Microsoft’s Incredible Stock Journey: A Legacy of Growth and Transformation

Microsoft (NASDAQ: MSFT) stands out as one of the stock market’s top performers. Since its initial public offering (IPO) in 1986, the stock has skyrocketed by over 434,000%. This impressive figure includes a notable underperformance during the tenure of former CEO Steve Ballmer, a 14-year period where shares dropped more than 30%.

Tracing Microsoft’s Share Growth Over the Years

Microsoft launched its shares at an IPO price of $21 each on March 13, 1986. Investors saw their initial investment multiply substantially due to nine stock splits, which led to 288 shares from one. The company executed 2-for-1 stock splits in 1987 and 1990, followed by two 3-for-2 splits in the early ’90s and five 2-for-1 splits between 1994 and 2003.

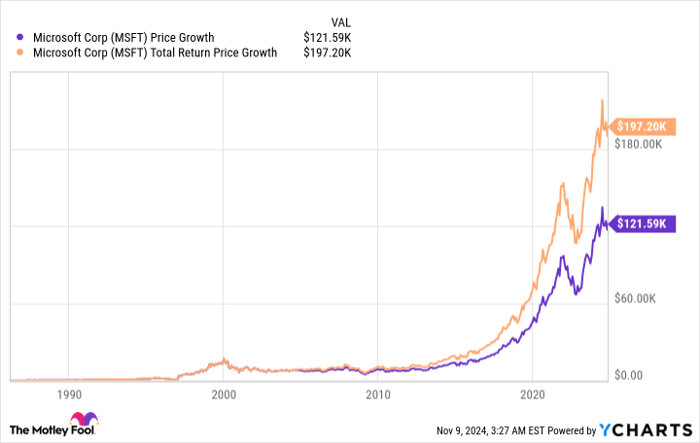

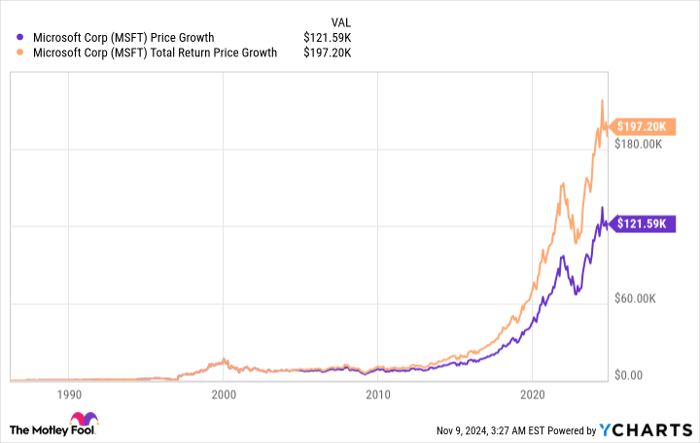

If an investor bought one share on the first trading day, the total value of the now 288 shares has increased to over $121,500 at current prices! Including dividends, the total return surpasses $197,000.

MSFT data by YCharts.

Selecting the Right Moments for Investment

Many early investors couldn’t have imagined that a single share would grow into 288 shares. Initially, Microsoft found success by dominating the PC operating systems market. However, the company’s resurgence, particularly under CEO Satya Nadella since 2014, has been driven by its strong position in the cloud computing industry and its growing involvement in artificial intelligence (AI).

Today’s new investors may not achieve the same staggering returns, but Microsoft’s history illustrates how remarkable growth can arise when a company is a leader in an emerging industry. Future investors can learn from this example to identify potential opportunities for growth.

Act Now: Don’t Miss the Next Investment Opportunity

If you’ve ever felt you lost out on investing in successful companies, consider this crucial moment.

Occasionally, our team of expert analysts identifies a “Double Down” stock—companies poised for significant growth. If you fear you’ve missed your chance, now is the time to review potential investments. The following examples illustrate recent successes:

- Amazon: A $1,000 investment from our recommendation in 2010 would now be worth $23,657!*

- Apple: A $1,000 investment from our 2008 recommendation would have grown to $43,034!*

- Netflix: A $1,000 investment from our 2004 recommendation would now be an astonishing $429,567!*

Currently, we are issuing ‘Double Down’ alerts for three exceptional companies, and this could be a unique opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.