Survey Reveals Citizens’ Top Fear: Corrupt Government Officials

According to a recent Chapman University survey, corrupt government officials are a leading concern for many Americans.

Insights from the Chapman Survey

Since 2014, the Chapman University Survey of American Fears has gathered data from over 1,000 respondents nationwide, exploring 85 different fears ranging from crime to natural disasters, including arachnophobia and the fear of public speaking. This month, findings revealed that around 65% of participants identified corrupt government officials as a significant fear.

A Personal Encounter with Fear

Fear can manifest in various forms. Personally, I experienced real fear decades ago when I was a passenger in a car that lost a rear tire while traveling at 70 miles per hour. Half-asleep, I felt the sudden thud as the car dropped, sending us spinning on the highway until we faced oncoming traffic. Fortunately, we survived, but that stretch of road still sends chills down my spine.

Political Anxiety on the Rise

The Chapman survey indicated increased political fears as well. Over half of Americans (51.6%) expressed fear over the upcoming November election outcome, while 48.6% are concerned about civil unrest that may follow. Steve Pfaff, Ph.D., a sociology professor, noted that continuous anxiety about government corruption reflects a deep mistrust among citizens, as they worry that powerful interests might unduly influence their government.

Approaching Election Day: Heightened Tensions

With Election Day approaching, accusations of cheating and corrupt officials abound. Current tensions depict the country as one of its most divided periods in recent history. Yet, it is crucial not to let fear undermine informed decision-making, especially concerning financial matters.

The Role of Fear in Investing

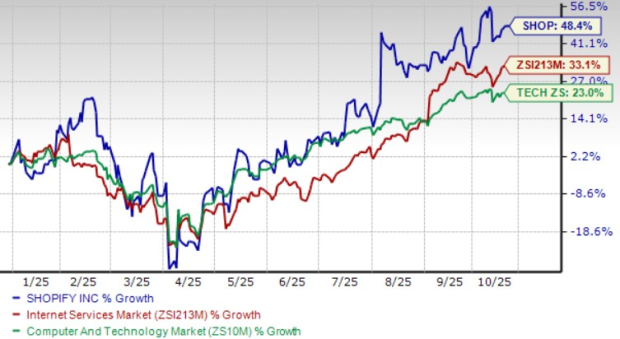

The stock market has its own gauge for fear: the Volatility Index (VIX). This index measures market volatility, with increases indicating rising uncertainty among traders. Investment expert Louis Navellier predicts heightened volatility across various assets surrounding the election. Last December, he boldly stated that Joe Biden would not be the Democratic nominee—a prediction that ultimately proved correct. Now, he foresees significant fluctuations next week.

Understanding Market Volatility

Volatility has come back with a vengeance…

And it’s starting to surge right now leading into Election Day…

But if we’re right, the biggest spike of all will come the day after the election…

I believe next week… we could see the VIX double, triple or even worse.

And what’s volatility, really?

It’s just a lot of unexpected, chaotic events, whipsawing investors.

Most investors get fearful and make poor decisions when faced with such uncertainties.

Preparing for Potential Market Chaos

In light of these predictions, Louis and his colleague Charles Sizemore are preparing to take advantage of the forthcoming volatility. They held a presentation focusing on the impacts of electoral uncertainty on the market. The **Freeport Society**, of which Charles is Chief Investment Officer, aims to provide insights for navigating these turbulent financial times.

Looking Ahead

Most folks are simply preparing for a repeat of the contested election results of 2020. The truth is, what lies ahead is unlike anything you’re prepared for…

The day AFTER the election could bring significant challenges for everyday investors.

As the Chapman survey indicates, many Americans are grappling with authenticated fear about the future. With the next week promising uncertainty, being well-prepared is paramount.

Take care and enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace