserve your spot, Click here to instantly secure your seat, and we look forward to seeing you.

How should we conclude today’s Digest?

Let’s finish with an insightful investing quote from author, asset manager, and trader Andreas Clenow:

Beware of trading quotes.

Have a pleasant evening,

Jeff Remsburg