“`html

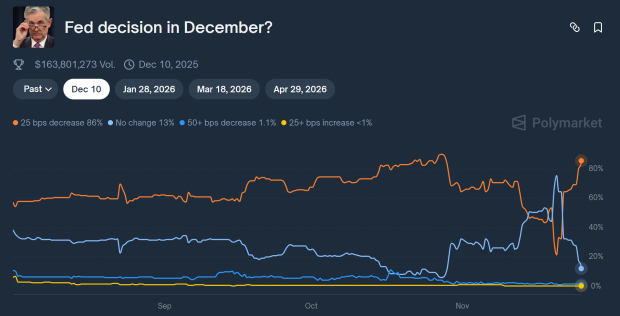

On November 5th, major indices corrected since previously signaling cracks in the 2025 bull market, which raised investor concern. However, there are optimistic indicators for year-end, notably a significant probability of a Federal Reserve interest rate cut in December, estimated at 82.7% by the CME FedWatch tool and 86% by Polymarket.

Additionally, a historical analysis shows that since 2009, of the 31 corrections exceeding 5%, only four have turned into bear markets, indicating that most corrections are short-lived. Corrections typically end between 5% and 6% decline.

Moreover, President Trump recently signed an AI executive order to boost U.S. capabilities in artificial intelligence and announced that Amazon will invest up to $50 billion in AI infrastructure, providing a potential positive impact on related companies. These developments may also contribute to increased consumer spending due to planned “Tariff Dividend Checks” for low- and middle-class Americans.

“`