April 2: A Crucial Day for Global Trade and Economy

This coming Wednesday, April 2, could be pivotal for the global economy. Investors and the general public in the U.S. have been concerned about the looming threat of tariffs for weeks, and the upcoming announcements may have lasting effects.

Without beneficial deals negotiated between the U.S. and its trade partners, worldwide trade may come to a standstill. Such a development could trigger a recession and lead to a significant downturn in the stock market.

The potential economic fallout could be severe; thus, preparation is key.

What to Expect on “Liberation Day”

In what President Donald Trump calls “Liberation Day,” major new tariffs will be announced. These tariffs aim to reshape the global economic landscape by addressing perceived unfavorable trading practices.

However, the long-term presence of these tariffs may significantly affect the economy. They could pull the country into a recession similar to or worse than the 2008 financial crisis.

Potential Consequences of Increased Tariffs

According to economic principles, tariffs impose a tax on imports. As a result, U.S. companies that import goods will face higher costs when tariffs are implemented. On “Liberation Day,” Trump plans to enforce a wide range of tariffs, impacting many imports.

U.S. companies will have several options: absorb the increased costs, pass them on to consumers (which would raise inflation), or restructure their supply chains (leading to business disruptions). Regardless of the chosen approach, a negative impact on economic growth seems inevitable.

The Institute of Supply Management’s Manufacturing and Services surveys from February 2025 reveal valuable insights into business sentiment. These surveys are highly regarded indicators of economic health in the manufacturing and service sectors.

One accommodation and food services firm remarked:

“Tariff actions have created chaos in information and pricing measures, forecasting, and forward buys, which may artificially inflate purchases to be followed by a drop off.”

Additionally, a construction company highlighted:

“Implementation of tariffs will have a significant cost impact on our projects. Most of the capital equipment we purchase is not produced in the U.S., or components are sourced from overseas manufacturers. We are also witnessing price increases in anticipation, similar to U.S. supplier responses during previous tariff implementations.”

Meanwhile, an information services provider stated:

“Tariffs will create a ripple effect that could severely harm our business.”

Lastly, a machinery company noted:

“Incoming tariffs are driving up prices for our products. We anticipate significant price increases from suppliers.”

Clearly, an escalating global trade war would hinder economic growth. If these tensions persist, many individuals could face financial challenges.

The Major Announcement Ahead

On April 2, “Liberation Day,” Trump is set to unveil a new series of extensive tariffs he has referred to as “the big one.”

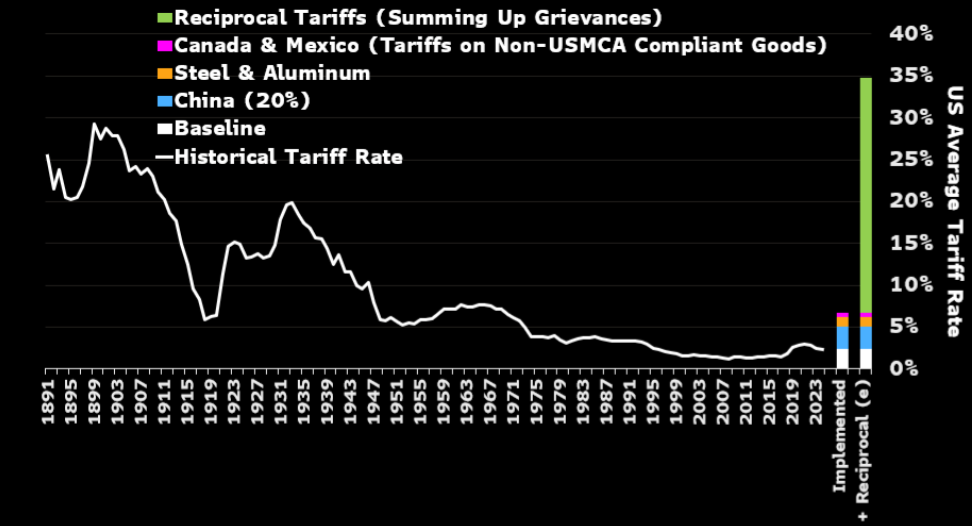

These tariffs might encompass a broad array of reciprocal tariffs against the U.S.’s largest trading partners. According to recent analysis from Bloomberg, such measures could increase the average U.S. tariff rate from 2.5% to 35%.

Consequently, we could witness the average tariff rate on incoming goods reach historical highs unseen for over a century!

Indeed, April 2 could prove to be the most consequential day of the year; being prepared is essential.

Despite these potentially dire predictions, we maintain some optimism. Past behaviors suggest that a prolonged trade war may not occur. Several agreements have already been reached on previously threatened tariffs, indicating a possible resolution rather than escalation in trade tensions in the coming months.

However, emerging risks warrant careful consideration and readiness.

In light of these developments, we have created a new special report: the Trade War Protection Playbook.

This report outlines our ten best stock market strategies to safeguard and potentially grow your wealth in response to worsening global trade conditions next week.

Be sure to obtain this critical report before April 2.

Learn how to mitigate against the upcoming trade war risks.

As of the publication date, Luke Lango does not hold any positions in the securities mentioned in this article.

P.S. Stay updated on Luke’s latest market insights by subscribing to our Daily Notes! You can access the latest issue on your Innovation Investor or Early Stage Investor sites.