“`markdown

**Medline’s $6.3 Billion IPO Marks Largest in 2025**

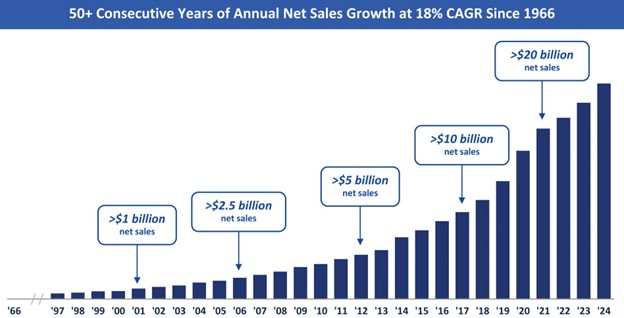

Medline (NASDAQ: MDLN), a Chicago-based medical supply company, completed its initial public offering (IPO) on [insert date], raising $6.3 billion by pricing its shares at $29. This IPO follows a $34 billion buyout in 2021, during which the company expanded its manufacturing facilities from 20 to 33 and increased sales from $17.5 billion in 2020 to projected $30 billion by 2026.

Medline operates 33 manufacturing facilities in over 100 countries, offering around 335,000 products with a focus on next-day delivery for 95% of U.S. customers. Analysts forecast earnings of $1.17 per share for 2025, anticipating a jump to $1.52 per share in 2026, supported by an estimated free cash flow of $1.5 billion in 2025 and $2.1 billion in 2026.

“`