ASML Faces Setbacks in AI Market Amid Disappointing Earnings

While most AI stocks enjoyed positive momentum in October, ASML (NASDAQ: ASML) stumbled after a less-than-stellar third-quarter earnings report and uninspiring guidance for 2025.

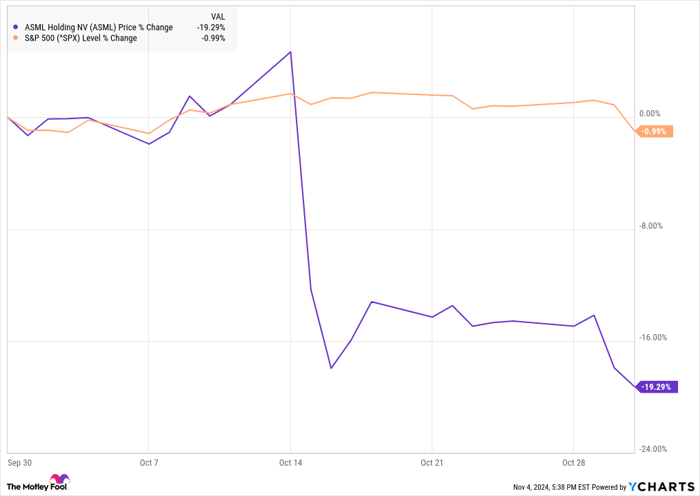

This news disappointed investors who believed ASML would thrive in the AI boom. The quarter saw weak orders and lackluster demand from China. As a result, the stock fell 17% by the end of the month, according to S&P Global Market Intelligence.

ASML data by YCharts

ASML Encounters Challenges

In nearly all categories, ASML did not meet investor expectations in the third quarter.

The company reported €7.47 billion in revenue, marking a 12% increase. This growth followed a previous decline in revenue. Earnings per share also rose from €4.81 to €5.28.

What raised concerns among investors were the forward-looking indicators. New bookings for the quarter amounted to only $2.6 billion, indicating a decline in demand. This figure was only half of what analysts had anticipated, reflecting weaker performance in China and a slower-than-expected recovery cycle. ASML is considered a key player in the chip industry, particularly as the top seller of lithography equipment.

CEO Christophe Fouquet mentioned, “It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, leading to customer cautiousness.”

With the weak order flow, management revised its guidance for 2025 down from earlier predictions made in 2022. Initially, ASML forecasted revenue of €30 billion to €40 billion but now expects it to fall within the lower range of €30 billion to €35 billion. Additionally, the company noted a “delayed timing of EUV demand,” projecting gross margins between 51% and 53%, which is lower than previously expected.

Interestingly, ASML announced its earnings a day earlier than planned due to a technical error, surprising the investment community.

![]()

Image source: Getty Images.

Future Outlook for ASML

Despite its challenges, ASML’s situation appears to be more of a temporary hurdle than an enduring downturn. Management indicated that some order delays are now expected to extend into 2026. They also reported that AI-related demand remains robust, suggesting potential growth opportunities.

With the CHIPS Act encouraging substantial investments in chip manufacturing, ASML is poised to benefit in the long run, even though the recent order slowdown is disappointing. This moment could present a buying opportunity for investors looking to capitalize on ASML’s growth potential.

New Opportunities Await Investors

Have you ever felt like you missed a prime opportunity to invest in top-performing stocks? If so, read on.

Occasionally, our expert analysts identify a “Double Down” stock recommendation, indicating that a company is on the verge of significant growth. If you’re concerned that you might have missed out on investing, now may be the optimal time to act before the window closes. The following data illustrates this:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $22,292!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,169!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $407,758!

We are currently issuing “Double Down” alerts for three remarkable companies, with potential opportunities that may not come around again for a while.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.