Rising Resource Nationalism: A Shift in Global Energy and Mining Policies

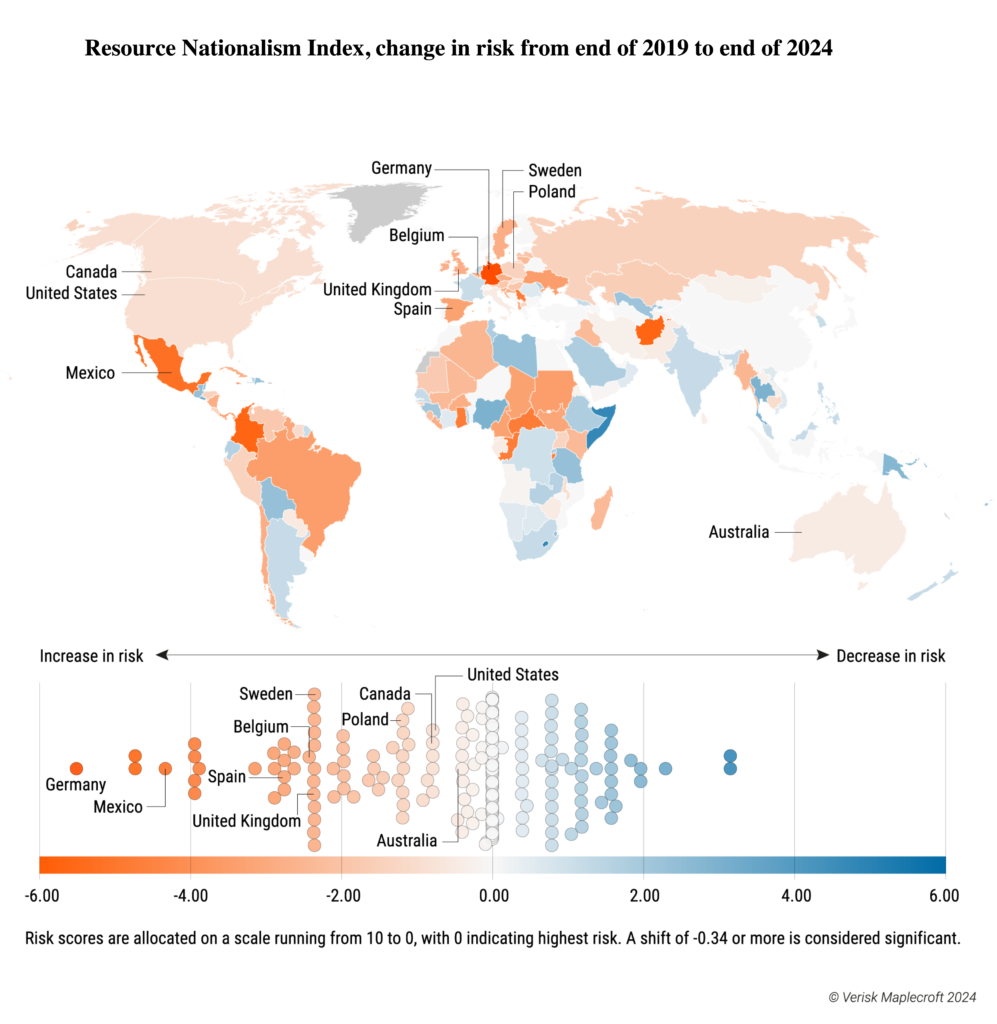

Verisk Maplecroft’s Resource Nationalism Index (RNI) has revealed a significant spike in protectionist policies affecting the energy and mining sectors worldwide. Focused on 198 countries, the index shows that the trend is particularly strong in Europe and North America, driven by geopolitical tensions and a changing global economy.

The situation in Europe is especially noteworthy, with major economies like Germany, Spain, the UK, and Poland experiencing considerable drops in the RNI rankings. Germany has seen the most dramatic decline, falling 122 places. This shift reflects an aggressive push to decrease reliance on outside energy and mineral sources.

Germany’s response has included both immediate actions, such as seizing Russian energy assets following the invasion of Ukraine, and long-term strategies aimed at boosting domestic manufacturing. By forming partnerships with resource-rich countries like Canada and Australia, Germany seeks to ensure access to vital minerals like lithium and cobalt.

Additionally, the European Union is enhancing its initiatives through frameworks such as the European Raw Materials Alliance (ERMA) and the Critical Raw Materials Act. These programs emphasize sustainable mining and recycling while working to decrease dependency on non-European sources.

North American Strategies

In North America, efforts to protect critical minerals have led to stricter trade and investment regulations. The US government has rolled out the CHIPS and Science Act and the Inflation Reduction Act to promote domestic production while limiting Chinese involvement in essential sectors. Collaborations like the Mineral Security Partnership illustrate a commitment to enhancing cooperation among allied nations, further solidifying trade barriers against geopolitical foes.

Canada is also taking a comprehensive approach with its Critical Minerals Strategy and the Investment Canada Act. These initiatives restrict foreign investments, especially from China, while promoting sustainable resource development that adheres to high environmental and labor standards.

Last year, Canada mandated three Chinese investors to divest from three lithium firms in a significant measure aimed at blocking Chinese expansion in the critical minerals sector.

In another strategic move, Ottawa intervened in June to prevent Australia’s Vital Metals from selling its rare earth stockpiles mined in Canada to China’s Shenghe Resources. Instead, the Canadian government offered a better deal to ensure these materials stayed domestic.

Canada is also collaborating with allies such as Australia and the US to bolster critical mineral supply chains through priority agreements for resource access.

As part of the Five Eyes Alliance—comprising the US, UK, Australia, Canada, and New Zealand—Canada is working to counteract price manipulation of critical metals.

Moreover, the US has formed various groups like the Committee on Foreign Investment (CFIUS) to scrutinize foreign acquisitions of critical mineral assets. Recently, the US imposed restrictions on exporting semiconductors and critical materials to China, limiting the country’s ability to advance its technologies. In retaliation, China banned exports of several key high-tech materials, including gallium and germanium, to the US.

A Fragmented Global Economy

The growth of resource nationalism, referred to by Verisk Maplecroft as “strategic,” highlights the difficulties arising from a fragmented global economic landscape. Jimena Blanco, the chief analyst at Verisk Maplecroft, emphasized that securing supply chains has become a primary focus for nations, opening up new incentive programs while narrowing options to “friendly” jurisdictions.

The report cautions that rising trade tensions are likely as countries like China and the US engage in reciprocal measures.

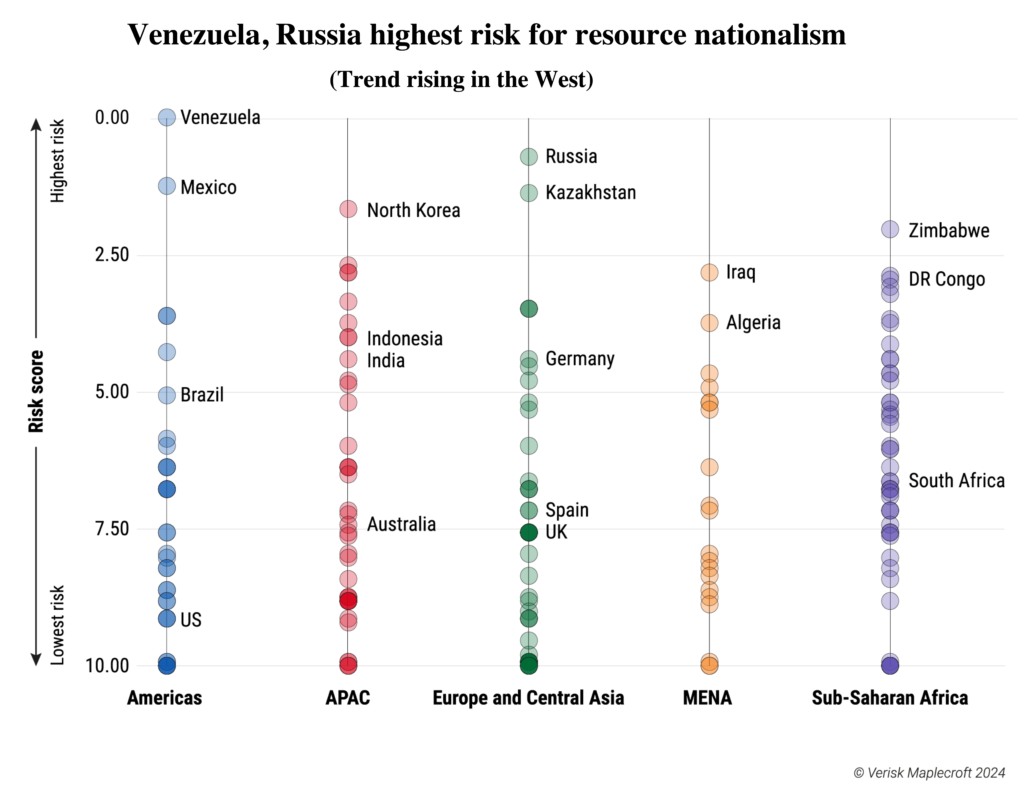

Furthermore, the study pinpointed the top ten jurisdictions with the highest risk, which include resource-nationalist states such as Venezuela, Russia, and Zimbabwe. These countries exert control over their resource wealth through nationalization policies and resource rent increases.

As resource nationalism evolves, Western economies seem ready to implement a combination of trade barriers, investment restrictions, and sustainability standards to maintain strategic autonomy.

For investors, these changes present a complex landscape filled with potential risks throughout the global supply chain. Blanco remarked, “Western nations are likely to increase localized supply chains and stricter trade policies, complicating matters for global businesses.”

The competition for critical minerals, essential to green energy and advanced technology, signals a widening economic divide around the world.