Co-authored with Beyond Saving

I’ve always been intrigued by the psychology of investing. Today, I want to talk about biases. A bias is a strong tendency to act in a certain way or to interpret something in a certain way. Two people given the same information might come to different conclusions and therefore different actions. Is the glass half empty or half full? Your answer to that question will exhibit a bias.

With investing, every transaction involves two people making an opposite investment decision. One is buying, and the other is selling. One wants more of the stock, the other wants less.

When managing our portfolio, we want to make “the best” decisions. Which isn’t really possible because none of us can see the future. However, we can try to at least make good decisions. Our efforts to make good decisions will be impacted by numerous biases that we have.

Let’s look at seven biases that are very common among investors, and might be costing you money.

1. Anchoring Bias

“Anchoring” bias is a tendency to rely too heavily on the first piece of information you receive on a topic. We commonly see advertisements that take advantage of anchoring bias by showing a high price, anchoring our expectation of what the price is, but then offering a “sale”.

In the market, this bias works in several ways.

An investor might have a good or bad perception of an investment based on a past experience. If we invested in a company and later sold at a loss, we might label it a “bad” investment and refuse to consider it in the future, even if conditions changed in a way that fixed whatever issues caused the prior underperformance. On the other hand, we might become particularly attached to a company that has provided a positive experience in the past. This could make us willing to overlook warning signs and poor current performance that seems so obvious to an external observer.

Of course, we do want to take the past into account. What we want to avoid is situations where our past experiences are clouding our assessment of the company currently.

2. Recency Bias

Where anchoring bias is putting too much weight on the first information we get about an investment, recency bias is putting too much weight on what happened recently.

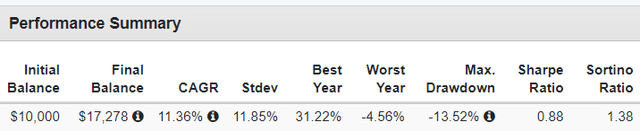

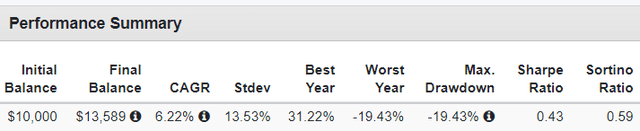

Consider these two investments, here are their 5-year returns. Based on this information alone, which one would you buy and why?

Investment A:

Investment B:

A very large number of investors that I know would choose Investment A. Indeed, many of the investments I write about regularly have 5-year charts that look more like Investment B, and on most days I get some form of the question: “Why would anyone buy Investment B? Its 5-year chart is horrible and has underperformed Investment A.”

What is Investment B? It is the S&P 500 ETF (SPY), the same investment as Investment A. The only difference is two months. Investment A is SPY from January 2015 through January 2020. Investment B is SPY from March 2015 through March 2020. Two months difference led to a 45% lower CAGR.

Recency bias is so pervasive among investors because the very tools we use to measure what is a “good” or “bad” investment are inherently biased. A large change in price over the last month or two will have an outsized impact on the 1-year, 5-year, and sometimes even 10-year returns.

We tend to look at the most recent price, and believe that it is “right”. I hear investors all the time proclaim that a certain investment decision was “good” or “bad” based on what the price is right now, without any analyses of value aside from the current trading price.

Another way that recency bias can impact us is making us believe that a stock is “cheap” just because it is down from recent highs, or believe that a stock is “expensive” because it is higher than recent lows. In both cases, we are making an assessment of the value of a stock based on recent trading prices, rather than any kind of attempt to identify the value of an investment to us.

As investors, we should always keep our eyes on the big picture. Avoid being influenced by short-term price movements.

3. Confirmation Bias

Confirmation bias is focusing on information that supports your existing beliefs. We are more prone to read opinions from people that we usually agree with. If we are bullish on a stock, we will more eagerly accept the arguments of others who are bullish, while dismissing the arguments of those who disagree without serious thought.

As investors, we should welcome arguments that are different than our own. We should do our best to seriously consider them, and question whether we might be wrong. It is, perhaps, one of the hardest things to do.

4. Exaggerated Expectation

A form of confirmation bias, exaggerated expectation is a tendency to expect that an extreme result is more likely than it really is. Like many biases, this is a bias that cuts two ways. When a stock price is falling, there will always be a chorus of investors insisting that it is likely to “go to zero”, even when an assessment of the financials concludes that is very unlikely. On the other hand, more than one stock has seen its price fly to unreasonable highs, and many investors project future valuations that would be unlikely even with extreme outperformance. Remember “Meme” stocks?

We must have realistic expectations for our portfolios and our stocks if we are going to make sound investment decisions. Having an exaggerated expectation could cause us to sell at poor prices, fearing a downside that simply isn’t likely to happen. Or it could cause us to overpay for an investment expecting an upside that could very well be impossible.

Navigating Behavioral Biases in Investment

Investing, much like life, is subject to the imperfections and foibles of human nature. Our psychological predispositions, while integral to our survival, can often lead us astray in the financial realm. Nevertheless, understanding these biases and developing systems to mitigate their influence is essential for astute investing.

Apophenia: The Bias of Finding Patterns

Apophenia, or the tendency to perceive meaningful connections between unrelated events, is deeply ingrained in human cognition. This inclination has been the impetus behind groundbreaking discoveries and inventions throughout history. Just as the first farmers discerned the relationship between seeds, soil, and water, and intentionally cultivated food, investors often seek patterns or causal relationships to explain market movements.

However, while our adeptness at identifying patterns has propelled progress, it also poses the risk of leading us astray. In the world of investing, this bias manifests as the constant search for explanations behind stock price movements. Yet, the reality is that share prices are often influenced by a myriad of individual decisions by investors, many of which may have no correlation to news events.

As discerning investors, it is imperative to filter out the noise and focus on news that tangibly impacts the long-term prospects and earnings of our investments, rather than succumbing to the allure of random explanations.

Risk Aversion: Understanding and Mitigating

Risk aversion, the predisposition to avoid risk even to the detriment of potential gains, is a prevalent bias in the realm of investing. While it is natural to recoil from experiences of loss or volatility, embracing an overly cautious approach can lead to missed opportunities and underperformance.

Every investment carries a degree of risk, and comprehending the balance between risk and potential reward is essential. Instead of solely fixating on evading risk, investors must meticulously evaluate whether the potential returns justify the inherent risks in an investment. A realistic appraisal of risks and rewards is imperative for sound decision-making.

Action Bias: The Temptation to Do Something

The innate inclination to “do something” often permeates investment decisions, leading individuals to trade excessively in pursuit of activity. However, the most prudent investment tactic can often be to refrain from impulsive actions and exercise restraint.

Rather than succumbing to the urge to constantly tinker with our portfolios, it is crucial for investors to discern when inaction is the most prudent course. Giving precedence to the question “Should I do anything?” over “What should I do?” is a crucial distinction that can safeguard against unnecessary trading and its detrimental effects.

Conclusion: Embracing a Methodical Approach

In navigating the labyrinth of behavioral biases that permeate investing, the adoption of a systematic approach is paramount. The creation and adherence to a well-defined investment system can serve as a bulwark against the pernicious influence of these biases.

The Income Method, designed to focus on the income produced by a portfolio, stands as an exemplar of such a system. By emphasizing the tangible cash flow generated by investments, it serves to counteract the noise introduced by volatile price movements.

Cash Flow Doesn’t Lie

Amidst the tumult of market gyrations and prevailing biases, the unembellished cash flow from investments offers a steadfast and truthful measure of performance. In contrast to transient price fluctuations, the stability of income serves as an objective gauge of realized performance, cutting through the biases engendered by ephemeral price movements.

Diversify Because You Won’t Always Be Right

Embracing diversification shields against the pernicious effects of confirmation bias and the inevitable fallibility of individual judgment. By spreading investments across a broad array of assets, investors fortify themselves against the detrimental impact of singular misjudgments and the biases that often accompany them.

Set Goals And Measure Progress

Establishing clear investment objectives and systematically assessing progress serves as a potent defense against the capricious influence of biases. By anchoring decisions to predetermined goals and objectively evaluating advancement, investors can mitigate the sway of subjective inclinations and emotional biases.

The Income Method: Navigating the Path to Financial Success

Setting income goals is the best way to objectively measure financial success. It allows investors to chart a path from their current income to their desired income and evaluate their progress towards that goal.

Before evaluating companies, it’s crucial to determine the amount of risk required and acceptable. Regular monitoring of income growth is essential to ensure it aligns with the set plan and to avoid unrealistic expectations.

Focusing on the income generated by a portfolio helps in avoiding apophenia, enabling investors to focus on the impact of news on dividend risk rather than stock price fluctuations.

For risk-averse individuals, a substantial income stream from investments brings peace of mind. Monitoring this stream allows for a measured approach to risk and facilitates adjustments to the investment strategy.

The Art of Continuous Buying

Embracing an income-focused strategy allows investors to constantly reinvest planned dividends, effectively creating a continuous stream of income for further investments. Without the need to sell, individuals find satisfaction in regularly adding to their portfolios, aligning with an action-oriented mindset.

The choice between automatic dividend reinvestment plans (DRIP) and manual reinvestment depends on individual lifestyle preferences. While DRIP is suitable for a hands-off approach, opting for cash dividends allows proactive investment decisions.

Empower Your Retirement Journey

Recognizing and understanding personal biases is crucial in developing an investment strategy that mitigates potential harm. The Income Method serves as a strategic framework to address and direct biases towards favorable outcomes.

The Income Method proves to be an effective strategy in navigating biases and achieving financial success.