It is easy to get caught up in the frenzy surrounding tech giants like Nvidia, reveling in their extravagant success on Wall Street. However, as the idiom goes, all good things must come to an end. The time inevitably arrives to pivot and redirect focus towards the next potential victors in the tumultuous stock market landscape.

Three savvy Motley Fool contributors embarked on a mission to unearth these hidden gems, ultimately identifying Palantir Technologies (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) as rising stars with the potential to yield lucrative returns for investors in the upcoming years.

Positioning yourself with these burgeoning tech stocks for the next half-decade could very well prove to be a shrewd investment strategy.

Palantir’s Momentum Continues Unabated

Jake Lerch (Palantir Technologies): Palantir Technologies is the epitome of resurgence in the tech sector. A standout performer in the current market milieu, Palantir’s trajectory has been nothing short of meteoric.

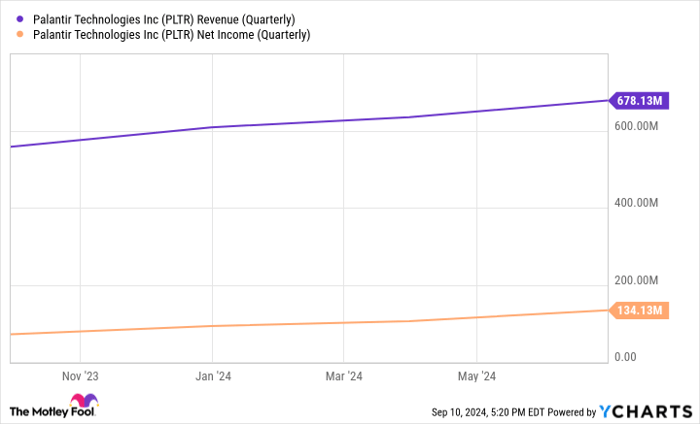

The news of Palantir’s impending inclusion in the S&P 500 propelled its shares to new heights, with a staggering 14% surge following the announcement. Boasting a revenue increase of 27% and a remarkable 87% surge in net income in its most recent quarter, Palantir is firing on all cylinders.

Affirm’s Strategic Partnership with Apple Spells Success

Justin Pope (Affirm): Affirm’s innovative business model, centered around personalized lending solutions, has garnered significant attention and user engagement. The company’s collaboration with retail behemoths like Amazon and Shopify has been a game-changer in the buy now, pay later space.

Recent developments with Apple integrating Affirm into Apple Pay open up a massive market of iOS users, hinting at exponential growth prospects for the company. As Affirm inches towards profitability and witnesses a surge in revenue growth, its stock is primed for a notable rebound.

MercadoLibre: The Next E-Commerce Frontier

Will Healy (MercadoLibre): While global investors were enamored with Amazon’s colossal rise, many overlooked the parallel growth story of MercadoLibre in Latin America. Navigating the unique challenges of the region, MercadoLibre has seamlessly pivoted from e-commerce to innovative financial and logistics solutions.

With a burgeoning market cap that pales in comparison to Amazon’s, MercadoLibre’s fast-paced growth and stellar financial performance are turning heads in the investment realm. Despite operating in a cash-centric society, the company’s holistic approach to digital financial services and streamlined logistics has garnered widespread acclaim.

MercadoLibre: A Bull in the Financial China Shop

The Highs and Lows of MercadoLibre’s Valuation

MercadoLibre, a company heralded for its monumental success, currently showcases a P/E ratio of 73, making some investors wary. However, its PEG ratio of under 0.9, coupled with significant profit growth, positions it as a potentially lucrative stock option. This anomaly of metrics paints MercadoLibre as a bull amidst a volatile financial landscape.

Analyst Insights on Palantir Technologies

When contemplating an investment in Palantir Technologies, it’s prudent to heed the insights from analysts at the Motley Fool Stock Advisor. Despite its merits, Palantir Technologies didn’t secure a spot amongst the top 10 recommended stocks. Historically, stocks that aligned with the recommendations of Stock Advisor witnessed exponential growth. For instance, when Nvidia featured on the list on April 15, 2005, an initial $1,000 investment would have blossomed into $729,857*, underscoring the potential within savvy stock picks.

The Phenomenon of Stock Advisor

Stock Advisor stands as a beacon for investors, offering a roadmap to success through portfolio construction, regular analyst updates, and bimonthly stock recommendations. Since its inception in 2002, the service has outperformed the S&P 500 index multifold, cementing its reputation for steering investors toward lucrative opportunities in the market.

For more insights and the top 10 stock recommendations, consult the Stock Advisor platform to navigate the ever-changing tides of the stock market landscape.