Why Taiwan Semiconductor is the Top Stock to Hold Now

Choosing a single stock to buy and hold can be challenging. Many factors influence this decision, including company longevity, innovation, and competition. It’s essential to ensure that the chosen company is aligned with significant growth trends in the market to avoid stagnation.

After thorough consideration, I’ve concluded that if I could buy and hold only one stock, it would be Taiwan Semiconductor (NYSE: TSM). This is a pivotal company in the tech industry, fulfilling most criteria for a long-term investment.

Where to invest $1,000 right now? Our analyst team just revealed the 10 best stocks to buy today. Learn More »

Taiwan Semiconductor: A Leader in Chip Manufacturing

Taiwan Semiconductor operates as a chip fabricator, focusing on manufacturing rather than marketing proprietary designs. Clients design their chips while TSMC handles production, effectively allowing the company to support various competitors, like Nvidia and AMD, vying for dominance in the GPU market.

This dual role enables TSMC to avoid excessive marketing costs, concentrating instead on advancing its chip production technology. This approach has allowed TSMC to maintain a competitive edge over companies like Intel and Samsung within the foundry sector.

Moreover, TSMC consistently leads in chip technology innovations. It currently produces cutting-edge 3nm chips and is progressing toward 2nm chip production. These new chips promise to be more energy-efficient, consuming 20% to 30% less power than their 3nm counterparts, a crucial factor for AI giants focused on minimizing operational costs.

Additionally, TSMC is developing its A16 chip, which is expected to offer 15% to 20% more energy savings compared to the 2nm chip.

According to TSMC management, demand for these advanced chips surpasses that for current 3nm or 5nm chips, signaling strong investment potential. Production for the 2nm chips is slated for late 2025, with the A16 chip anticipated in mid-2026. Given TSMC’s strong history of innovation, it remains a prime candidate for singular investments.

Furthermore, TSMC is ideally positioned within key market trends, particularly in artificial intelligence (AI). Management predicts AI-related revenue could grow at a compounded annual growth rate (CAGR) of approximately 45% over the next five years.

With numerous clients placing long-term orders, TSMC possesses unparalleled visibility regarding AI demand forecasts, making its insights valuable to investors. Overall, management projects a revenue CAGR of nearly 20% over the next five years, highlighting substantial growth potential for the company.

One area of concern for potential investors is TSMC’s location in Taiwan, where geopolitical tensions, particularly with China, have raised anxiety. However, the company has responded by expanding its U.S. investment from an initial $65 billion to $165 billion, facilitating the establishment of new manufacturing facilities. This expansion may help mitigate geopolitical risks and enhance short-term stock performance.

Ultimately, investing in Taiwan Semiconductor signals a belief in the increasing adoption of advanced chips across various industries, a solid bet given the market trends. Thus, TSMC would be my top choice if limited to a single stock for purchase.

TSMC’s Investment Potential Looks Promising

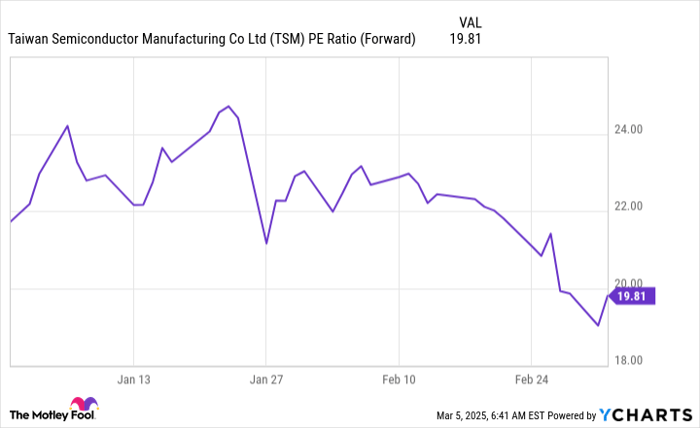

If you don’t own shares yet, this may be a good opportunity; TSMC shares are currently priced at 19.8 times forward earnings.

TSM PE Ratio (Forward) data by YCharts

In comparison, the broader S&P 500 (SNPINDEX: ^GSPC) trades at 21.6 times forward earnings, indicating that TSMC’s stock is attractively priced, especially considering its anticipated growth trajectory.

TSMC represents a sound investment at this time, and investors should consider acquiring shares while the price remains favorable.

While TSMC stands out as my top stock recommendation, maintaining a diversified portfolio with at least 25 stocks is generally a better strategy. Nonetheless, TSMC is an excellent addition to many portfolios, and current market conditions present a strong buying opportunity.

Is Investing $1,000 in Taiwan Semiconductor Right for You?

Before making a purchase, consider the following:

The Motley Fool Stock Advisor analyst team has identified their best 10 stocks for investors, and Taiwan Semiconductor Manufacturing is not among them. The 10 selected stocks are poised for significant returns in the upcoming years.

For context, when Nvidia was included in this list on April 15, 2005… a $1,000 investment made then would have grown to approximately $690,624!*

Stock Advisor provides a user-friendly investment strategy featuring guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has significantly outperformed the S&P 500.* Explore the latest top 10 list by joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

Keithen Drury holds positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool is invested in and recommends Advanced Micro Devices, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool suggests the following options: short May 2025 $30 calls on Intel. For more details, refer to the Motley Fool’s disclosure policy.

The views expressed in this article are those of the author and do not necessarily represent the views of Nasdaq, Inc.