Earlier last week, investor Keith Gill, better known as Roaring Kitty, returned to X, the social media platform formerly called Twitter.

Roaring Kitty was a huge factor in the initial meme stock phenomenon back in 2021. With his return to social media, dozens of meme stocks saw massive gains. Shorts sellers are on the retreat and all sorts of highly-shorted stocks are blasting off right now.

Not all meme stocks are of equivalent quality, however. Many of these heavily-shorted companies have seen their share prices slump for a reason. In general, meme stocks are a speculative trade.

But there are some diamonds in the rough. These are three meme stocks with 10% or more of their share floats currently sold short that have surprisingly strong fundamentals, in addition to the meme factor.

Rocket Lab USA (RKLB)

Source: T. Schneider / Shutterstock.com

Rocket Lab USA (NASDAQ:RKLB) is a meme stock that could be headed for the moon, literally. The space company provides launch services and space systems solutions for government agencies, defense companies and commercial enterprises.

Rocket Lab designs, manufactures and services spacecraft, along with providing ancillary services, such as on-orbit management solutions.

While the company has been in business since 2006, Rocket Lab has seen business take off over the past couple of years. Revenues skyrocketed from $62 million in 2021 to $245 million in 2023. Analysts see that figure jumping another 79% to $437 million in 2024.

Needless to say, as space-related industries gain steam, Rocket Lab’s addressable market should continue to grow.

However, short sellers are much less convinced. More than 20% of Rocket Lab’s stock is currently sold short. That seems like an awfully risky bet, given Rocket Lab’s gargantuan revenue growth figures, along with the fact that analysts see the company becoming profitable in 2026.

Rocket Lab also has $492 million in cash and short-term investments, giving it a fortress balance sheet. Rocket Lab’s strong growth, healthy finances and favorable industry and business model make it one of most attractive meme stocks to buy today.

Unity Software (U)

Source: viewimage / Shutterstock.com

Unity Software (NYSE:U) is one of the two primary graphics engines, along with rival Unreal, that video game developers use to produce their games.

Unity’s ecosystem is prized for interoperability, easily allowing developers to make a game that runs seamlessly across PC, console, mobile phone, and even virtual and augmented reality systems. This last point makes Unity a key player in the emerging metaverse hardware and services universe, such as being a partner in developing apps for the Apple Vision Pro.

Unfortunately, Unity has run into significant operational hurdles along the way. The company has long relied on advertising for revenues, which has led to earnings volatility. In addition, management tried to push through deeply unpopular price hikes to developers last year, and had to ultimately roll that back, burning significant goodwill.

Unity has turned into a messy situation and short sellers are circling the water. About 10% of Unity stock’s float has been sold short and shares are just a couple percent above their all-time lows.

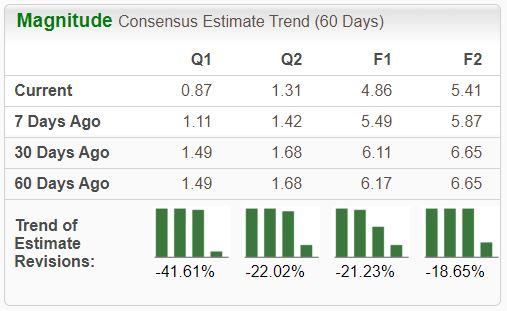

But the bears are overplaying their hand. Unity has slashed costs and is expected to become tremendously profitable this year. In addition, a new CEO just took over this month.

With improved profitability, new leadership and massive short interest, the conditions are here for Unity to become a leading metaverse meme stock.

Petco Health (WOOF)

Source: Walter Cicchetti / Shutterstock.com

Petco Health (NASDAQ:WOOF), as a leading retail for pet food, toys and wellness items. had a promising IPO. In January 2021, the stock started trading at $26, 44% above the IPO price, and would soar 63% on their initial trading day. But it’s been mostly downhill since then.

In fact, shares recently hit a fresh new all-time low of just $1.41 per share in April. Since then, however, WOOF stock has started to recover, thanks to meme stock mania, with shares rising to around $2.50 this week.

It’s not hard to see why meme traders are excited. For one, the company has a highly memorable ticker symbol. And the company’s 21% short interest practically jumps off the screen, making it an obvious squeeze target.

Beyond those points, however, there’s a promising business here as well. Petco generates roughly $6 billion in annual revenues, which is a huge number for a company whose market capitalization is just $765 million today.

Sure, the pandemic-era pet adoption boom has ended. But Petco is right-sizing operations to reflect current industry conditions and could return to profitability within the next couple of quarters. This makes WOOF stock a great meme play for May 2024.

On the date of publication, Ian Bezek held a long position in U stock. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.