US Gold Reserves Under Scrutiny: Importance of Fort Knox Audit

Attention on US gold reserves has surged, driven by skepticism regarding the actual amount stored. President Donald Trump, alongside Elon Musk, the head of the Department of Government Efficiency, expressed plans to visit the Fort Knox Bullion Depository, hinting at a potential live-stream of the event.

“We’re going to take a look and if there’s 27 tons of gold, we’ll be very happy,” Trump stated. “I don’t know how the [expletive] we’re going to measure it, but that’s okay. We want to see lots of nice, beautiful, shiny gold in Fort Knox.”

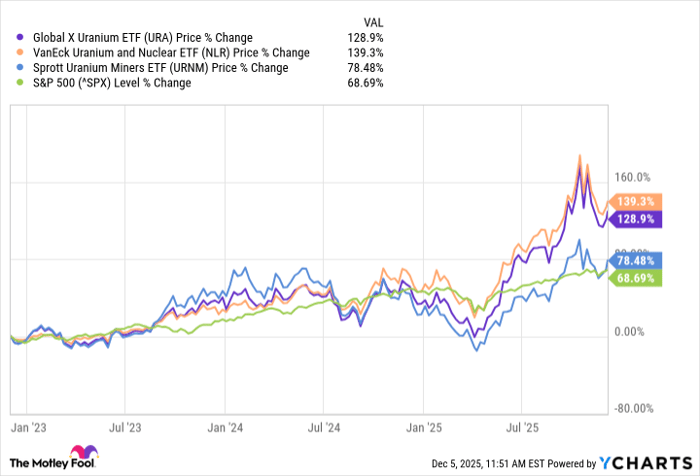

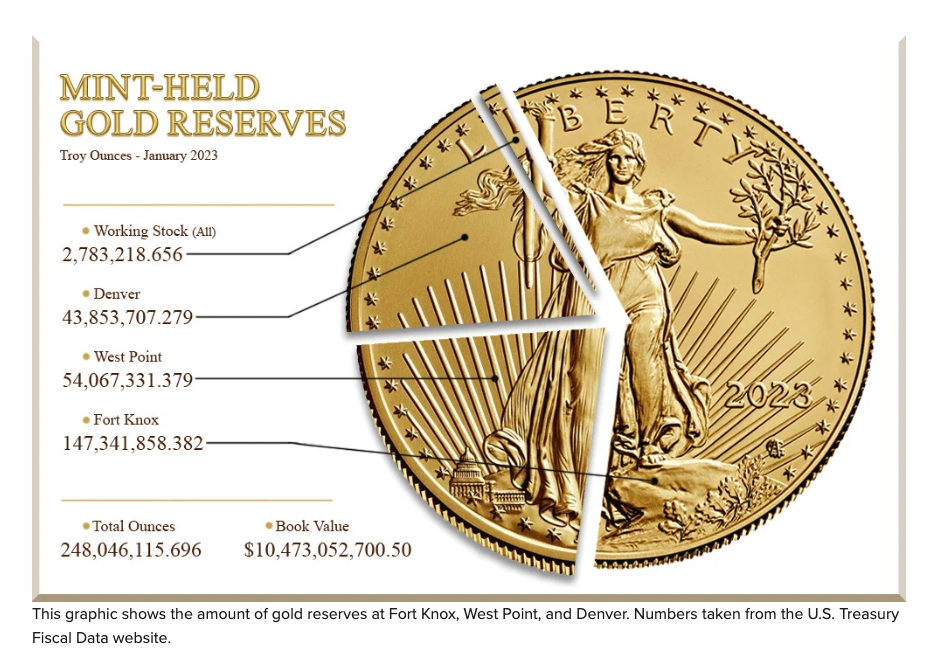

Gold plays a crucial role in both historical and modern financial systems. Establishing that Fort Knox contains the expected 147.3 million ounces of gold, valued at around $428 billion at current prices, is vital. A shortfall could lead to significant market instability, devalue the US dollar, and cause an unexpected spike in gold prices.

Market Confidence and Stability

The widespread belief that Fort Knox holds one of the world’s largest gold reserves bolsters confidence in the US financial system. A comprehensive audit revealing lower reserves could trigger widespread panic, spurring a selloff of US assets and creating repercussions across international markets.

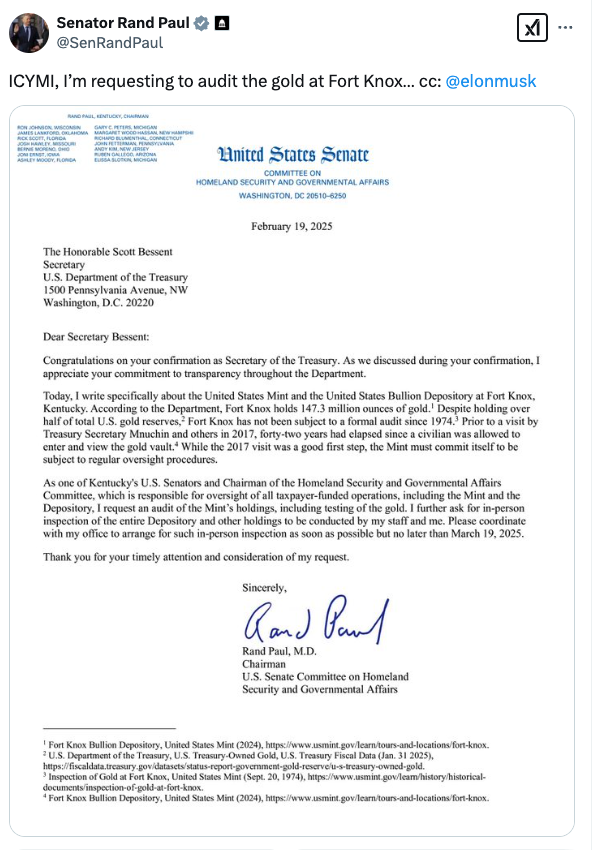

The last complete audit of the depository occurred in 1953. Although a brief tour by journalists and Congress members took place in 1974, it was not a full inspection. Since then, only routine vault seal checks have been conducted, with access restricted primarily to Treasury officials, such as Steve Mnuchin in 2017.

Impact on the US Dollar

While the US dollar is not backed by gold, a significant gold reserve provides implicit stability. If a lower than expected amount of gold were detected at Fort Knox, trust in the dollar might diminish, leading to depreciation. This decline would make imports more costly, contributing to inflation, while increasing the competitiveness of US exports.

Some policymakers, including Trump’s nominee for the Council of Economic Advisers, Stephen Miran, have suggested that selling US gold reserves could intentionally weaken the dollar to enhance trade advantages. However, an uncontrolled loss of confidence poses a far greater risk.

Gold Prices and Central Banks

Doubts surrounding US gold reserves may increase demand among investors and central banks, potentially driving prices upward.

Emerging markets, which have recently been accumulating gold, could hasten their purchases, exacerbating price increases. Higher gold prices may benefit current holders of the metal, but they might also make it less attainable for those seeking a hedge against economic instability.

Geopolitics

Unearthing lower than expected gold reserves could weaken the US’s global standing and bargaining power. Nations like China and Russia, which have been stockpiling gold, might exploit this situation to advance alternative financial systems that rely less on US influence.

Need for Transparency

The absence of a thorough audit since 1953, noted alongside restricted access to Fort Knox, has sparked numerous conspiracy theories. While some suspect the gold remains untouched, others theorize about secret sales or counterfeit bars.

High-profile advocates like Elon Musk and Senator Rand Paul have raised calls for transparency, emphasizing that the American public deserves assurance that their national assets are secure.

A full, independent audit—potentially live-streamed—could address public doubts and reinforce trust in US financial institutions.