Last summer, the U.S. Securities and Exchange Commission (SEC) filed lawsuits against two major crypto exchanges, Coinbase and Binance, alleging that the exchanges had listed and traded unregistered securities in the form of various cryptocurrencies. This week, the regulatory body’s legal teams faced the exchanges in court as the companies vehemently argued that the SEC had failed to prove that those cryptocurrencies should be classified as securities.

You’re reading State of Crypto, a CoinDesk newsletter analyzing the convergence of cryptocurrency and government. Click here to subscribe for future editions.

The Ongoing Saga

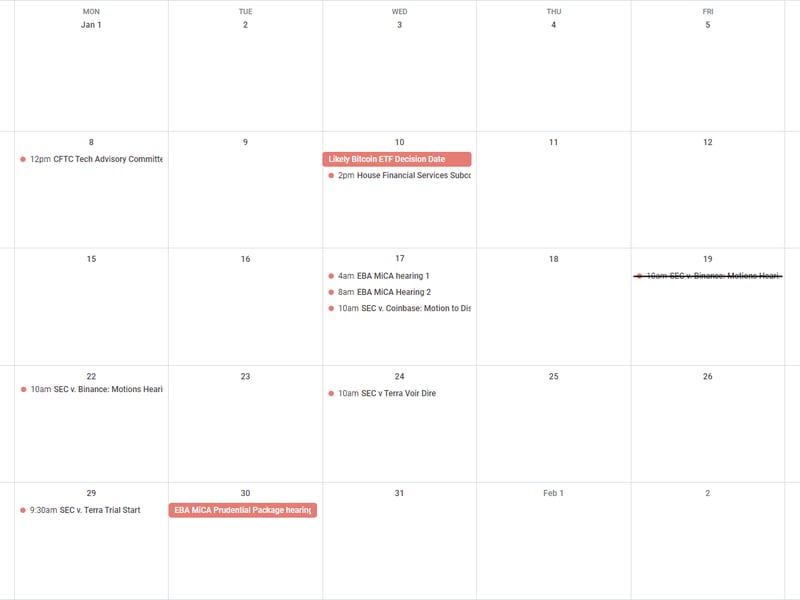

There’s no rest for the weary: While last week revolved around the uncertainty of SEC approval for spot bitcoin exchange-traded funds (ETFs) and the tumultuous series of events leading up to the final approval, this week sees us back in court as the SEC’s Enforcement Division fiercely argues its case to have cryptocurrencies classified as securities.

Significance of the Battle

A considerable slice of the U.S. crypto industry hangs in the balance, depending on the outcome of the SEC’s legal tussles with Coinbase, Binance/Binance.US, and Kraken. Should federal judges concur that various digital assets are indeed securities, it would entail new registration and reporting obligations for issuers and trading platforms. Conversely, a ruling in favor of the exchanges would signal a green light to a substantial portion of the industry, implying that the SEC has overstepped its jurisdiction or that tailored laws by Congress are necessary.

Unpacking the Legal Dispute

In June 2023, the SEC sued Coinbase and Binance, alleging that the companies listed digital assets such as solana (SOL), filecoin (FIL), and axie infinity (AXS), among others, which the SEC deemed to be unregistered securities.

The cryptocurrency industry, unsurprisingly, was deeply agitated by these suits, despite SEC Chair Gary Gensler having forewarned about the impending legal actions. Over the past few months, lawmakers, industry lobbyists, and other stakeholders have filed amicus briefs urging the courts to side with the defendants’ motions to dismiss the cases outright.

Jesse Hamilton outlined the Coinbase hearing on Wednesday, and many of the fundamental ideas mirror those of the Binance case. While the entire article is noteworthy, one of his pivotal points may be that a dismissal at this stage is improbable.

Judge Katherine Polk Failla pursued rigorous questioning during the hearing but has yet to deliver a ruling.

An SEC attorney stated that the token itself was not a security, but rather the actual transactions involved during the hearing.

A Friday hearing for the SEC’s case against Binance was rescheduled to Monday due to adverse weather conditions in the Washington, D.C. area.

Concurrently, an intriguing hearing unfolded before the U.S. Supreme Court where two parties contested a longstanding Supreme Court precedent called the Chevron doctrine, which provides federal regulatory agencies the leeway to interpret federal laws for the purpose of rulemaking.

SCOTUSblog reported indications that this precedent might be overturned following the hearing.

Michael Passalacqua, an associate with Willkie Farr & Gallagher LLP, underscored the significance of this case, asserting that if this precedent is revoked, regulatory agencies “would be less inclined to discover new interpretations within ambiguous (and often dated) statutes.”

“We may even see crypto legislation gain traction in Congress as lawmakers might be incentivized to enact new laws to regulate the industry (as opposed to relying on agency interpretations),” he remarked.

Wednesday

- 09:00 UTC (10:00 a.m. CET) The European Banking Authority (EBA) conducted the initial of two hearings on the Markets in Crypto Assets Regulation (MiCA), scrutinizing regulatory technical standards (RTS) and implementing technical standards (ITS).

- 13:00 UTC (2:00 p.m. CET) The EBA held its second MiCA hearing, which focused on guidelines for preventing illicit crypto activities.

- 15:00 UTC (10:00 a.m. EST) There was a hearing in SEC v. Coinbase.

Friday

- 15:00 UTC (10:00 a.m. EST) A hearing in SEC v. Binance was scheduled but was postponed to Monday due to inclement weather in Washington, D.C.

- (Axios) Brady Dale and Crystal Kim, alongside several of their colleagues at Axios, compiled this fascinating timeline chronicling the bitcoin ETF saga.

- (The Air Current) TAC created a reading list of stories that perhaps provide an explanation for how Boeing began this year by watching a deactivated emergency exit door blow off an aircraft during flight (Disclosure: I’m invested in Boeing shares).

- (IRS) The Internal Revenue Service has stated that a controversial component of the 2021 bipartisan Infrastructure Investment and Jobs Act, which altered Section 6050I of the U.S. code to require businesses to report crypto transactions exceeding $10,000, will not take effect until the Treasury Department formulates appropriate regulations. The reporting mandate is in force for cash transactions surpassing that amount.

If you have any thoughts or questions on what I should cover next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See you next week!

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.