Disney’s Rising Costs: A Balancing Act of Prices and Profits

Anyone who’s priced a Walt Disney (NYSE: DIS) vacation recently may be experiencing sticker shock. A trip to Disneyland in California now costs around 6% more after recent price hikes, while Disney World tickets in Florida are expected to follow suit next year. The price of entry has always been high, but these increases add to the overall cost burden for visitors.

Additionally, the growing expenses extend beyond entry tickets. For example, a slice of gourmet chocolate cake can now reach up to $26. Disney’s cruises have also increased corkage fees and higher suggested gratuities, reflecting rising costs across the board.

Shareholder Concerns Amid Rising Prices

These actions have raised valid concerns among shareholders of The Walt Disney Company. Even though Disney’s parks and cruises provide a premium experience, there are limits to what visitors are willing and able to pay. The real question is whether these price increases could ultimately be detrimental to the entertainment giant.

This concern is valid; the risks are significant. Disney’s theme parks, resorts, and related “experiences” generate the most revenue and profit for the company. If Disney misjudges consumer willingness to pay, the financial fallout could be considerable.

Critical Performance of Parks and Resorts

In Disney’s defense, the company is not alone in facing these challenges. Like many businesses, it is grappling with rising operating costs and must adapt accordingly.

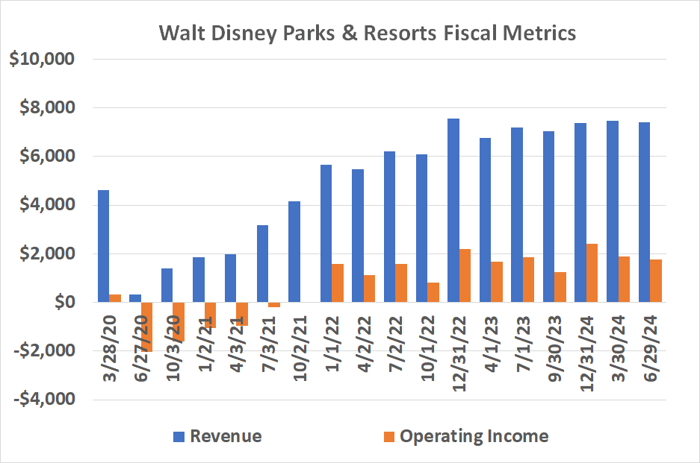

The situation, however, may be even more precarious than it appears. The theme parks, resorts, and vacation businesses are currently stagnating, with some signs of contraction evident in both revenue and profits.

Data source: The Walt Disney Company. Chart by author. Numbers are in millions.

While some consumers still have disposable income, many households are struggling financially. A pricey vacation is not a practical choice for most right now. This trend is particularly concerning for current and potential investors, as Disney’s parks and resorts account for roughly half—or more—of its operating income.

Data source: The Walt Disney Company. Chart by author. Numbers are in millions.

If growth is lacking in Disney’s theme park and experiences division, the overall company’s growth in revenues and earnings is unlikely as well. Profits have improved since late 2022, primarily driven by gains in its television and streaming divisions. However, this rebound may have plateaued. Future growth will depend on the performance of other business segments.

Challenges and Consumer Sentiment

Recent ticket price hikes and increased costs for in-park amenities aim to combat this stagnation, but the strategy could backfire. While there are still many who can afford a Disney vacation, rising prices might deter average consumers. There are signs this is already happening.

Walt Disney raised prices in October last year, and this year’s increase came with notable consumer response. Disney’s CFO, Hugh Johnston, acknowledged in August that the higher prices impacted demand for experiences. He noted, “we saw a slight moderation in demand during the third fiscal quarter ending in June” and warned of flat revenue numbers from parks in the near term.

We expect to see a flattish revenue number in Q4 coming out of the parks… just a couple of quarters of likely similar results.

Other signs suggest consumers feel financial stress. For instance, Walmart reported that higher-earning households were a key driver of its fiscal second-quarter sales growth, indicating even wealthier shoppers are feeling pressure. Furthermore, snack giant PepsiCo saw a 3% decline in second-quarter volume sales as consumers became “price conscious” and sought better value.

Management’s Strategy Under Scrutiny

Economic recovery is inevitable, and consumers will eventually be able to handle Disney’s higher prices. However, given the significance of the experiences business to Disney’s overall financial health, current price increases may do more harm than good. The time to raise prices is during an economic boom when consumers have more financial flexibility. Conversely, in a downturn, organizations should prioritize delivering value rather than hiking prices.

Should You Invest in Disney Now?

Before investing in Walt Disney, consider this:

The Motley Fool Stock Advisor analysts recently identified their pick of the 10 best stocks to invest in, and Walt Disney was not included. The stocks they selected have the potential for significant future returns.

For context, when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth about $867,372!*

Stock Advisor provides investors with guidance on building a successful portfolio, including regular updates and two new stock choices each month. The service has more than quadrupled the returns of the S&P 500 since its inception.*

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and endorses Walmart and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.