By Sam Kovacs.

Setting the Stage

As we embark on this new era, it’s prime time to select a few gems. After all, what better way to gauge the investment waters than to reflect on past picks and tailor our approach for the year ahead?

Taking a moment to review last year’s dividend stock picks, we’ll glean some valuable insights and unveil the cream of the crop for 2024.

Past Performers

Previously, I delved into what I believed were top-notch selections for dividend investors throughout 2023.

Last year, we found success by focusing on the AI/Semiconductor trend.

Our portfolio included Broadcom (AVGO), Intel (INTC), and Digital Realty (DLR), all of which outperformed the S&P 500 (SP500).

Being contrarian paid off. It involves recognizing value while enduring a cyclical trend that goes against the security, with the hope of reaping long-term gains.

As I highlighted last year:

If your investment horizon extends beyond your lifetime and you are dependent on dividends for retirement, short-term performance is inconsequential. Sacrificing it for robust long-term results is justifiable.

Our contrarian picks faced challenges in 2023, yet their fundamental value proposition remained intact. The adverse trends persisted, demonstrating the endurance of pessimism and market corrections.

The key lies in identifying budding trends and seizing undervalued stocks to ride them to maximum gains without protracted waiting periods.

In 2024, our picks are rooted in emerging trends that we expect to materialize in the coming year.

2024 Selection Number 5

Not all business development companies (BDCs) are created equal. I often liken comparing Blue Owl Capital Corporation (OBDC) to Eagle Point Credit (ECC) to members of our Investing Group, emphasizing OBDC’s exceptional management and wealth accretion for its investors through increased NAV and generous dividends.

In contrast, ECC has eroded net asset value, with dividends merely recouping investors’ initial outlay.

OBDC, trading at $14.56 with a NAV of $15.4 and yielding 9.6% (excluding special dividends), stands as my premier BDC pick.

Taking into account last year’s special dividends, the yield surges by an additional 1.7% based on the current price.

Benefiting from rising rates in 2023, OBDC capitalized on substantial income from its predominantly senior secured loans to mid-market companies.

Although its portfolio companies’ interest coverage dipped to 1.8x, from 2.5x, OBDC remains sanguine about their ability to retain a sufficient cushion between earnings and interest payments in 2024, bottoming out at 1.5x midway through the year.

With a prolonged rate adjustment anticipated, OBDC is poised to benefit from the prevailing environment for years to come. Echoing Fed Chair Powell’s latest remarks, a soft landing is envisioned, advocating sustained benefits for OBDC.

Financial Projections and Investment Picks for 2024

The Morgan Stanley Pick

Back in June 2021, the financial landscape was ripe for a prudent investment. At $92 per share, Morgan Stanley (MS) presented an irresistible value proposition with its doubled dividend. Fast forward two and a half years, and the stock is still lingering at $92, yet boasting two 10% dividend hikes since acquisition. The current 3.7% yield surpasses its median 2.4% yield over the past decade.

Inflation is asserting itself, tapping the Fed’s target rates on various annualized periods, signaling an imminent rate cut that is pivotal in the current environment. The Fed’s handling of the pandemic-induced inflation may have been amiss, but their swift response in the form of a rate hike cycle was commendable. As we eagerly await the upcoming inflation data and the Federal Reserve’s policy hints, the prospect of a 2024 rate cut is palpable, promising a surge in M&A activity. Goldman Sachs (GS) is already painting a rosy picture of the 2024 M&A landscape.

The Dick’s Sporting Goods Pick

Dick’s Sporting Goods, Inc. (DKS) has been a pleasant surprise in the retail segment, defying market expectations with a 20% surge in 2023, cushioned by a minor 25% setback in August. While the broader retail sector suffered in late December after Nike (NKE) downgraded its guidance, DKS maintained its upward trajectory, buoyed by its House of Sports initiative and omnichannel experience, underlying signs of market share gains.

Trading at $141, just shy of its $146 all-time high achieved in 2021, DKS is poised to break the barrier and ascend towards the $200 mark in 2024. The burgeoning consumer discretionary stocks are primed to bridge the gap with sector leaders Amazon (AMZN) and Tesla (TSLA), commanding substantial portions of the SPDR Consumer Discretionary Index.

Anticipating a broadened performance of the consumer discretionary sector in 2024, away from the dominance of tech-associated names, promises a dynamic investment landscape for discerning investors.

Recession Speculations and 2024 Investment Picks

The buzz about an impending recession in 2024 is spreading like wildfire. The dire predictions of 2023 have suddenly shifted to the new target of economic downturn set for the upcoming year. But why the certainty? Are we simply convinced that a recession is inevitable in 2024? Perhaps it’s time to question this popular narrative, for history has shown us that the Federal Reserve has a knack for orchestrating soft landings, as evidenced by the mid ’90s. If they pulled it off back then, who’s to say it can’t be done again?

The Case for DKS

As market tides lift all boats, DKS is poised to benefit from the rising fortunes of similar enterprises. Furthermore, it remains undervalued with a respectable 2.84% yield. An equitable DKS price, in my estimation, would fall within the range of $180 to $200 at the present moment.

2024 Pick Number 2: Verizon Communications Inc.

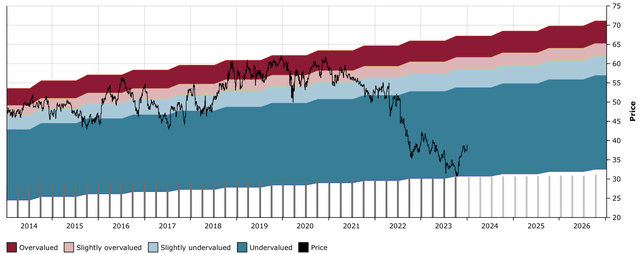

Verizon Communications Inc. (VZ) has been, without a doubt, a bitter pill to swallow throughout 2022 and 2023.

Admittedly, our entry was premature, but we mitigated the potential damage by gradually building our position.

In April 2022, we acquired some shares at $54, followed by additional purchases in August 2022 at $44, and finally topping up in October 2023 at $35.

Consequently, while the stock has depreciated by 28% from our initial purchase at $54, the current price of $39 only represents a 9% decrease from our average cost of $42 on the position.

This method of incremental acquisition serves to illustrate its merits. In our model High Yield portfolio, for example, VZ constitutes merely 2.5% of the entire portfolio, allowing us the potential to double our position at the prevailing price.

This is a decision that is earnestly under consideration at present.

At the ongoing price, VZ offers a noteworthy yield of 6.75%. This stands substantially above its 10-year median yield of 4.5%.

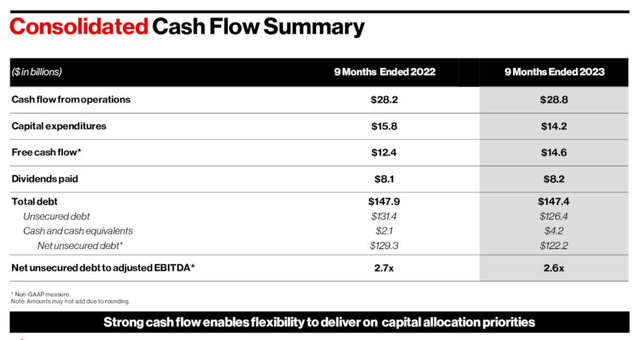

During the initial 3 quarters of 2023, the company has already surpassed its entire 2022 free cash flow (“FCF”) figures.

It has elevated its FCF projection by $1 billion, now anticipating a surplus of over $18 billion in free cash flow for the year 2023.

Naturally, this affords the company ample resources to sustain its generous dividend and effectively dispels any speculations regarding a dividend reduction.

The FCF payout ratio is expected to settle at 56%, a prudent ratio by all standards.

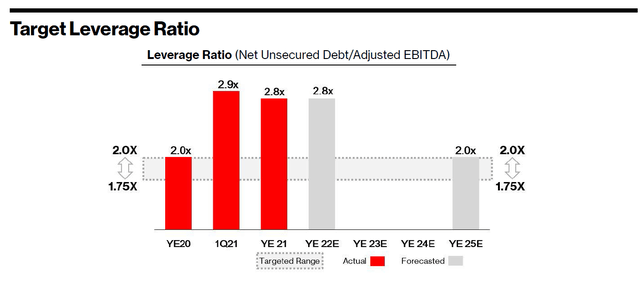

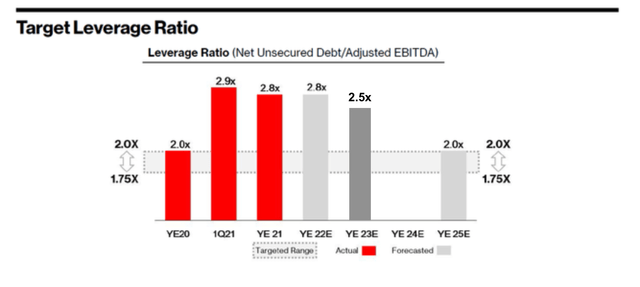

The reduction in debt, despite CAPEX reaching the higher end of the quarterly spectrum, was heartening. It appears highly probable that VZ will achieve its targeted leverage ratio within the next two years.

Following an extensive spree of spectrum acquisitions, the firm is presently transitioning into a phase of reduced CapEx, thus further empowering itself to reduce its debt ratios.

This was the projection unveiled at the 2022 investor day.

This approximate update is likely to mirror the situation by the conclusion of the fiscal year 2023.

This implies that a year or two down the road, buybacks will become a viable option, as hinted by the management in the Q3 earnings call (emphasis added):

Our previously stated objective revolves around achieving a ratio of 2.25 over the net debt to EBITDA. We are steadfast in continuing to work towards this target, as it remains a primary goal for us. Our capital allocation priorities are clear: firstly, investment in our business. Secondly, fortifying our board to enable consistent increments in dividends, a tradition we have upheld for 17 consecutive years. Lastly, the reduction of our debt burden. Once we achieve this ratio, we will initiate discussions regarding buybacks.

But our intention is not to engage in sporadic or one-off buybacks. It must entail a sustained, ongoing program at all times. Although we have not reached that juncture as yet, our team’s adept management is evident. Tony has highlighted the $2.6 billion reduction in debt this quarter, facilitated by the declining tenders. We are committed to this strategy, leveraging our current cash flow situation.

At the current pace of reducing net debt by $2.5 billion per quarter (a figure that may accelerate in 2024), we are approximately 6 quarters from achieving that 2.25x multiple. This projection indicates that, by the end of the coming year, the potential $2.5 billion to $3 billion per quarter could be earmarked for buybacks, offering an impressive buyback yield.

This development would be warmly welcomed, as it would pave the way for sustained dividend increments in the ensuing decade.

I firmly believe that the worst has passed for VZ, and while I am content with the shares purchased at $35, a close call to the $32 nadir, I am even more gratified to acquire shares at the current price of $39, as the stock exhibits hints of an ascending trajectory.

It would not surprise me in the least if VZ surged by 50% to reach $60 within the next two years.

2024 Pick Number 1: Rexford Industrial Realty, Inc.

I am of the belief that 2024 will mark the resurgence of the real estate investment trusts, or REITs.

Rexford Industrial Realty, Inc. (REXR) stands as one of my absolute favorite REITs, owing to its superior management, substantial embedded growth, strategic positioning within the robust REIT industry and an enviable geographical focus within its sector, not to mention its exceptional niche within its habitat.

It is a company that has mastered the art of doing everything right.

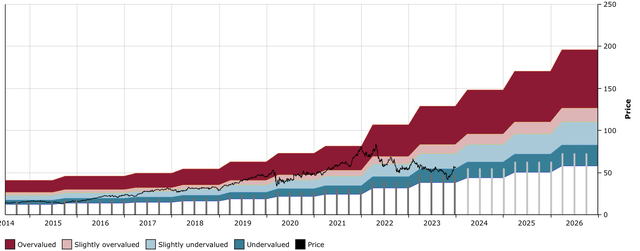

At its current trade price of $55 and a yield of 2.7%, I am confident it could ascend to as much as $85 in 2024, representing a 55% premium over the prevailing price.

The Case for Adding Rexford Industrial to Your Portfolio

Rexford Industrial has weathered the storm amidst high interest rates, making it a standout in the REIT sector. A closer evaluation reveals that this company presents a compelling investment opportunity, despite recent market fluctuations.

Stability Amidst Industry-Wide Challenges

In a period of turmoil for REITs, with high-interest rates dragging down the industry, Rexford Industrial has demonstrated remarkable stability. Unlike its counterparts, Rexford Industrial boasts a low 17% Net Debt/EV ratio, with 100% of its debt on a fixed rate and no significant maturities before 2027. Despite this robust financial position, the company’s stock price has followed the downward trajectory of the entire sector.

Furthermore, the impending expiration of a $400 million unsecured term loan in July 2024 should not cause alarm. The loan includes two one-year extensions, which, if exercised, could extend its expiration to July 2026. Additionally, the interest rate on this loan is a modest 4.83%. In the first quarter of this year, the company secured a $300 million senior loan at a 5% interest rate, indicating that the cost of replacing the loan would likely have a negligible impact.

Potential for Substantial Growth

The company’s proficiency in repurposing and redeveloping properties to optimize yields, coupled with the revaluation of expiring leases at higher rates, positions Rexford for significant growth. With notable cash mark-to-market yields of 43% year to date, even without further growth, the current portfolio’s revaluation would result in 10% FFO growth annually until 2027.

Rexford’s impressive growth rates have outpaced competitors, culminating in increased dividends for investors. The company’s ability to leverage its existing portfolio for growth portends sustained profitability.

Strategic Market Position

Rexford’s strategic focus on markets with limited new construction permits and strong demand, particularly in Southern California, has shielded it from the brunt of industry-wide challenges. By concentrating on smaller units in premium locations, the company has achieved positive net absorption, with an occupancy rate of 97.75%. Notably, the company’s vacancies increased by only 20bps over the past three quarters, compared to the market’s 110bp increase, clearly illustrating its strength within the market.

Conclusion

In closing, Rexford Industrial’s resilience in the face of formidable headwinds and its strategic market position make it a compelling addition to any investor’s portfolio. While unforeseen variables may impact its trajectory, the company’s value proposition, combined with its income potential through yield and dividend growth, makes it a strong contender in 2024.