Invesco QQQ Trust ETF Analysts Project 10.94% Upside

In our latest analysis, we’ve compared the prices of the Invesco QQQ Trust ETF’s underlying holdings with analysts’ average 12-month target prices. The results indicate a strong potential for growth.

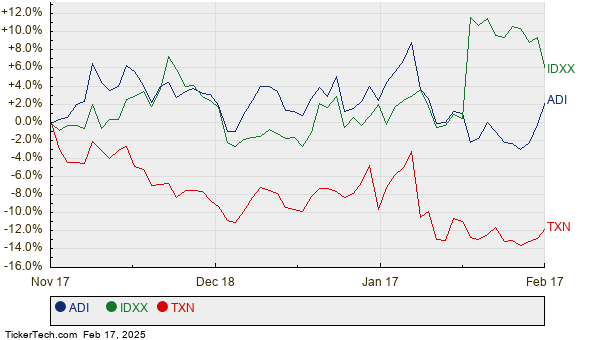

Currently, the Invesco QQQ Trust ETF (Symbol: QQQ) has an implied target price of $597.01 per unit, while it is trading at approximately $538.15 per unit. This difference suggests that analysts anticipate a 10.94% increase for this ETF over the next year based on its holdings. Among QQQ’s notable stocks with significant upside potential are Analog Devices Inc (Symbol: ADI), Idexx Laboratories, Inc. (Symbol: IDXX), and Texas Instruments Inc. (Symbol: TXN). For instance, ADI is priced at $214.61 per share, yet analysts project a higher average target of $256.19, representing a 19.38% upside. Similarly, IDXX, currently at $444.53, has a target of $519.50, indicating a potential rise of 16.87%. Lastly, analysts forecast TXN to reach a target price of $208.57, which is 13.95% higher than its current price of $183.03. The price performance of these stocks over the past year is illustrated in the chart below:

Below is a summary of the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco QQQ Trust ETF | QQQ | $538.15 | $597.01 | 10.94% |

| Analog Devices Inc | ADI | $214.61 | $256.19 | 19.38% |

| Idexx Laboratories, Inc. | IDXX | $444.53 | $519.50 | 16.87% |

| Texas Instruments Inc. | TXN | $183.03 | $208.57 | 13.95% |

Investors may question whether analysts are justified in their price targets or if they are overly optimistic. It is crucial to consider recent company and industry developments to understand the basis for such projections. High price targets relative to actual trading prices may signify optimism, but they could also lead to potential downgrades if deemed unrealistic. Further research is essential for investors to assess these forecasts accurately.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of KWAC

• DIBS Videos

• CCXX Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.