“`html

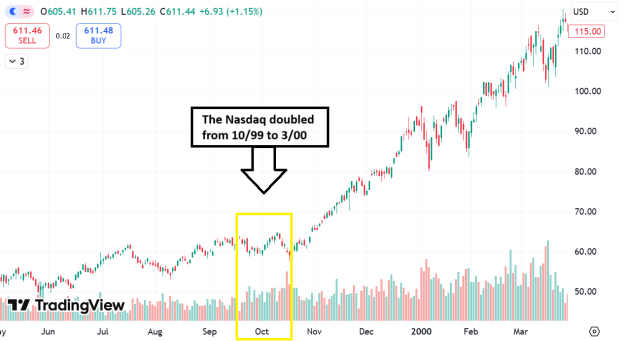

Paul Tudor Jones’ Market Analysis: In a recent CNBC interview, billionaire investor Paul Tudor Jones compared the current market conditions to those of October 1999, suggesting investors prepare similarly as the Nasdaq has risen 50% in the past six months, driven by AI enthusiasm. His analysis indicates substantial growth potential, noting that the Nasdaq doubled from 1999 to 2000.

Federal Reserve Interest Rate Cuts: The Federal Reserve has cut interest rates 12 times when the S&P 500 Index was within 1% of its all-time high, historically leading to an average return of 15% one year later, according to JPMorgan. Currently, the S&P’s P/E ratio is 23x, below the peak of 40x in 2000, but still elevated compared to historical norms.

Investor Sentiment: Despite a significant 50% rise in stocks, investor sentiment remains cautious, with bullish sentiment at 42.9% and bearish sentiment at 39.2%, according to the AAII Sentiment Survey. There is also a record $7 trillion in low-risk money market funds, signaling potential future inflows into the stock market.

“`