Amazon Joins Race with Quantum Chip Amidst Market Uncertainty

Editor’s Note: The financial landscape might be unpredictable, but innovation keeps moving forward. This is why InvestorPlace Senior Analyst Louis Navellier remains optimistic. Recently, Amazon introduced Ocelot, its inaugural quantum computing chip, adding to the competition against Microsoft and Google as they race to lead in this cutting-edge technology.

However, quantum computing is intricate, and grasping its market implications can be daunting. For this reason, Louis Navellier will hold an urgent briefing on Thursday, March 13, at 1 p.m. ET just ahead of Nvidia’s major “Quantum Day” announcements. Click here now to secure your spot for this complimentary event.

Moreover, Louis and his team have developed a special series on quantum investing for their e-letter, and they’ve granted us permission to share one of those pieces here today.

Currently, markets are facing a sharp sell-off due to concerns over a potential recession triggered by President Trump’s recent tariffs on Canada, Mexico, and China. We will continue to follow this developing story in Smart Money later this week. Should any prompt action be required in our services, we will keep you informed.

The Evolution of Innovation

Innovation has a curious nature. Technological revolutions often advance slowly at first. Then suddenly, everything changes. Consider the history of electricity. For centuries, humans viewed lightning as a mysterious force, with little understanding of its potential.

It wasn’t until the 1600s that individuals began experimenting with static electricity, and the first functioning electric motor was invented in 1871. A further 76 years later, transistors were leveraged to realize electricity’s complete potential. Since that pivotal moment, transistors have transformed the globe, enabling monumental advancements like space exploration and sophisticated data calculations.

Quantum computing is on a similar trajectory. The first operational quantum machine, the cesium atomic clock, was activated by physicist Louis Essen in 1955. By directing microwave signals at cesium atoms, he achieved a “superposition” state, a quantum condition described by physicist Max Planck in 1900. This marked an early turning point in quantum mechanics.

Today, we are at the threshold of what could be quantum computing’s “transistor moment.” Recently, three major tech companies have announced new developments in their respective quantum chips:

- Alphabet Inc. (GOOG)

- Amazon.com Inc. (AMZN)

- Microsoft Corp. (MSFT)

This leads us to an important question: which of these firms will produce the first functioning “quantum transistor”? Understanding where to invest is crucial.

This article will delve deeper into these quantum chips. While some technical details might be complex, they are vital for making informed investment choices in this dynamic space.

Upon completing this reading, you will gain insight into my specific quantum investment recommendation, potentially outpacing these established contenders.

Now, let’s take a look at these three groundbreaking quantum chips.

The Workhorse of Quantum: Alphabet

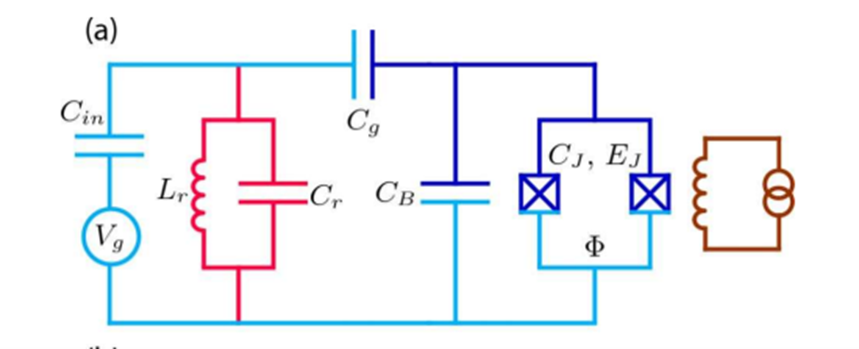

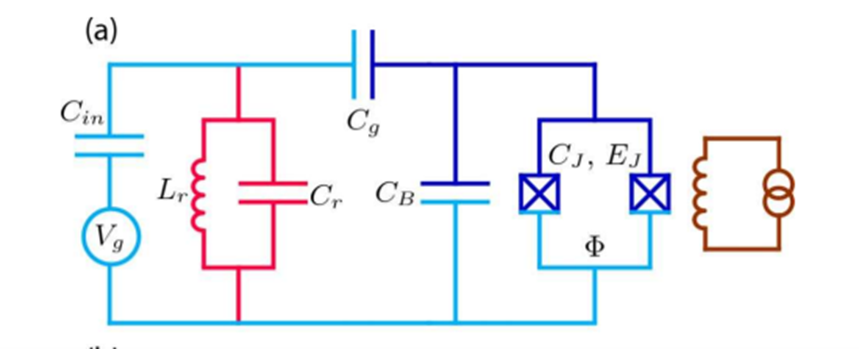

In 1999, Japanese researchers pioneered the “charge qubit,” a basic circuit combining a capacitor and inductor to create quantum-like oscillations. This breakthrough enabled scientists to generate quantum behavior on circuitry.

Advancing this concept, Yale researchers developed the “transmon qubit” in 2007. This design employed a series of capacitors to reduce noise disruptions, allowing qubits to be maintained for extended periods and decreasing error rates to approximately 1 in 500. Below is a simplified circuit diagram of this innovation.

Source

Transmon qubits have emerged as the backbone of quantum chips, providing a reliable means to create controlled quantum states. However, the ongoing task is to lower their error rates sufficiently for effective quantum calculations. Alphabet has taken the lead in this competitive sector.

In 2019, Alphabet made headlines by launching its Sycamore quantum chip, which was the first to integrate 54 transmon qubits on a single circuit board. Following that, on December 9, they introduced Willow, a chip featuring 105 qubits, capable of maintaining coherence for up to 68 microseconds—

Alphabet, Amazon, and Microsoft Race Ahead in Quantum Computing Technology

Alphabet, Amazon, and Microsoft are pushing the boundaries of quantum computing with new chip technologies aimed at transforming the industry. Each company is taking different approaches to tackle the significant challenges of error rates and scalability in their quantum systems.

Alphabet’s Breakthrough with the Willow Chip

Alphabet has made notable strides with its Willow chip, which features 105 qubits and claims a fivefold advancement compared to earlier versions. This chip can currently manage about three errors at a time, which remains insufficient for widespread practical use. Experts project that effective solutions for complex problems, such as breaking encryption, will require millions of qubits. However, packing such a high number of qubits is complicated, particularly because Willow’s superconducting qubits need to operate at near-zero temperatures.

Despite its limitations, Willow represents one of the most significant developments in quantum technology. It addresses the critical issue of scaling error rates, suggesting that even larger chips could soon be on the horizon.

Amazon’s Experimental Crossover: The Ocelot Chip

Amazon launched its Ocelot quantum chip on February 27, showcasing an innovative design that employs five “cat qubits.” This new qubit type stores quantum data in a microwave cavity rather than on a superconducting circuit, differentiating it from Alphabet’s transmon qubits.

The name “cat qubit” references Schrödinger’s cat thought experiment, which illustrates the peculiarities of quantum states. While still experimental, cat qubits demonstrate great promise due to their significantly lower error rates. For instance, bit-flip errors can occur as infrequently as 1 in 100,000, resembling a rare coin flip.

Ocelot also excels in maintaining coherence for up to one millisecond, benefiting from the protective qualities of microwave cavities against external disturbances. However, they struggle with phase-flip errors, which could confuse the relative phase among qubits. To mitigate this, Amazon integrates four traditional transmon qubits into the system, forming an error-correcting web that enhances overall accuracy.

Despite the challenges associated with microwave cavities—such as thermal noise affecting performance—Amazon’s hybrid approach has successfully reduced error rates by 90%. The long-term viability of this strategy remains to be seen.

Microsoft’s Aspirational Majorana 1 Chip

Microsoft is taking a more daring path with its Majorana 1 chip, unveiled on February 19. Utilizing a topological qubit design, the chip aims to simplify scaling from dozens to millions of qubits. The underlying theory suggests that a spread-out arrangement of data increases error resistance, which could enhance overall performance.

The Majorana 1 chip consists of semiconductor wires made from indium antimonide (InSb) and indium arsenide (InAs), materials renowned for their ability to store electron spins. These wires are enveloped in a thin aluminum shell, which facilitates the formation of quantum states.

It’s crucial to acknowledge that Microsoft faces significant barriers since the functionality of topological qubits has yet to be validated. The Majorana 1 chip factor only addresses a small part of the broader issue. One major challenge is reading the information dispersed across these surfaces without disrupting it. Microsoft’s recent publication in the journal Nature introduces a new measurement technique that enables a single-shot reading, minimizing errors and noise during data retrieval. While this advancement is promising, it underscores the considerable distance Microsoft must cover to achieve its quantum ambitions.

Impact on Investors and the Quantum Computing Landscape

The competitive landscape of quantum computing extends beyond these three tech giants. Numerous companies are in the race to develop next-gen qubits, and the ultimate victor is still uncertain.

Traditional semiconductor companies, like NVIDIA Corporation (NVDA), recognize the existential threat posed by quantum computing to their market dominance. As the industry evolves, investors should remain vigilant about developments that could shift the balance of power in quantum technology.

NVIDIA’s Upcoming ‘Q Day’ Could Transform Quantum Computing Landscape

Developments in quantum computing promise to revolutionize tasks that traditional chips struggle with, such as 3D modeling and data encryption. Quantum chips are expected to handle these complex tasks much faster than current technology allows.

Recognizing this potential, companies like NVIDIA are investing substantial amounts—billions of dollars—into quantum computing startups. NVIDIA seeks to remain at the forefront of this transformative technology, and individual investors should take note as well.

Mark Your Calendars for NVIDIA’s Announcement

Investors should take note of NVIDIA’s “Q Day,” scheduled for Thursday, March 20, at 1 p.m. Eastern. This is anticipated to be a significant turning point in the quantum investing landscape. It is expected that NVIDIA will unveil a breakthrough technology that could positively impact the stock prices of one of its smaller “Q” partners—an entity significantly smaller than NVIDIA.

Join the Urgent Summit on Quantum Investing

To prepare for this event, I invite you to participate in an urgent summit on Thursday, March 13, at 1 p.m. ET. This session is one week before NVIDIA’s announcement, allowing you to stay ahead of the trends.

During this complimentary event, I will share insights about a small-cap company that is strategically positioned to benefit from NVIDIA’s forthcoming “Q Day” revelations. This company has robust technology secured by 102 patents, which could prove vital to future advancements.

Proven Success in Predicting Quantum Potential

This is not my first insight on such matters. I previously made a successful prediction regarding NVIDIA itself. In fact, one of my readers realized a remarkable 50X return from my advice on NVIDIA back in 2016. This could be your opportunity to get in early on the quantum revolution.

Click here now to secure your spot.

Sincerely,

Louis Navellier

Disclosure: As of this email’s date, I directly or indirectly own securities related to the commentary presented below:

NVIDIA Corporation (NVDA)