**SaaS Stocks Experience Major Decline Due to AI Disruption**

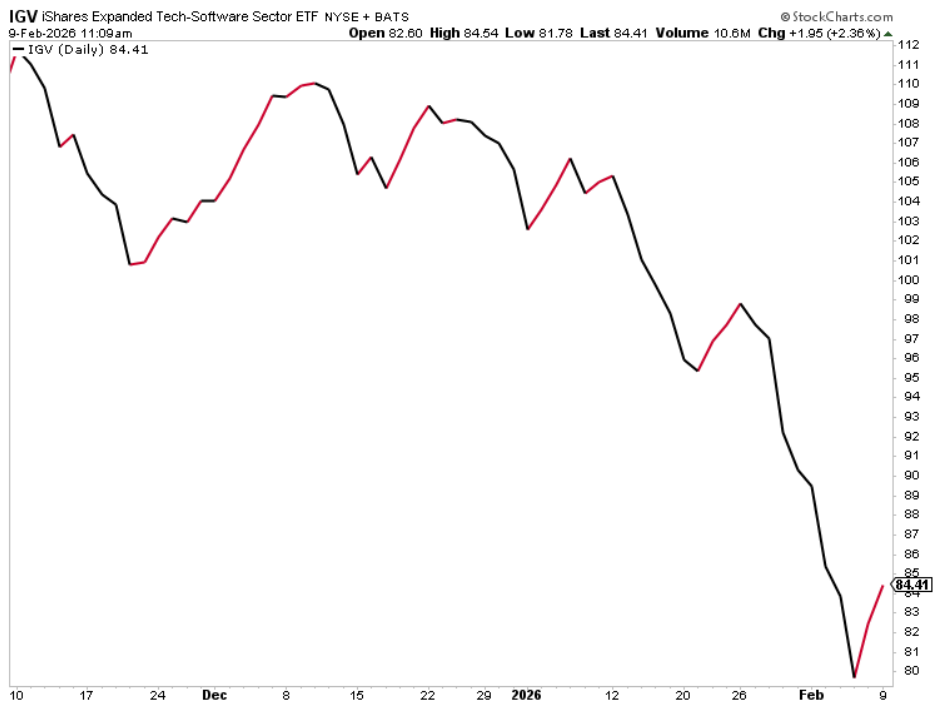

Software-as-a-Service (SaaS) stocks have plunged more than 20% since late 2025, marking one of the fastest drawdowns for the sector outside of past financial crises. This shift, termed “SaaSmageddon,” is not driven by macroeconomic factors but rather by AI technologies that threaten traditional seat-based pricing models. AI agents, such as Anthropic’s Claude Cowork and Google’s Project Genie, are reducing the need for human labor by autonomously completing complex tasks, thereby diminishing demand for software licenses linked to individual users.

As a result, firms like Salesforce and Adobe are facing valuation compression as they struggle to adapt. While chipmakers like Nvidia flourish, many SaaS companies—especially those offering generic services—are at risk of obsolescence. This transformative phase is reshaping the software landscape into three zones: Red Zone (facing AI obsolescence), Yellow Zone (under margin pressure), and Green Zone (AI-resistant companies). The future of software investment will hinge on identifying companies with strong, differentiated value propositions that can withstand these changes.