Apple TV+ Draws Attention with Severance Season 2, But Challenges Persist

Apple’s streaming service, Apple TV+, is celebrating the success of Severance season 2, which premiered its finale today. Severance has surpassed Ted Lasso to become Apple TV+’s most-viewed series based on unique viewer counts from January 17, the release date of season 2, to February 17.

Alongside Severance, shows like Ted Lasso, Slow Horses, and Silo have attracted significant attention in recent years. Despite these successes, Apple TV+ offers a limited selection compared to larger competitors such as Netflix (NFLX), Amazon (AMZN), and Disney (DIS). This limited library has resulted in financial challenges, with the service reportedly losing over $1 billion, according to The Information. The platform had approximately 45 million subscribers in 2024.

While a $1 billion loss is significant, Apple’s low spending on content—averaging around $100 million annually for a dozen movies—and its formidable cash position (a cash balance of $141.37 billion as of December 28, 2024) suggest that these losses do not pose an immediate threat to the company. Apple’s strategy includes using Apple TV+ to enhance its broader Services portfolio, which boasts over 1 billion paid subscribers, more than double the figure from four years ago.

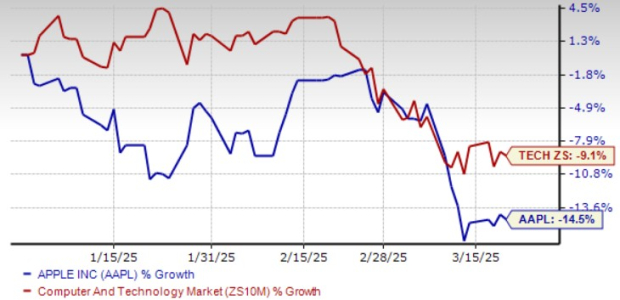

The growth of Apple’s Services, particularly in the fiscal first quarter, where revenues rose 14% year over year, positions it as a crucial growth driver, even as the company anticipates low double-digit revenue growth for the March-end quarter (second-quarter fiscal 2025). Thus, the popularity of Severance could positively impact Apple’s overall Services business. However, the question remains whether this boost can assist AAPL stock, which is down 14.5% year to date, in recovering.

Apple Stock’s Performance

Image Source: Zacks Investment Research

Challenges in iPhone Sales Impact Apple

Apple has felt the impact of declining demand for the iPhone in China, facing fierce competition from companies like Huawei and Xiaomi, as well as criticism regarding its Apple Intelligence offerings. In the first quarter of fiscal 2025, iPhone sales fell 0.8% year over year to $69.14 billion. However, sales of the iPhone 16 improved in markets where Apple Intelligence was available, resulting in a record number of upgrades and a peak active installed base during the reported quarter. The iPhone was particularly popular in the United States, Urban China, India, the U.K., France, Australia, and Japan, per data from Kantar.

Although sales in Greater China dropped 11.1% year over year, Apple saw strong sales growth in emerging markets, notably India, where it emerged as the top-selling smartphone. The company experienced double-digit growth in its installed base across these markets.

In December, Apple rolled out the first features of Apple Intelligence, initially in U.S. English, and has since expanded to more regions, including Australia, Canada, New Zealand, South Africa, and the U.K. A major update featuring a range of new languages is slated for April, which should further drive iPhone upgrades and boost the installed base.

AAPL Estimates Reflect Downward Trend

Currently, the Zacks Consensus Estimate for Apple’s fiscal 2025 earnings has seen a slight decrease of a couple of cents to $7.26 per share over the past month. This figure indicates a 7.56% growth compared to fiscal 2024.

Historically, Apple has outperformed Zacks Consensus Estimates in the past four quarters, achieving an average earnings surprise of 4.39%.

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Apple Shares May Be Overvalued

Currently, AAPL shares seem overpriced, with a Value Score of D indicating a high valuation at this time.

Apple is trading at a significant premium, with a forward 12-month P/E ratio of 27.85X compared to the sector average of 23.92X—a clear indicator of a stretched valuation.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

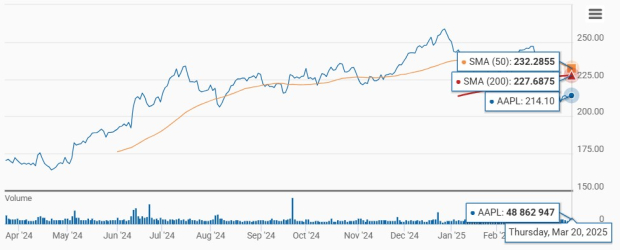

Notably, AAPL shares are trading below both their 50-day and 200-day moving averages, signaling a bearish trend.

Apple Below 50-Day & 200-Day Moving Averages

Image Source: Zacks Investment Research

Concerns Surround Apple Intelligence Performance

Apple’s initiative with Apple Intelligence has attracted attention, yet delays in updates to Siri expected in 2026—pushed back from 2025—have raised concerns. Amid rising competition from Microsoft and Google, Apple seems to be lagging, which could impact investor confidence.

While the Services segment stands strong as a revenue generator, the lackluster performance of Apple Intelligence poses a challenge for its core product lines such as the iPhone, iPad, and Mac. Consequently, we believe Apple’s short-term growth prospects do not warrant its current premium valuation.

AAPL holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more optimal entry point in the stock. For more insights, you can view today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, …

Exclusive $1 Access to Top Stock Picks for 30 Days

In an unprecedented move, we are offering our members a remarkable opportunity: 30 days of access to our entire portfolio of stock picks for only $1, with no further obligations.

While thousands have seized this chance, many others have hesitated, assuming there must be a catch. There is a reason behind this offer: we want you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more. In 2024 alone, these services managed to close 256 positions, achieving double- and triple-digit gains.

If you want to stay updated with the best recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days. This report is available for free today.

For detailed analysis, check reports on popular stocks:

- Amazon.com, Inc. (AMZN): Free Stock Analysis Report

- Apple Inc. (AAPL): Free Stock Analysis Report

- Netflix, Inc. (NFLX): Free Stock Analysis Report

- The Walt Disney Company (DIS): Free Stock Analysis Report

For more insights, read our original article on Zacks Investment Research: Severance’s Fame is Good for Apple TV—Is It True for AAPL Stock?

Visit Zacks Investment Research for more information.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.