“`html

The Federal Reserve, led by Jerome Powell, held interest rates steady for the eighth consecutive meeting on Wednesday, keeping the fed funds rate between 4.25% and 4.50% since December 2024. This decision comes despite signs of easing inflation and slowing economic growth. Two members of the Federal Open Market Committee (FOMC), Christopher Waller and Michelle Bowman, dissented in the vote, marking a notable split with Fed leadership for the first time in three decades.

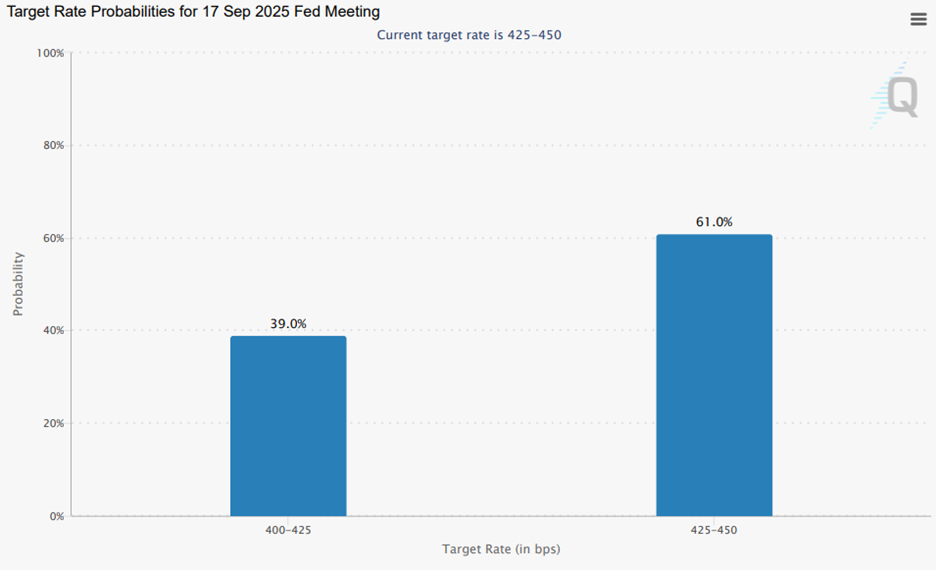

The Personal Consumption Expenditures (PCE) index report released this week shows core PCE, the Fed’s preferred inflation measure, rose 0.3% in June—higher than the anticipated 0.2%—with a year-over-year rate of 2.8%. Real personal spending and personal income both rose by 0.3%, though these figures fall below forecasts, indicating a modest recovery. The CME FedWatch Tool now shows a 61% likelihood the Fed will maintain rates steady.

Analysts emphasize that the Fed’s continued inaction could destabilize the economy, arguing for rate cuts in September, December, and further into next year to reach a target of approximately 3%. With global interest rates declining, the U.S. risks falling behind in economic stability if it does not respond to these changing conditions.

“`