TSMC Shows Strong Growth Amid Market Challenges in 2025

Shares of Taiwan Semiconductor Manufacturing (NYSE: TSM), known as TSMC, have faced challenges in 2025. Early-year concerns over artificial intelligence (AI) infrastructure spending were compounded by recent tariff-related market turmoil, leading to a broader Stock market sell-off. Despite these factors, TSMC’s latest financial results reveal that the company continues to maintain an impressive growth trajectory.

On April 17, TSMC reported its first-quarter performance. Revenue and earnings surged significantly compared to the previous year, and management’s guidance suggests they do not foresee a slowdown in growth due to the ongoing trade conflicts.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks for immediate investment. Continue »

A closer examination of TSMC’s quarterly results underscores why it stands out as a solid investment in the AI chip sector.

Demand from AI Fuels TSMC’s Growth

The company reported a remarkable 35% increase in Q1 revenue, totaling $25.5 billion, while earnings rose nearly 54%, driven by enhanced margins. Specifically, TSMC’s net profit margin saw a 5 percentage point improvement from the previous year, reflecting its ability to command higher prices from customers.

According to Counterpoint Research, TSMC held an impressive 67% share of the global foundry market by the end of Q4 2024. This represents a 6 percentage point increase from the prior year, showcasing its technological edge and strong customer relationships.

TSMC provides chip manufacturing services to leading AI companies, including Nvidia, Broadcom, Marvell, AMD, and Intel, which produce various AI accelerators: CPUs, GPUs, and custom processors. Grand View Research projects that the AI chip market could expand at an annual growth rate of 29% through 2030.

By fabricating chips for all major AI semiconductor designers, TSMC represents a prime opportunity to tap into this burgeoning market. Furthermore, TSMC’s growth potential extends beyond AI, as it also manufactures chips for Samsung, Qualcomm, and Apple. This positions TSMC favorably to benefit from the growing adoption of AI-driven devices like smartphones and PCs.

The market for generative AI-capable smartphones and PCs is expected to see annual growth of nearly 35% through 2029. This supports TSMC’s optimistic revenue guidance of $28.8 billion for Q2, reflecting a 38% increase compared to the same period last year and indicating potential acceleration in growth.

Moreover, TSMC anticipates a 5.5 percentage point year-over-year increase in its operating profit margin for Q2, which should significantly enhance its earnings growth. Notably, TSMC has held steady on its capital expenditure forecasts for 2025 amid tariff apprehensions, signaling confidence in strong chip demand. CEO C.C. Wei addressed this during the latest earnings call:

“While there are uncertainties and risks from potential tariff impacts, we haven’t observed any shifts in customer behavior. Therefore, we expect our full-year revenue for 2025 to increase by nearly mid-20s percent in U.S. dollar terms.”

TSMC projects that its AI chip revenue will double this year, prompting plans to enhance its advanced chip packaging capacity to satisfy the growing demand for AI GPUs and custom processors needed for AI training and inference.

Why TSMC is a Strong Buy

TSMC’s impressive earnings growth appears to be on track for sustained momentum in the upcoming quarter. Additionally, the long-term growth prospects in the AI chip sector, along with TSMC’s established dominance in the foundry market, strongly position the company for continued success in the current year and beyond.

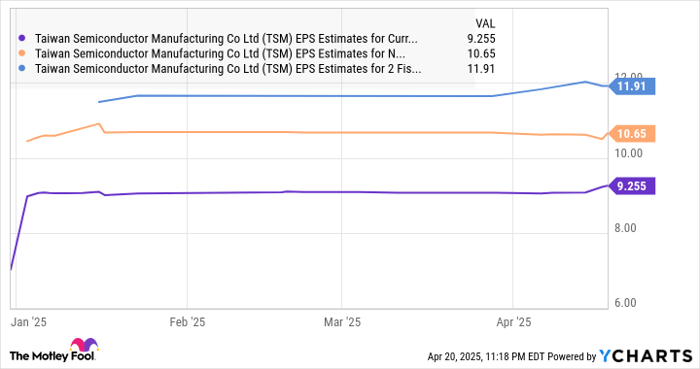

Analysts predict a 31% increase in TSMC’s earnings this year. It is also expected to sustain double-digit earnings growth over the next few years.

TSM EPS Estimates for Current Fiscal Year data by YCharts

Long-term opportunities in the AI chip sector, projected to grow at nearly 35% annually through 2035, may enable TSMC to exceed market growth expectations. Additionally, trading at under 20 times earnings makes TSMC a compelling buy to capitalize on the rapidly expanding AI chip market.

In light of TSMC’s 25% decline this year, investors seeking to diversify their portfolio with a premier AI Stock may find TSMC’s robust earnings growth and favorable valuation suggest potential for significant market gains.

Is Now the Time to Invest $1,000 in TSMC?

Before purchasing stock in Taiwan Semiconductor Manufacturing, consider the following:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for investors, and Taiwan Semiconductor Manufacturing did not make the list. The included stocks may offer robust returns in the coming years.

For example, when Netflix was featured on December 17, 2004, a $1,000 investment would now be worth $561,046*! Similarly, a $1,000 investment in Nvidia on April 15, 2005, would now be worth $606,106!*

The Stock Advisor’s total average return is 811%, outperforming the S&P 500’s 153%. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of April 21, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom and Marvell Technology and has a disclosure policy regarding its positions.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.