“`html

The Trade Desk (TTD) has experienced a significant decline of 54.5% year-to-date, compared to a 30.4% growth in the Zacks Internet Services industry, and gains of 22.8% and 15% in the Zacks Computer & Technology sector and S&P 500 Composite, respectively. As of the latest trading session, TTD closed at $53.49, significantly below its 52-week high of $141.53 and nearing its 52-week low of $42.96.

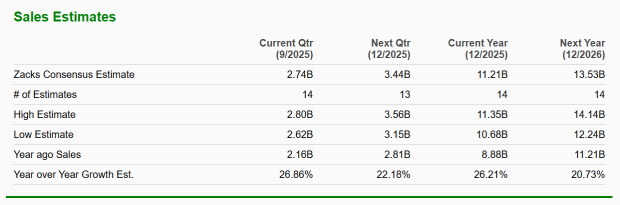

The decline is attributed to a cautious advertising spending environment amid macroeconomic uncertainties and increased competition from companies like Amazon and Google. Total operating costs surged by 17.8% year-over-year to $577.3 million, straining profitability. For Q3 2025, TTD anticipates revenues of at least $717 million, representing a 14% year-over-year growth.

Despite the challenges, TTD is focusing on growth in Connected TV (CTV) and developing its AI platform, Kokai. Analysts recommend holding onto TTD, which currently carries a Zacks Rank of #3 (Hold), awaiting clearer signs of revenue recovery and diminished macro uncertainties.

“`