Ethereum, launched in 2015, is now the second-largest cryptocurrency by market cap, following Bitcoin. As of May 2023, it supports over 75% of the top 200 tokens, with 158 of them operating on its blockchain. Ethereum’s unique features, particularly its deflationary model established post-September 15, 2022, and the transition to Proof-of-Stake, have fueled a significant 159% price increase since April lows.

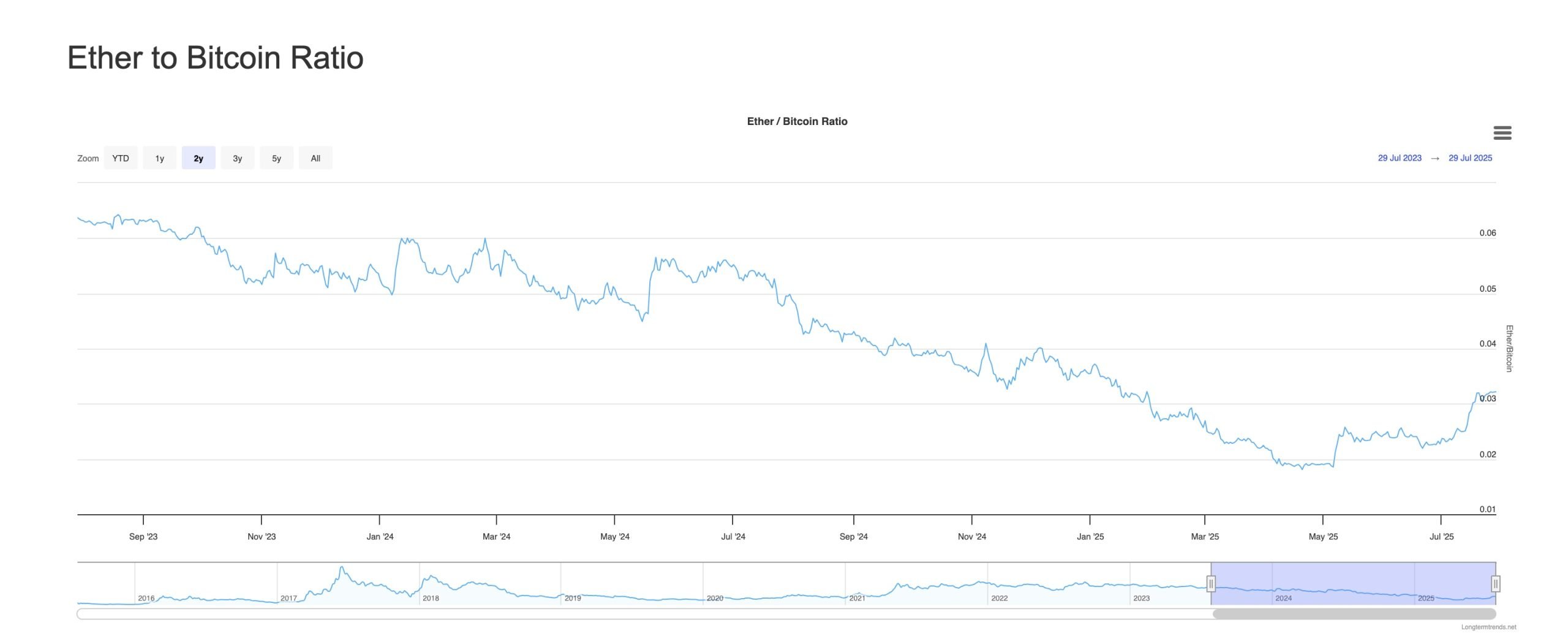

Currently, the Ethereum-to-Bitcoin ratio has closed above the crucial 0.039 resistance level, indicating a bullish trend. Additionally, major institutional moves, including BitMine Immersion Technologies’ $250 million investment in Ethereum and Peter Thiel’s stake, underscore a growing trend of institutional validation for Ethereum. As the global financial backdrop becomes increasingly uncertain, Ethereum is being embraced as a viable store of value, with potential benefits from upcoming ETF approvals and broader adoption in traditional finance.

The market dynamics suggest Ethereum is evolving into the “digital silver” amid a looming economic crisis, with its unique properties appealing to both investors and institutions looking for stable, yield-generating assets.