Understanding Current Trends and Key Stocks in the S&P 500

Investors often perceive market conditions in black and white, leading them to herd mentality and recency bias when selecting stocks. This perspective is valuable in understanding recent activity in the S&P 500 (SNPINDEX: ^GSPC). Current trends in the index reveal which stocks merit close attention as the market fluctuates between extremes.

The Current State of the S&P 500

Goldman Sachs has published a report indicating that concentration levels within the S&P 500 are reaching the highest they have been in 93 years. Historically, such levels have only been recorded eight times over the last century: in 1932, 1939, 1964, 1973, 2000, 2009, 2020, and now. The weight of the top 10 stocks in the S&P 500 is at an unprecedented high.

Image source: Getty Images.

Key Stocks to Monitor

Many investors may wonder which stocks are currently influencing the S&P 500’s movements the most. As of April 24, the top 10 stocks by market cap are:

- Apple: $3.1 trillion

- Microsoft: $2.9 trillion

- Nvidia: $2.6 trillion

- Amazon: $1.9 trillion

- Alphabet: $1.9 trillion

- Meta Platforms: $1.3 trillion

- Berkshire Hathaway: $1.1 trillion

- Broadcom: $880 billion

- Tesla: $826 billion

- Eli Lilly: $770 billion

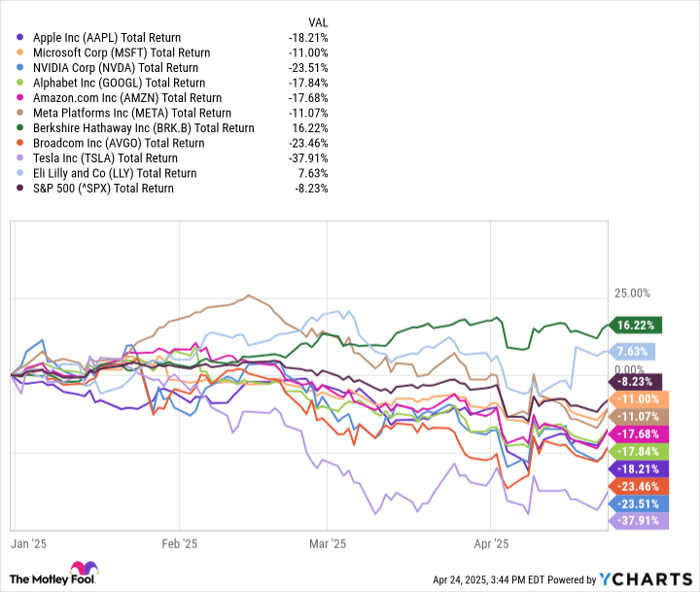

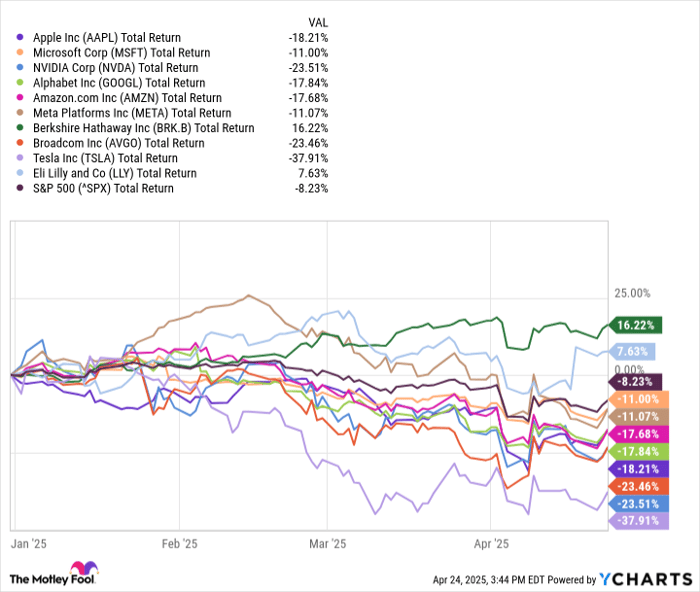

AAPL Total Return Level data by YCharts

Excluding Berkshire and Eli Lilly, most of the aforementioned stocks are underperforming the S&P 500 thus far this year.

Implications of These Trends

Two key ideas emerge from this data. First, it is not unexpected to see a decline in high-growth technology stocks, including the so-called “Magnificent Seven.” Recently, investors have been rushed to invest in large-cap tech stocks due to bullish narratives surrounding artificial intelligence (AI). This surge has led to a remarkable rally in big tech. However, during uncertain economic times, such as now, it’s common for investors to take profits and redirect funds into safer investments, like consumer defensive stocks or commodities.

Investors may now view high-growth stocks less favorably, which prompts a shift towards perceived safer opportunities. This situation raises an interesting question: Why is the current episode of volatility considered different from past instances? The answer likely lies in recency bias.

The second point is that despite many growth stocks underperforming, their substantial weight in the S&P 500 remains significant. This suggests that while individual stock performance may falter, their influence is still powerful due to the presence of institutional funds with long-term strategies. Additionally, the Magnificent Seven, along with Berkshire and Eli Lilly, continue to lead their sectors. Given their popularity among hedge funds and retail investors, recent sell-offs are expected to be temporary, with these companies likely remaining favored in the long run.

Investing in any of the top 10 stocks gives exposure to high-growth industries, including AI, cloud computing, cybersecurity, and more. All of these stocks could represent good buying opportunities, depending on individual sector preferences and risk tolerance.

Should You Invest $1,000 in the S&P 500 Index Now?

Before making an investment in the S&P 500 Index, consider this:

The analyst team recently pointed out what they see as the top 10 stocks for investors, excluding the S&P 500 Index. These selected stocks could yield significant returns in the coming years.

For context, consider Netflix’s inclusion on December 17, 2004. If you invested $1,000 at that time, it would be worth approximately $594,046 now! If you invested in Nvidia when it made the list on April 15, 2005, your $1,000 would be valued around $680,390.

Notably, the average return from this analyst group’s recommendations is 872%, outperforming the S&P 500’s 160% return. It’s important to stay updated on their latest insights.

The views and opinions shared here are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.