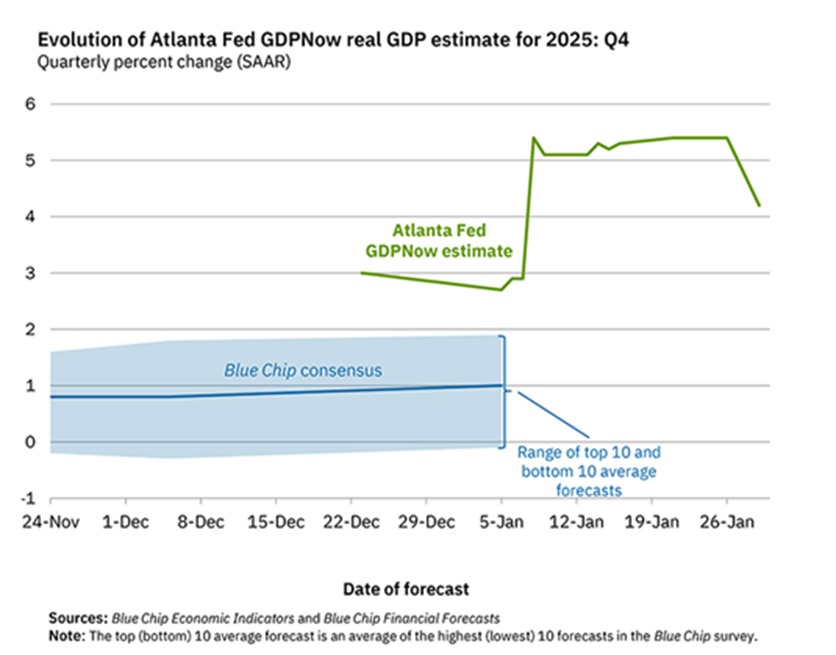

The U.S. economy is showing signs of accelerated growth, with the Commerce Department revising its Q3 GDP estimate to a 4.4% annual pace, following a 3.8% growth in Q2. This marks the strongest consecutive quarters of growth since 2021, driven by a 3.5% increase in consumer spending and resilient corporate activity despite elevated interest rates. The Atlanta Fed, however, has lowered its fourth-quarter GDP estimate but still expects growth over 4%.

Notably, small-cap stocks are beginning to lead the market, with the Russell 2000 index climbing 7% in January, significantly outpacing the S&P 500 and Dow Jones. This shift is seen as indicative of a market transition, potentially signaling what’s being termed an “AI Dislocation,” where investment focus may shift from established mega-cap leaders to smaller companies involved in the broader AI ecosystem.

In terms of projections, Louis Navellier suggests the U.S. could see GDP growth reaching 6% at some point in 2026, emphasizing the importance of recognizing underlying economic trends. Investors are urged to look for opportunities in smaller, less recognized companies as market leadership evolves.