eBay Inc. (NASDAQ: EBAY) shares rose 3.8% following a strong Q4 2025 earnings report released on [exact date]. The company reported revenue of $2.97 billion, exceeding expectations of $2.87 billion, while gross merchandise volume (GMV) climbed to $21.2 billion, reflecting a nearly 6% increase globally and about 10% in the U.S. Additionally, eBay plans to acquire the secondhand clothing marketplace Depop from Etsy Inc. for $1.2 billion, aiming to attract more Gen Z and Millennial customers.

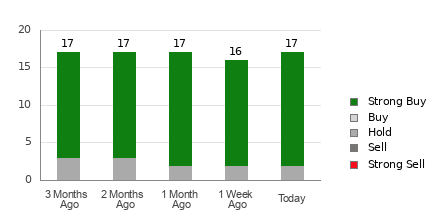

eBay’s advertising revenue hit $544 million in Q4, representing nearly 2.6% of GMV, and the company stated that over 4.8 million sellers used promoted listing tools. The recommerce segment contributed over 40% of GMV and grew at around 10% during the year. Analysts have raised price targets for eBay stock, with some forecasts above the current consensus price of $96.52.

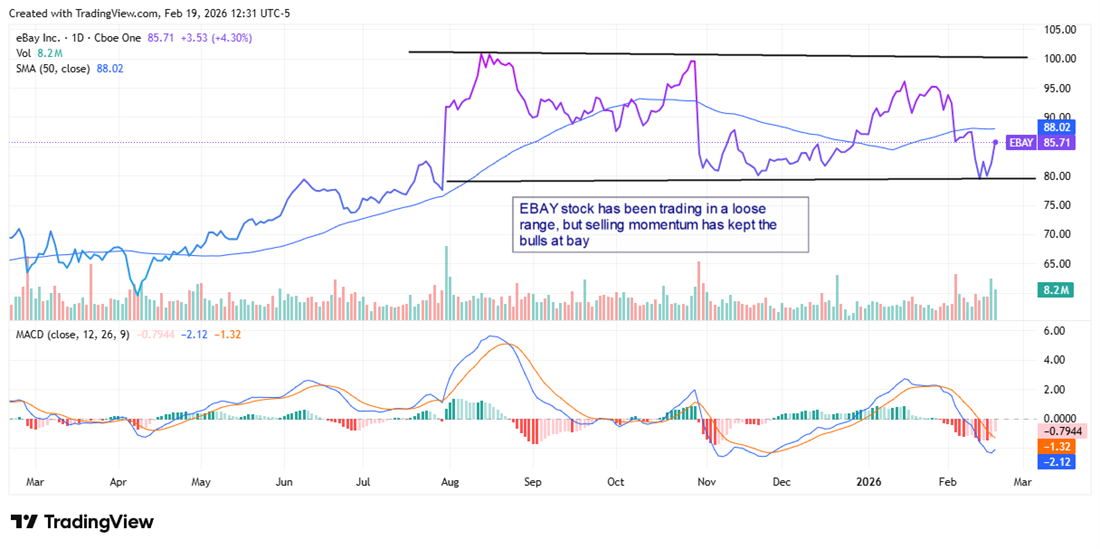

Despite the positive outlook, eBay faces risks including potential cyclicality in GMV growth driven by commodities, the short-term costs associated with the Depop acquisition, and a dip in non-GAAP gross margin. These factors highlight challenges the company must navigate to sustain its growth.