Investing involves a delicate balance of risk and potential reward, the search for growth in a sea of stability, and the anticipation of future promise against a backdrop of proven results. Among these considerations, growth stocks emerge as appealing opportunities, particularly for those seeking to invest a fixed sum, such as $1,000. In this realm, Roku (NASDAQ: ROKU) shines as a growth stock that is often misunderstood and warrants keen attention from prospective investors.

Unveiling the Rationale Behind Roku’s Appeal

Roku has firmly established its position in the rapidly expanding media streaming industry, a sector that lies at the heart of modern media consumption patterns. The company’s inception as a division of Netflix (NASDAQ: NFLX) involved producing the initial set-top boxes for video streaming. Fast forward to 2024, and Roku remains a dominant market leader, capturing a staggering 51% share of the global connected TV (CTV) market in the third quarter of 2023, according to data analysts at Pixalate.

After encountering a few quarters of stagnant growth, Roku has reinvigorated its financial performance, recording a 14% year-over-year surge in fourth-quarter sales to $984 million and generating $176 million in free cash flow. These robust financial indicators underscore Roku’s solid fiscal position.

Moreover, Roku has continuously expanded its user base, even during challenging economic conditions. Over the past year, the company has added 10 million net new active user accounts, bringing its total user count to 80 million. Notably, the platform’s streaming hours have also witnessed a 21% uptick during the same period, signaling not only growth but also increasing user engagement.

Looking ahead, Roku’s forward-looking guidance suggests a focus on sustained revenue growth and enhanced free cash flows. The company’s strategic initiatives include an aggressive cost-cutting program and minimal price adjustments following the recent inflationary phase. While acknowledging the challenges posed by a volatile macro environment and a recovering ad market, Roku anticipates a year-over-year sales upswing of approximately 20% to reach around $850 million in 2024.

Playing the Long Game

Despite these robust financial metrics, Roku’s stock witnessed a 24% decline at the close of trading on Friday after its Thursday earnings release. This seemingly counterintuitive market response reflects the prevailing volatility and investor sentiment but also unveils a potential under-the-radar investment opportunity.

Currently, the only compelling reason to divest Roku shares would be to lock in recent price gains. Notably, the stock had surged by 132% from the end of 2022 to the close of Thursday’s trading session. However, foregoing the future prospects of Roku would likely lead to regret, akin to rueing the sale of Roku shares at this modest plateau in the near future.

For long-term investors, Roku’s strategic direction aligns seamlessly with industry trends. The ongoing shift toward digital media consumption represents a trend that Roku is ideally positioned to capitalize on. CEO Anthony Wood consistently emphasizes that all media viewing and advertising will inevitably shift to digital platforms, and Roku stands poised to capitalize on this fundamental sea change.

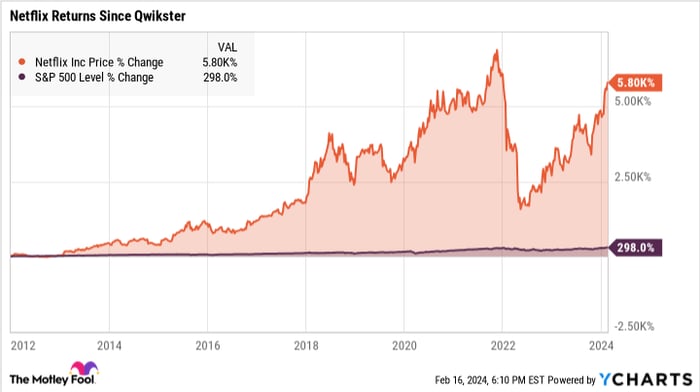

The recent price downturn mirrors a similar scenario witnessed with Netflix shares in 2011, when the company transitioned its streaming service into a viable business model and divested its traditional DVD-mailer segment. This period, reminiscent of the Qwikster debacle, occurred approximately 6,000% in market-beating stock returns ago.

It’s important to note that Netflix’s price drop was triggered by a potentially risky strategic shift, while Roku’s stock faltered following a robust earnings report with promising guidance. There are no radical new strategies on the horizon for Roku.

In my assessment, Roku’s stock underwent a 24% decline for no palpable reason. For investors with $1,000 to allocate, such junctures present an opportunity to invest in a robust company at a discounted valuation. If you’re considering a foray into the growth stock arena, Roku makes a compelling case.

Have $1,000? Roku Warrants Your Attention

On account of its robust fundamentals, clear growth trajectory, and market position signifying resilience and adaptability, Roku emerges as a standout growth stock poised to deliver substantial returns over time. Despite potential hurdles along the way, Roku’s operational framework remains solid. Diligent consideration, as with any investment, is essential, but Roku’s recent performance and future prospects render it a suitable contender for inclusion in your investment portfolio.

Personally, I am inclined to bolster my Roku investment as soon as I can divert my attention away from discussing it.

Considering a $1,000 Investment in Roku?

Before delving into Roku’s stock, contemplate this: the Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks for investors to buy at present… and Roku didn’t make the cut. These selected stocks are poised to potentially yield substantial returns in the years to come.

Stock Advisor offers investors a user-friendly roadmap for success, encompassing guidance on portfolio construction, regular analyst updates, and a pair of new stock recommendations each month. Since 2002, the Stock Advisor service has delivered returns that are more than three times the performance of the S&P 500*.

Explore the 10 recommended stocks

*Stock Advisor returns as of February 12, 2024

Anders Bylund holds positions in Netflix and Roku. The Motley Fool holds positions in and recommends Netflix and Roku. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.